Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 28, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The start of the second half of 2024 brings a barrage of data releases including worldwide PMI data, while key official updates include US payrolls, eurozone inflation and Japan's Tankan updates. Beside data releases, there will also be the publication of June Fed minutes and Fed speaker appearances, not to forget elections in Europe.

Worldwide manufacturing, services and detailed sector data will be updated through the first week of July, offering the earliest insights into full global economic conditions. This follows the flash PMI data that have so far alluded to slowing developed economy growth momentum, albeit the US bucking the trend, and also softening price pressures. India flash PMI data meanwhile continued to show expansion at a robust pace to sustain its recent stand-out performance.

The key US data to watch in the fresh week will be the releases of June non-farm payrolls, with early flash PMI data hinting at sustained job additions midway through 2024. While the June employment report may offer data clues as to when the Fed will eventually lower rates, the week will also be filled with written and verbal cues in the form of June Fed minutes and Fed chair Jerome Powell's appearance. As far as the flash PMI data have shown, average prices charged in the US increased at the slowest pace in five months in June, thus allaying some fears that underlying price pressures have remained overly stubborn, notably for services.

In Europe, politics may overshadow economic fundamentals for markets in a week where elections unfold in both the UK and France. That said, tier-1 releases remain in abundance alongside the PMIs, including the update of eurozone and Germany inflation, and industrial production data due from both Germany and France. Specifically, we will be looking for official confirmation of easing inflationary pressures in the eurozone after the HCOB Flash Eurozone PMI showed falling prices gauges in recent months, vindicating the ECB's June rate cut.

More detailed PMI data will also be due from APAC economies, with the focus also on Japan's Tankan survey after the au Jibun Bank Japan PMI Future Output Index outlined falling optimism amid rising costs.

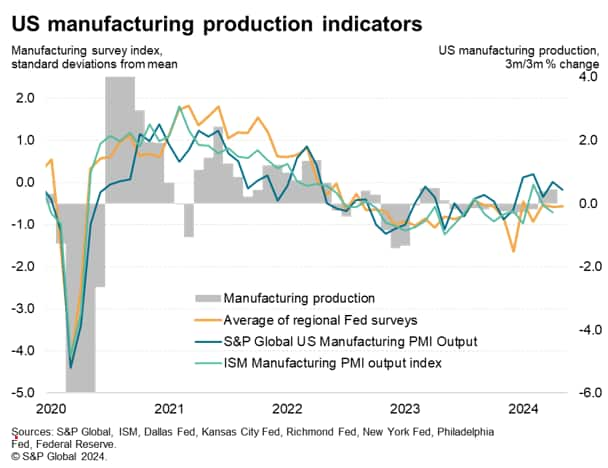

Flash PMI survey data from S&P Global showed the US economy gaining further growth momentum in June. Manufacturing output expanded, and has fared better in the S&P Global surveys than recent data from other surveys have signalled, albeit losing a little pace in June to underscore how the sector continues to struggle amid weak demand.

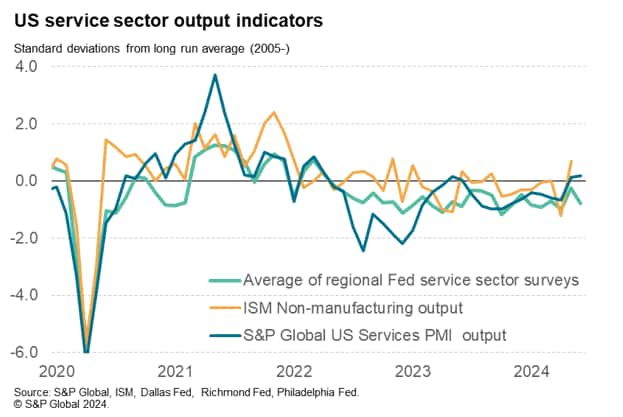

There was meanwhile better news from the service sector, where growth was the fastest for over two years. Markets will be interested to see the ISM survey data, updated in the coming week alongside final S&P Global PMI data, though this ISM survey has been volatile in recent months, urging caution in interpreting any signals.

Monday 1 Jul

Canada, Hong Kong SAR Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Jun)

South Korea Trade (Jun)

Indonesia Inflation (Jun)

Japan Consumer Confidence (Jun)

United Kingdom Nationwide House Prices (Jun)

United Kingdom Mortgage Lending and Approvals (May)

Germany Inflation (Jun, prelim)

United States ISM Manufacturing PMI (Jun)

Tuesday 2 Jul

South Korea Inflation (Jun)

Australia RBA Meeting Minutes (Jun)

Eurozone Inflation (Jun, flash)

Canada Manufacturing PMI* (Jun)

United States JOLTs Job Openings (May)

Wednesday 3 Jul

United States Market Holiday (Partial)

Worldwide Services, Composite PMIs, inc. global PMI* (Jun)

Japan Tankan Index (Q2)

Australia Building Permits, Retail Sales (May, prelim)

Turkey Inflation (Jun)

Brazil Industrial Production (May)

United States ADP Employment Change (Jun)

Canada Trade (May)

United States Trade, Factory Orders (May)

United States ISM Services PMI (Jun)

United States FOMC Minutes (Jun)

Thursday 4 Jul

United States Market Holiday

Hong Kong SAR PMI* (Jun)

Australia Trade (May)

Switzerland Inflation and Unemployment Rate (Jun)

Germany Factory Orders (May)

United Kingdom Construction PMI* (Jun)

Eurozone HCOB Construction PMI* (Jun)

Canada Services PMI* (Jun)

Global Sector PMI* (Jun)

United Kingdom General Election

Friday 5 Jul

Japan Household Spending (May)

Thailand Inflation (Jun)

Germany Industrial Production (May)

United Kingdom Halifax House Price Index* (Jun)

France Industrial Production and Trade (May)

Taiwan Inflation (Jun

Eurozone Retail Sales (May)

Canada Employment (Jun)

United States Non-farm Payrolls, Average Hourly Earnings, Unemployment (Jun)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Worldwide manufacturing and services PMI

The first week of July sees the release of worldwide manufacturing and services PMI data on Monday and Wednesday respectively. Additional detailed sector PMI data will be updated on Thursday for insights into which the sectors are powering the global economy midway through 2024. Areas of focus include growth variances after growth momentum was found to have eased across Europe and Japan in June but remained robust in the US, according to the flash PMI data, while inflationary pressures eased across the major developed economies, though notably bar the UK.

Americas: Fed Powell speech, Fed minutes, ISM PMI data plus US and Canada labour market reports

Besides the final PMIs, key data releases due from the US include June non-farm payrolls, factory orders, trade and ISM surveys. According to flash PMI data, employment levels rose for the first time in three months, which backs the consensus expectations for a sustained rise in non-farm payrolls in June.

On the central bank side, Fed minutes from the June Federal Open Market Committee (FOMC) meeting will be updated for insights into when the Fed may lower rates. Fed Powell will also be speaking early in the week, with his comments parsed for clues.

EMEA: Eurozone and Germany inflation, UK house prices, Germany and France industrial production

In addition to the UK and French elections, European PMI releases will include construction PMIs due Thursday as well as final June inflation figures from the eurozone. The latest PMI prices readings from the HCOB Eurozone PMI showed inflationary pressures easing in recent months and pre-empting softer inflation readings for June. In particular, this was underpinned by the cooling of service sector cost pressures, though the trend for manufacturing prices will be worth monitoring in the months ahead.

APAC: RBA meeting minutes, Australia trade, Japan Tankan and consumer confidence data, Indonesia, South Korea, Philippines, Thailand, Taiwan inflation

The detailed PMI data releases for the APAC region are accompanied by inflation figures, which will be updated across a myriad of APAC economies including the major manufacturing hubs. Tier-2 data to watch from Australia and Japan meanwhile include Australia trade figures, while the Bank of Japan releases its second quarter Tankan survey results. This comes after the au Jibun Bank Japan PMI indicated easing optimism among private second firms in the second quarter.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.