Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 14, 2018

IHS Markit US PMI indicates strong start to fourth quarter

- IHS Markit PMI data indicate robust start to fourth quarter, though weather impact clouds the picture

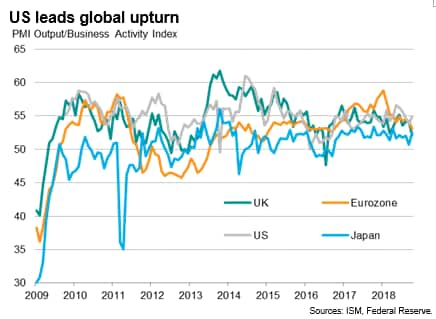

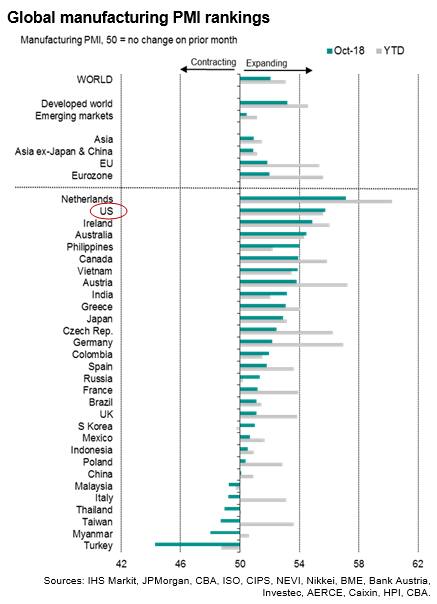

- Upturn means US increasingly leads other major economies in terms of output growth

The October IHS Markit US PMI surveys showed a rebound in business activity from a weather-torn September, providing an early indication that the economy has started the fourth quarter on a solid footing. The upturn means the US has opened a gap in outperforming other major developed economies.

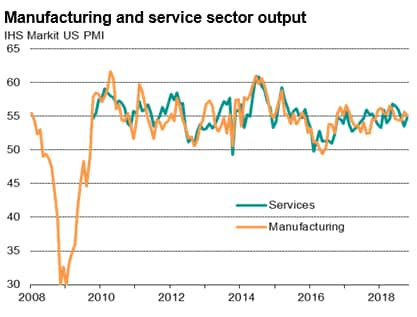

At 54.9 in October, the final seasonally adjusted IHS Markit U.S. Composite PMI™ Output Index picked up from 53.9 in September to lie just below the average of 55.1 seen so far in the year to date.

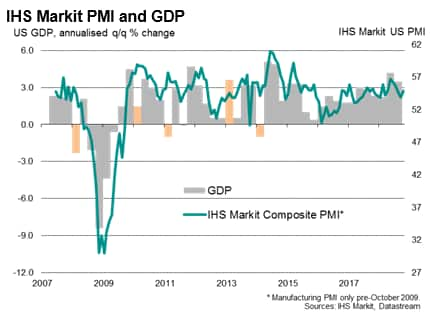

Strong domestic demand was a key factor reported to have propelled service sector growth higher in October. Combined with steady output growth recorded in the manufacturing sector, the survey data suggest the economy grew at its fastest rate since July. Comparisons with GDP indicate that the latest survey data translate into an annualised rate of economic growth of around 2.5-3.0%.

Expectations towards business growth over the coming years meanwhile spiked higher, suggesting companies are expecting a strong end to the year for the economy. The data therefore adding to signs that the US will see another quarter of solid economic growth, building on 4.2% and 3.5% rates of increase seen in the second and third quarters respectively, which represented the best back-to-back quarterly expansions for four years.

A more reliable picture

The composite PMI output index has a strong track record of accurately predicting official GDP data, albeit with notable divergences apparent in earlier years when the GDP data are considered to have failed to fully capture seasonal changes in the economy (see chart, where the orange bars highlight consistently weak first quarters to the year). The PMI has, over these years, tended to paint a more accurate picture of the underlying pace of economic growth.

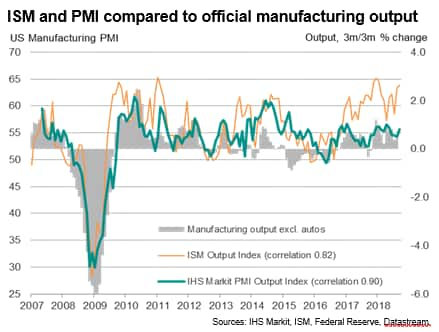

The PMI data also offer an advantage over ISM survey data, which have tended to over-state growth in recent years (read more about these divergences in our recent paper comparing the two surveys and our note on their use in 'nowcasting').

Outperformance

As a result of the improved performance in October, the US moved ahead of other major developed economies in terms of economic growth. In contrast, growth slowed in the UK and Eurozone, though showed a welcome pick-up in Japan.

The US's stronger performance was also highlighted by the US moving up the global manufacturing PMI rankings, beaten only by the Netherlands in October.

Watching the weather (impact)

One word of caution comes from analysis of the survey's anecdotal evidence, which indicated that at least some of the improved performance reflected business returning to normal after weather-related disruptions in September.

With the combined September-October reading being the lowest since March, November's survey results will be important in providing insight into the extent to which the underlying trend of economic growth remains resilient in the face of widespread concerns about the impact of tariffs and trade wars.

For more information contact economics@ihsmarkit.com.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-indicates-strong-start-to-fourth-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-indicates-strong-start-to-fourth-quarter.html&text=S%26P+Global+US+PMI+indicates+strong+start+to+fourth+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-indicates-strong-start-to-fourth-quarter.html","enabled":true},{"name":"email","url":"?subject=S&P Global US PMI indicates strong start to fourth quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-indicates-strong-start-to-fourth-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+US+PMI+indicates+strong+start+to+fourth+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-indicates-strong-start-to-fourth-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}