Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 25, 2023

By Ben Herzon and Lawrence Nelson

With growth above trend, and labor markets tight — and perhaps tightening — there can be little near-term relief from inflation pressures emanating from taut labor market conditions. Recent declines in inflation are certainly welcome news, but to the extent they merely reflect the unwinding of pandemic-era idiosyncratic price increases, they may soon fade, leaving core inflation rates still intolerably above the Fed's 2% objective.

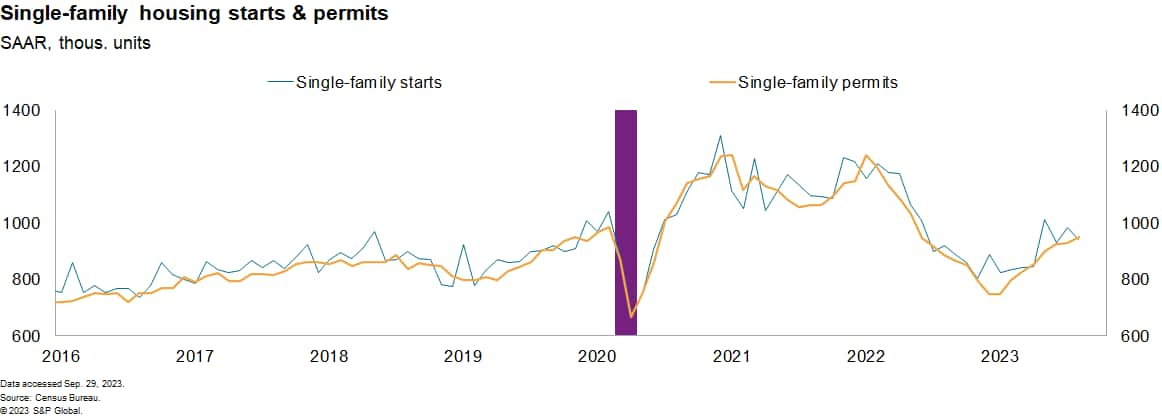

Much of the new data last week related to housing activity and painted a mixed picture of conditions in that sector. Housing starts tumbled in August, likely constrained by adverse weather conditions across the country — record rainfalls in the Southwest, a hurricane in Northern Florida, and record heat in the plains. Permits, which are based on a near-universal sample and are not as influenced by weather, climbed to a 10-month high as permits for single-family units rose for the seventh consecutive month. The National Association of Homebuilders' Housing Market Index fell in September to the lowest level in five months as mortgage rates approaching 21-year highs are undermining demand.

The National Association of Realtors reported that existing home sales fell in August while the median sales price rose to a record high. Sales are constrained on the demand side by high mortgage rates and on the supply side by lack of inventory for sale that, somewhat paradoxically, also reflects the impact of high mortgage rates on homeowners' (un)willingness to move. Normally one might associate high and rising mortgage rates with softening house prices from the demand side of the market, but currently the adverse impact of high mortgage rates on inventory appears to be forcing prices up. We believe that single-family housing activity has formed a bottom from which there will be a grudging recovery, but that multifamily housing is being overbuilt and that construction of multi-family units will decline over the next few years.

We continue to watch two developments that pose potentially significant downside risks to our forecast of GDP growth in the fourth quarter. The UAW strike against the major domestic automakers entered its second week as the union announced walkouts at thirty-eight distribution centers. The impact of the strike on GDP in the third quarter will be minor — we estimate today less than 0.1 percentage point — but a widespread and protracted strike would significantly impact fourth-quarter growth. Meanwhile, odds of a federal government shutdown are rising. The direct effect on GDP is a decline in the federally provided services which, in the National Accounts, are measured at labor costs. Together, a long widespread strike and prolonged shutdown could push fourth-quarter GDP growth significantly negative. If the disruption ended before January, growth in the first quarter of 2024 would be just as significantly boosted by the subsequent recovery (and catch up) in production.

The Federal Open Market Committee met last week and, as we expected, left its policy rate unchanged in the range of 5.25 % - 5.50% while suggesting that further rate hikes are more likely than not. Of more interest were changes to the Fed's Summary of Economic Projections, which showed notable upward revisions to near-term GDP growth and downward revisions to the near-term unemployment rate. In addition, the median "appropriate" federal funds rate for 2024 and 2025 were revised up nearly half a percentage point as the Committee seems intent on discouraging expectations of an early or quick reversal of policy. We expect the FOMC to raise its policy rate to a peak range of 5.5% - 5.75% in November and begin cutting rates in May of next year.

This week's economic releases:

Learn more about our economic data and insights

Explore our Global Economic Outlook

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.