Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 10, 2023

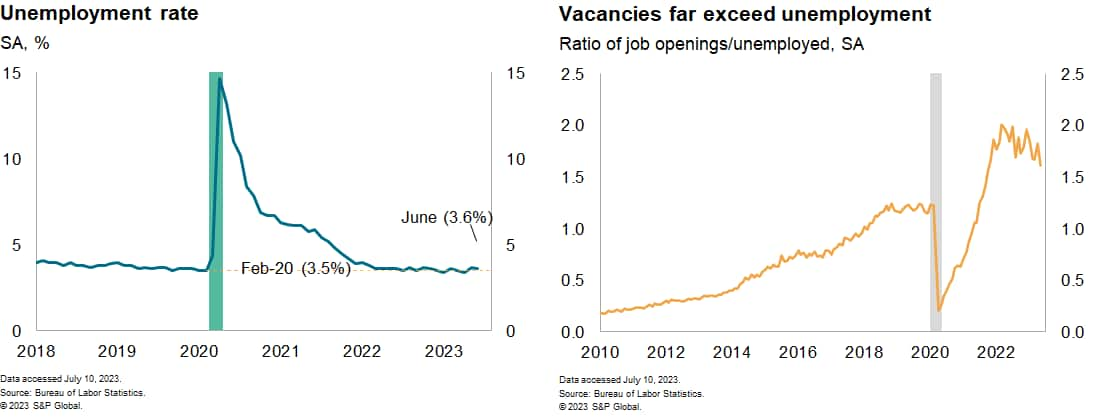

Labor market indicators, including Friday's employment report for June, the Job Openings and Labor Turnover Survey (JOLTS), and initial claims for unemployment insurance, on balance show a labor market that remains very tight — with a significant excess of demand over supply — and only hints that conditions are loosening.

Employment at nonfarm establishments rose 209 thousand in June, leaving the average gain in payrolls over the most recent three months at a robust 244 thousand. This is well above the roughly 100 thousand monthly gain that would be consistent with no material change in labor-market tightness, assuming no change in the labor force participation rate. The unemployment rate ticked back down to 3.6%.

The JOLTS data did show a roughly 600 thousand decline in private-sector job openings in May from an elevated April reading. Still, the job openings rate (job openings as a percent of employment plus openings) remains quite elevated, near 6% compared to 4.2% in 2019, suggestive of continued labor-market tightness.

Average hourly earnings (AHE) have recently accelerated, particularly sharply in manufacturing. The three-month annualized change in manufacturing AHE in June rose to 6.4%, continuing an uneven climb from a 3.7% rise over the 12 months of 2022. Overall AHE growth is also showing signs of turning upward again after a year-long slide.

This, of course, is going in exactly the opposite direction from what would be required to see core price inflation decline sustainably to the Fed's 2% target, i.e. increases in the range of 3%-3½%. We continue to expect that a material loosening of labor-market tightness, including a rise in the unemployment rate to over 4.5%, will be needed to get wage and price inflation back under control. That will likely require some additional tightening of financial conditions to slow aggregate spending and to ease demand relative to supply across product and labor markets.

The rise in interest rates over the last several weeks and in the last few days suggest that financial markets are getting the message. The minutes from the June policy meeting of the Federal Open Market Committee had a hawkish tilt, supporting our forecast and market expectations that the Fed will raise the policy rate 25 basis points (one-quarter percentage point) at its July meeting. We expect another rate hike in November.

This week's economic releases:

Learn more about our economic data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.