Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 11, 2019

Vietnam GDP up strongly again in 2018 as manufacturing outperforms

- GDP up 7.1% in 2018, best since 2007

- Manufacturing sector continues to lead growth as PMI sees best annual average since survey's inception

"To reap a return in ten years, plant trees. To reap a return in 100, cultivate the people." Ho Chi Minh's thoughts on planning for the future are relevant today in Vietnam, where the economy seems in a perfect position to defy signs of slowing demand elsewhere and thrive in the global economy.

An increasing openness to foreign investment, a relatively stable economy and a surging manufacturing sector make the country an attractive location for international firms, an appeal which appears to have strengthened in recent months given worries about trade tensions and instability elsewhere.

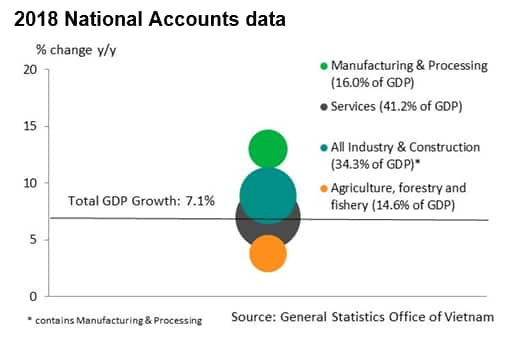

Official estimates indicate that Vietnamese GDP rose 7.1% in 2018, the best result since 2007 and cementing the country's position as one of the fastest growing economies in the world.

Manufacturing output surges

The manufacturing sector continued to be the strongest segment of the economy in 2018, with output up some 13% from the previous year.

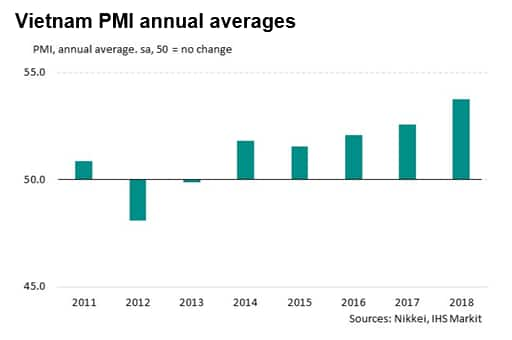

The official figures on manufacturing chime with the strength signalled by the Nikkei Vietnam Manufacturing PMI, compiled by IHS Markit. The survey saw output rise on a monthly basis throughout 2018, with the annual average for the headline PMI the highest since the survey began in 2011.

December saw further solid increases in output, new orders and employment, with firms' confidence regarding the 12-month outlook remaining strongly positive amid expectations of continuing new order growth and business expansion plans.

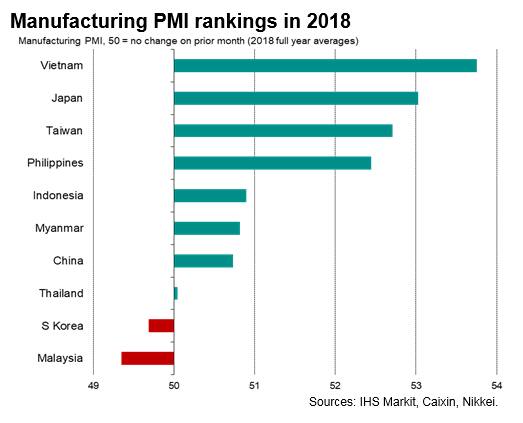

The annual average PMI reading for Vietnam in 2018 was also the highest of all countries surveyed in Asia.

Further success likely in 2019

The Vietnamese economy looks set to continue to grow strongly during 2019, despite signs of weakness in the global economy: global economic growth slowed to a 27-month low in December.

While softer global growth and trade tensions are downside risks for the Vietnamese economy, a number of factors are likely to mitigate any negative outcomes. In recent years, the Vietnamese authorities have been gradually relaxing ownership rules of companies, notably by aiming to reduce the number of state-owned enterprises through privatisations and removing restrictions on foreign ownership of companies. This contrasts with difficulties in doing business elsewhere in the region, which makes Vietnam an attractive investment destination. For example, South Korean company Samsung's factories in Vietnam now produce almost one-third of the firm's global output [*].

Other positives for Vietnam include a relatively stable exchange rate at a time when other emerging market currencies have come under pressure after the US Federal Reserve embarked on a rate rising cycle. The Vietnamese dong moves in a crawling peg against the US dollar, and depreciated only modestly during 2018.

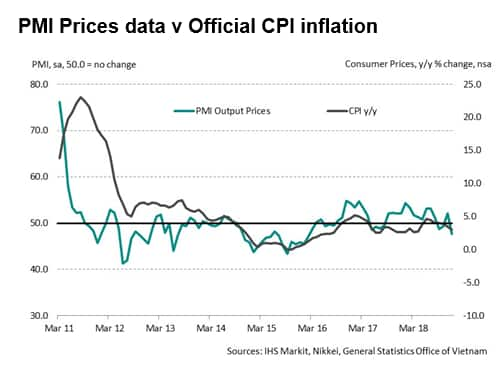

Relative currency stability also contributes to a lack of volatility in inflation and interest rates. Consumer prices rose 3.0% year-on-year in December 2018, below the central bank's target of 4.0% and therefore not putting any pressure on policymakers to raise interest rates. The latest PMI survey, meanwhile, signalled monthly reductions in both input costs and output prices in December as the Vietnamese manufacturing sector remains internationally competitive.

There are also signs that foreign multinational companies are relocating production and supply chains to Vietnam in the face of growing trade tensions between China and the US.

International competitiveness, a stable economic environment and an increasing openness to business therefore all place Vietnam in a good position to weather any global economic headwinds during 2019. IHS Markit forecasts a further strong rise in GDP of 6.7% for this year.

Andrew Harker, Associate Director at IHS

Markit

Tel: +44 1491 461 016

andrew.harker@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-gdp-up-strongly-again-in-2018-110119.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-gdp-up-strongly-again-in-2018-110119.html&text=Vietnam+GDP+up+strongly+again+in+2018+as+manufacturing+outperforms+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-gdp-up-strongly-again-in-2018-110119.html","enabled":true},{"name":"email","url":"?subject=Vietnam GDP up strongly again in 2018 as manufacturing outperforms | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-gdp-up-strongly-again-in-2018-110119.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vietnam+GDP+up+strongly+again+in+2018+as+manufacturing+outperforms+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-gdp-up-strongly-again-in-2018-110119.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}