Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 04, 2025

S&P Global's PMI survey data for the US indicated a faster rate of output growth in March, but the overall upturn remained modest to round off a first quarter which has seen growth weaken compared to late last year. Many manufacturers have reported the fading of a tariff-front-running upturn in output, and financial services firms are acting as an increasing drag on the services economy, countering a weather-related improvement in some other sectors. Companies are also concerned about an adverse impact on demand from federal budget cuts. Business expectations have meanwhile deteriorated, and cost pressures intensified, with both trends often linked to tariffs and heighted policy uncertainty.

The S&P Global US Composite PMI Output Index rose to a three-month high of 53.5 in March. That was up from 51.6 in February. However, the index remains well below levels seen throughout the second half of last year, and has hence signalled a marked slowing of economic growth over the first quarter as a whole. Historical comparisons indicate that the survey data point to GDP having risen at an annualized rate of just 1.5% in the first quarter, down sharply from the 2.4% rate seen at the end of last year.

While March saw a welcome rebound in service sector business activity after a weak start to the year, manufacturing slipped back into contraction for the first time since December.

Different factors are at play here: companies in the service sector often reported that growth was dampened in the first two months of the year by especially adverse weather in some states, from which activity rebounded in March amid improved weather conditions. There is a suggestion, therefore, that the expansion in March may exaggerate the true underlying growth momentum in the services economy.

In manufacturing, the first two months of the year saw companies report higher production as they sought to front-run tariffs, but this effect waned in March.

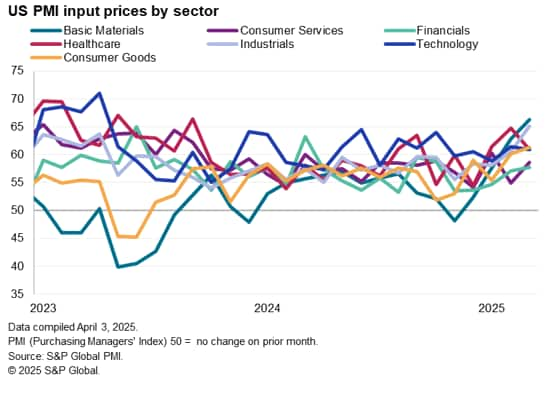

However, drilling down into more sector detail provides further important insight. Here we can see that that principal area of concern in March was basic material manufacturing, followed by consumer goods, both of which saw output fall after particularly robust gains in February. Companies in both sectors reported a renewed softening of demand growth, often linked to tariff-related factors.

Output growth meanwhile accelerated in all other major industries, led by technology and healthcare followed by industrials and consumer services, all of which also saw increased rates of new business growth during March. However, all bar healthcare have seen weaker first quarters on average compared to the closing quarter of last year.

Financials meanwhile lagged, despite seeing a small uplift to growth, amid the first fall in new business placed at financial services firms for 16 months. The financial sector was in fact the only major sector to report falling demand in March, and has also seen by far the sharpest deterioration in relative performance between the fourth and first quarters. This can be linked in part to a tightening of some financial conditions, notably around equity market performance and reduced expectations of lower interest rates supporting economic growth in the months ahead.

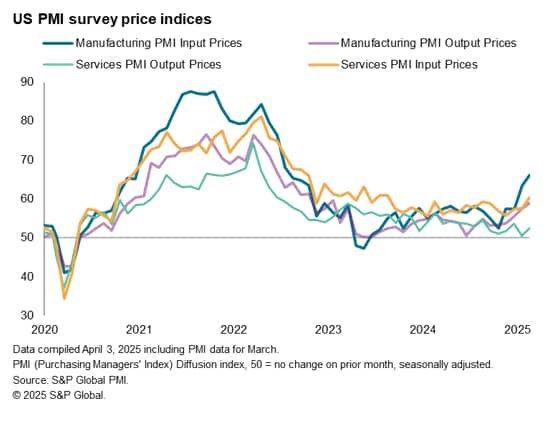

From an inflation perspective, a tariff-related impact was increasingly evident. Input costs rose in March at a rate not seen for almost two years as firms across both services and manufacturing reported intensifying supplier-driven price hikes, reportedly fueled by tariffs.

Of particular note was a surge in manufacturing input costs, the rate of inflation rising to the highest since August 2022. Barring the pandemic, this level of factory input cost inflation has not been recorded since August 2022 and, prior to that, June 2011.

However, cost increases were not limited to manufacturing. Service providers also reported accelerating input price inflation, which hit the highest for one and a half years.

There was a divergence in the degree to which these higher costs were passed through to customers, however, with selling price inflation rising sharply in manufacturing but remaining subdued in services, the latter reportedly restrained by competition and reduced prices for financial services, linked in part to the recent lowering of interest rates.

The focus turns to the outlook, for which a gloomier picture is presented by the PMI's future expectations index edging lower again in March. Business sentiment is now the lowest since late 2022 barring only the heightened uncertainty seen ahead of last year's Presidential election.

While optimism remains buoyant in manufacturing by standards seen over the prior three years, it has cooled since the turn of the year. Optimism in services has meanwhile ebbed to one of its lowest levels seen over the past two years.

Companies reported heightened concerns and uncertainty around the impact of political change, including DOGE-related budget cutting, tariffs, and the degree to which foreign demand may be affected by recent policy initiatives. Concerns have also risen in relation to the recent increase in prices, and the degree to which higher costs may harm margins, dampen demand, and reduce the central bank's scope to lower interest rates.

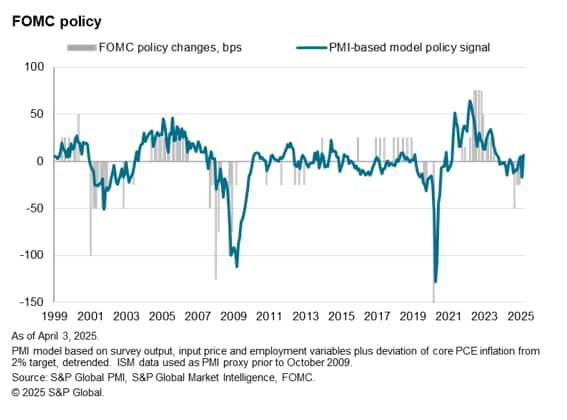

The rise in costs reported in March, combined with the recovery of output growth from the recent low seen in February and an associated upturn in employment registered by the survey, hints at a slight shift in policy bias. Whereas the survey indicators had collectively been running at level historically consistent with a slight bias toward looser monetary policy in February, the March data have signaled a shift toward a slight tightening bias.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings