Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 04, 2022

Week Ahead Economic Preview: Week of 04 July 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Services PMIs and US non-farm payrolls to feed recession-risk and policy debate

This week, services PMI data for all major developed and emerging economies will be in focus, coming on the heels of last week's manufacturing PMIs to thereby give a more comprehensive overview of the latest growth and inflation signals. US, China, Eurozone and UK composite PMIs will take centre stage, building the economic picture for June ahead of the US employment report on Friday. The central bank meeting in Australia will meanwhile form the main monetary policy focus alongside the release of the latest FOMC minutes.

Fears of recession rose following the worldwide manufacturing PMIs, which indicated weaker performances in the US, UK, EZ and Japan. Even a rebound in manufacturing output in mainland China disappointed, failing to be accompanied by a robust improvement in demand. There were, however, tentative signs of improvements on the price front, with inflationary pressures easing amid fewer supply constraints (see box).

The release of service sector PMI data this week will therefore add to insights into the degree to which rebounding activity in the consumer sector can withstand the headwinds of rising inflation, growing economic gloom and tighter financial conditions amid rising interest rates. Clues as to path of the latter in the US will also be gleaned from the non-farm payroll report and the latest FOMC minutes. The FOMC hiked the Fed Finds rates by 75 basis points at its last meeting and noted that another hike of the same increment could be made at the upcoming meet in order to tackle 40-year high inflation, though markets have been pricing in less aggressive longer-term rate picture following recent disappointing economic data. June's non-farm payrolls is therefore likely to provide another material steer for Fed watchers.

This week also sees a central bank meeting for Australia, with investors, eyeing decisions on interest rates. It's widely expected that policymakers will increase efforts to rein in on escalating inflation by lifting interest rates by 50 basis points.

Inflation focus shifts to service sector after signs of easing industrial price pressures

Global manufacturing growth continued to weaken in June, according to the latest PMI data. The JPMorgan PMI - compiled by S&P Global - now at its lowest since August 2020 (see special report). The deterioration took place despite an easing of COVID-19 restrictions in China (which allowed mainland manufacturing activity to rise at the fastest rate for over a year), reflecting weakened factory trends in the US, Europe and across much of Asia.

More encouragingly, the alleviation of China's pandemic restrictions contributed to a further easing of supply chain delays, which - alongside a stalling of global demand growth for manufactured goods - has helped cool price pressures, albeit with energy providing further upward pressure on costs.

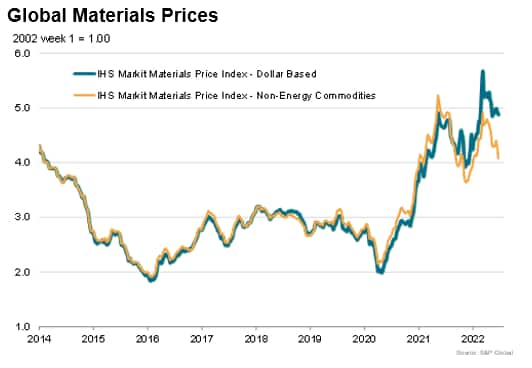

Our Materials Prices Index shows global prices down 14% from their pandemic peak in the week ending 20 June, and some 22% lower if energy is excluded, underscoring the steepness of the recent commodity price drops. Copper, for example, is now trading below $8000 per ton for the first time for almost one and a half years. However, as our chart shows, even excluding energy, commodity prices clearly remain elevated by historical standards on average, and oil and gas continue to be supported by supply concerns. Nonetheless, the non-oil commodity market should feed through to lower CPI inflation in the second half of 2022. The attention of course shifts to the extent to which service sector costs are being driven higher by rising wages and fuel costs. For that, we await the coming week's service PMI data.

<span/>Monday 04 July

US Market Holiday

S&P Global Canada Manufacturing PMI (Jun)

S&P Global Singapore Manufacturing PMI (Jun)

S&P Global Australia Services & Composite PMI (Jun)

Germany Balance of Trade (May)

South Korea Inflation (Jun)

Switzerland Inflation (Jun)

Turkey Inflation (Jun)

Tuesday 05 July

Worldwide Services PMIs* (Jun)

Australia Retail Sales (May)

Brazil Industrial Production (May)

France Industrial Production (May)

Mexico Consumer Confidence (Jun)

Reserve Bank of Australia Interest Rate Decision (Jul)

Singapore Retail Sales (May)

Spain Consumer Confidence (Jun)

United States Factory Orders (May)

Wednesday 06 Jul

S&P Global United States Services PMI** (Jun)

S&P Global Eurozone Construction PMI (Jun)

S&P Global France Construction PMI (Jun)

S&P Global Germany Construction PMI (Jun)

S&P Global Italy Construction PMI (Jun)

S&P Global/CIPS United Kingdom Construction PMI (Jun)

S&P Global Hong Kong SAR Manufacturing PMI (Jun)

Eurozone Retail Sales (May)

France Retail Sales (May)

Germany Factory Orders (May)

Spain Industrial Production (May)

United States FOMC Minutes

United States ISM Non-Manufacturing PMI (Jun)

Thursday 07 Jul

Australia Balance of Trade (May)

Brazil Retail Sales (May)

Canada Balance of Trade (May)

Canada Ivey PMI (Jun)

Germany Industrial Production (May)

Japan Household Spending (May)

Mexico Inflation (Jun)

Switzerland Unemployment (Jun)

United Kingdom Halifax House Price Index (Jun)

United States Balance of Trade (May)

Friday 08 Jul

Brazil Inflation (Jun)

Canada Unemployment (Jun)

France Balance of Trade (May)

Italy Industrial Production (May)

Russia Consumer Confidence (Q2)

Russia Inflation (Jun)

United States Non-Farm Payrolls (Jun)

What to watch

June Global Services and Composite PMIs

Amid the lingering implications of COVID-19 and intensifying inflationary pressures, worldwide services and construction PMIs will be watched intently this week for indications of how the global economy has fared at the end of the second quarter. In recent months, the service sector has been outperforming the goods sector, with the latter hampered by material and staff shortages. However, June's PMI data will be eagerly assessed for any signs of weakening demand spreading to services as the pandemic rebound fades amid the cost-of-living crisis and tighter financial conditions, with the feed-through of higher price to wages also a key area of concern.

Americas: US and Canada non-farm payrolls and trade balance, Brazil inflation and industrial production

The start of the third quarter brings US and Canada non-farm payrolls and trade balances. Recent survey data have indicated some pull-back in firms' hiring as the demand environment weakened in June. Any deterioration in the rate of payroll additions will naturally add to recession risk in the US, while wage growth will also be eyed as any uplift could add to the Fed's enthusiasm for more aggressive policy tightening. Meanwhile, Brazil will release their Industrial production and retail figures for May. This will be followed by inflation data for June, which is expected to be elevated given recent tensions.

Europe: Eurozone retail sales, industrial production statistics for France, Germany, Italy and Spain, UK house prices

June PMI manufacturing data pointed to concern across Europe with the UK and Eurozone PMIs at or near 2-year lows. In fact, all Eurozone countries saw weaker improvements in their PMIs, and in some cases reported contractions in output. Industrial production data for Germany, France, Italy and Spain will therefore be closely watched.

Asia-Pacific: Australia interest rate decision, South Korea inflation, Japan household spending

The Reserve Bank of Australia will meet in the coming week to discuss changes to policy. It's anticipated that there will be a further tightening of monetary policy with policy rate set to rise to 1.35%.

Meanwhile, South Korea inflation data are also expected this week while Japan will release household spending figures.

Special reports

APAC Economy - Rajiv Biswas

Global Manufacturing - Chris Williamson

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-july-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-july-2022.html&text=Week+Ahead+Economic+Preview%3a+Week+of+04+July+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-july-2022.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 04 July 2022 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-july-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+04+July+2022+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-july-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}