Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 20, 2024

This research paper showcases the strength of the Purchasing Managers' Index™ (PMI®) in tracking changes in eurozone and US consumer price inflation. Due to the twin features of timeliness and non-revision, PMI data have a significant advantage relative to other indicators and our empirical analysis finds that, when nowcasting changes in inflation, PMI-based models consistently outperform widely-used benchmarks.

Nowcasting is a type of forecasting which focuses primarily on estimating present (or the very-near past or future) economic conditions, and remains popular among economists, policymakers, and investors when predicting near-term changes in key macroeconomic variables. Most commonly, this framework has often been used to predict changes in gross domestic product (GDP). However, dramatic developments in consumer prices observed since the start of the COVID-19 pandemic, which represented a stark turnaround from the benign inflation environment of the 2010s, has fuelled greater interest in using nowcasting tools to understand short-term inflation dynamics - especially in the context of central bank decision making with their focus on price stability.

Nowcasting techniques are especially favoured for their ability to understand current price developments in near 'real-time'. This is an important feature for decision-makers. By utilising the most recently available data, a better understanding of the likely developments of official price statistics ahead of their release can be used to optimise policy or investment judgements.

A key source of timely, unrevised information to be used in nowcasting applications are PMI data. These monthly indices are typically based on survey responses from representative panels of business executives across manufacturing and private services economies. Panellists provide monthly information on a wide variety of metrics such as output, new orders, employment, prices, supply chain stress and stocks. The surveys are typically conducted in the middle of the month and released on either the first (manufacturing) or third (services and composite - aggregates of both sectors) working days of each month following the reference period. In addition to final data, 'flash' data is also released for some economies including the eurozone, France, Germany, and the US. These numbers are based on around 85%-90% of the final sample and are available around 10 days before final release, and well-ahead of official statistics*.

Figure 1 shows the visual relationships between annual changes in Eurostat's Eurozone Consumer Price Index (CPI) and two price indices from S&P Global Market Intelligence - the Eurozone Manufacturing PMI Output Prices Index and the Eurozone Services PMI Input Prices Index**. Whilst PMI panel members are asked to compare variables mid-month to mid-month, we nonetheless track the respective PMI series against year-on-year changes in consumer prices - the most common metric used by economists.

Both show good relationships with the official data series: for manufacturing the correlation coefficient since 2013 is 62%; for services an impressive 93%. This difference is perhaps to be expected given the respective position of the manufacturing sector in the supply chain, a point supported by the observation that manufacturing data tends to 'lead' both the services and official consumer price series. In fact, for manufacturing charges, the correlation coefficient is nearly equal (92%) to that of services input prices when applying a 7-month lead.

Similar trends are observed for equivalent US data, although the 'lead' of manufacturing PMI data is less obvious than seen in the eurozone (see figure 2). Correlation coefficients with official data are high: respectively 80% for the Manufacturing Output Prices Index and 81% for the Services Input Prices Index.

Given the strong relationships that exist between the survey and official data, combined with the desirable features of timeliness and non-revision, the PMIs are strong candidates for nowcasting consumer price inflation statistics in both the eurozone and the US. Through a simple nowcasting exercise we therefore seek to highlight the short-term predictive power of the PMIs in nowcasting year-on-year changes in consumer prices.

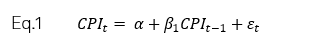

We begin with a benchmark model based on a simple autoregressive (AR) specification as shown in equation 1:

whereby annual consumer price inflation (CPI_t) in period t is simply a linear function of a lagged version of itself (CPI_(t-1)). Such models are usually seen as a baseline to predict changes in inflation, and generally viewed as very useful in terms of their forecasting performance.

However, we have added a PMI variable to our baseline model:

Consumer price inflation is now viewed as a linear function of lagged inflation and a current period reading for a PMI variable.

These parsimonious models can be estimated easily though an Ordinary Least Squares (OLS) regression, and we utilise this widely used technique to run out-of-sample nowcasting exercises for the period January 2020 to May 2024. Both the eurozone and US CPI data are transformed to year-over-year series, whilst the PMI prices data are provided in their usual diffusion index form. Note the PMI data can take various definitions, be it the manufacturing input or output price indices or their service sector equivalents. With the various forms of the PMI price indices taking up the position of the variable PMI_t, this means that we run four separate versions of equation 2 (and therefore generate four individual nowcasts).

To assess the nowcasting performance of each PMI index, we use the root mean square forecasting errors (RMSFE) against that of the benchmark model (denoted as 'BM' as defined in equation 1). In the case of the RMSFE ratio (PMI model over the benchmark), any readings below 100% signal that PMI data improves the benchmark model (i.e. has relatively lower errors). Values closer to zero should be viewed as the most positive.

We estimate a 'central' nowcast to compare against the benchmark by taking a simple weighted mean of the four individual model nowcasts produced by equation 2. Such an approach has a long and positive history in academic literature, generally performing well in nowcasting exercises over a sustained period, and at the very least matching more econometrically sophisticated specifications (e.g. dynamic factor models).

Results are shown in table 1. They indicate that models including PMI data outperform the benchmark model for both the eurozone and the US, providing clear evidence that PMI prices data add significant value in nowcasting exercises. This is especially the case for the US. Compared to the benchmark model, the PMI driven 'central' nowcast improves on the BM's predictive power by around 29%. Meanwhile, for the Eurozone the PMI model has a significant, but more modest, 19% gain over the benchmark***.

In addition to headline PMI price indices, more granular sector data are available from S&P Global for some territories. For these PMI products, S&P Global Market Intelligence maps individual company responses to industry sectors according to standard industry classification (SIC) codes. Indices are available for a wide range of sectors, including basic materials, consumer goods, consumer services, financials, healthcare, industrials, and technology.

For the US, correlation analysis found that the following sectors were strongly related to annual changes in the consumer price index: Industrial Services PMI Input Prices, Consumer Services PMI Input Prices, Industrial Services PMI Output Prices and Technology PMI Output Prices. We use these indices to run the same nowcasting exercises as before. Their individual performances, alongside the headline US PMI price indices, are shown in table 2.

Whilst all individual models improve on the benchmark model, Consumer Services Input Prices and Industrial Services Input Prices perform especially strongly in predicting inflation (ranking 3rd and 4th in terms of predictive power). These indices were combined with the broader Manufacturing PMI Output Prices and Services PMI Input Prices indices, i.e. using the top 4 most 'powerful' indices to create a new equally weighted PMI central nowcast. As expected, the national sector PMI data add some additional value, with a 30% gain over the benchmark over the out-of-sample period (see table 3). Notably this is a slightly better performance than when just using headline PMI price indices and suggestive of some additional value in using national sector PMI data in nowcasting applications.

PMI data are timely, and respective price indices are closely correlated with year-on-year changes in consumer prices for the eurozone and the US. These relationships can be exploited to better predict inflation than hard-to-beat benchmark forecasting models. In addition, the availability of national sector PMI data ensures that the PMI datasets have sufficient range, depth, and options to make them an essential tool for those that wish to anticipate changes in official consumer price indices in a timely manner.

*PMI series produced by S&P Global Market Intelligence are also geographically far-reaching, now covering over 40 countries.

**The Manufacturing PMI Output Price Index and Services PMI Input Price Index were selected as these have the best visual and statistical relationships with official consumer price inflation.

***Of the four PMI price indices included in the 'central' nowcast, the Manufacturing Output Price Index and Services Input Price Index were the strongest performers when considering predictive power. This was true for both the eurozone and the US.

Please click here for the full report

Paul Smith, Economics Director, S&P Global Market Intelligence

Tel: +44 1491 461 038

Email: paul.smith@spglobal.com

Sian Jones, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 017

Email: sian.jones@ihsmarkit.com

Eleanor Dennison, Economist, S&P Global Market Intelligence

Tel: +44 1344 328 197

Email: eleanor.dennison@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.