Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2019

US manufacturing recession extends into August as export slide deepens

- Manufacturing PMI hits lowest since 2009

- Survey puts manufacturing production on course for third successive quarterly decline

- Weakness led by steepest fall in exports for ten years

- Business optimism sinks lower, hiring stalls and price pressures moderate

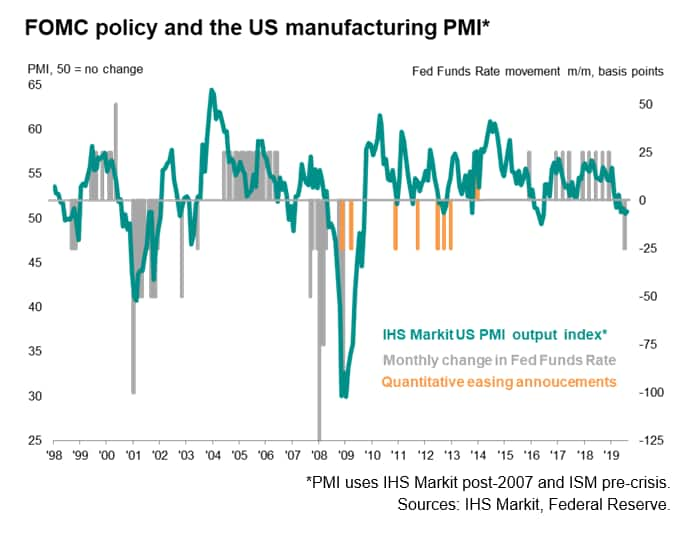

US manufacturers are enduring a torrid summer. Survey gauges of output and new orders are down to their lowest since 2009 and business confidence regarding the outlook has deteriorated further, linked primarily to an intensifying drop in exports and trade war worries.

Output on course for third quarterly fall

The seasonally adjusted IHS Markit Manufacturing PMI™ posted 50.3 in August, up from the flash reading of 49.9 but still down slightly from 50.4 in July. As such, the latest reading was the lowest since the depths of the financial crisis in September 2009.

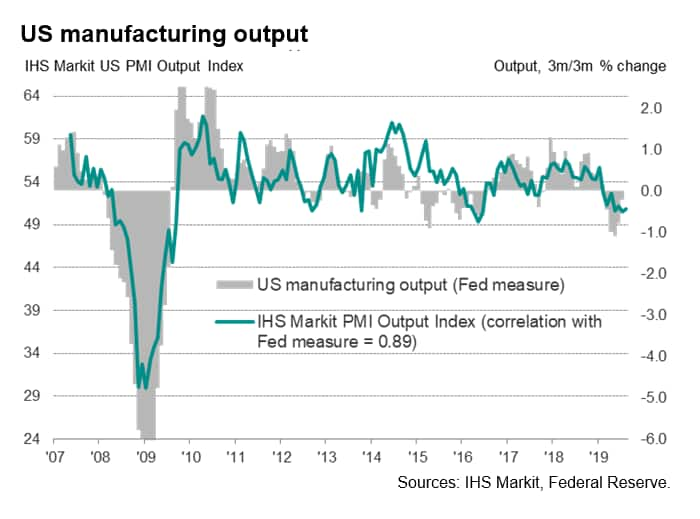

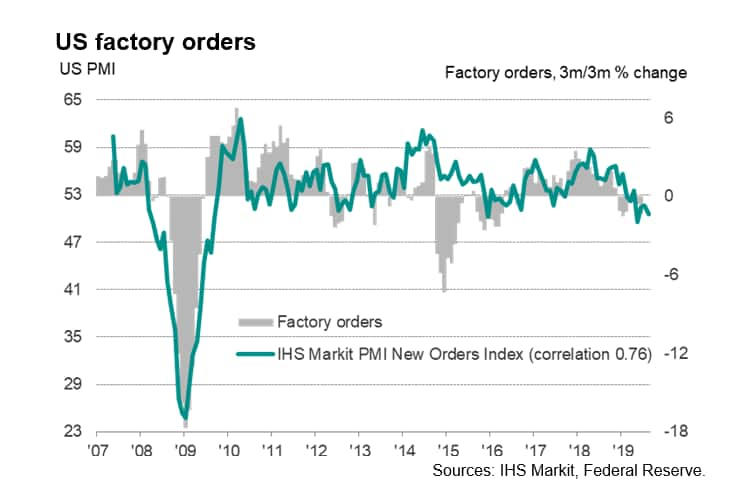

Output and order book indices are both among the lowest seen over the past ten years, indicating that manufacturing is likely to have again acted as a significant drag on the economy in the third quarter, dampening GDP growth. At current levels, the survey indicates that manufacturing production is falling at an annualised rate of approximately 3% (-0.8% on a quarterly basis), according to historical comparisons of the PMI data against Federal Reserve production numbers.

The PMI's output index exhibits a correlation of 89% against official manufacturing output growth and a regression adjusted r-square of 0.79, illustrating the powerful predictive ability of the PMI, which is available almost one month ahead of the official numbers.

If the PMI is correct in signalling a further fall in output so far in the third quarter, production would have now fallen for a third successive quarter, extending the manufacturing recession. So far, official data for the third quarter are only available up to July, which showed a 0.4% monthly decline.

Export woes

Deteriorating exports are the key to the downturn, with the August PMI showing new orders from foreign markets dropping at the fastest rate since 2009. Many companies blamed slower global economic growth for weakened order books, but also pointed the finger at rising trade war tensions and tariffs.

Hiring hit by weakened confidence

Hiring has meanwhile stalled as companies worry about the outlook. The PMI's only subjective question on optimism, which asks companies about their own projection for output in the year ahead, has slumped to its lowest since comparable data were first available in 2012. Many stated that uncertainty and fears of a global economic downturn weighed on confidence.

The drop in the survey's employment index hints at a worsening of payrolls in manufacturing to the tune of approximately 25,000 jobs being lost per month, which contrasts markedly with the recent upbeat official jobs data available up to July.

Easing price pressures

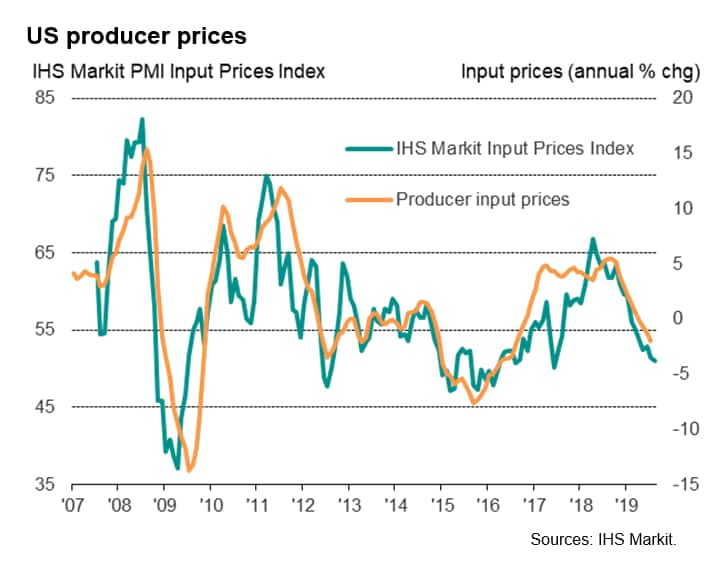

Similarly, price pressures are at their lowest for three years, as crumbling demand has removed firms' pricing power.

Historically muted rises in both input prices and output charges were once again reported by manufacturers in August. A reduction in demand for inputs reportedly limited suppliers' price power, and pressure to remain competitive meant firms largely refrained from sharp rises in output charges. Compared against official input price data, the survey gauge of producer input prices for August suggest prices fell at an increased annual rate.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-recession-extends-into-august-030919.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-recession-extends-into-august-030919.html&text=US+manufacturing+recession+extends+into+August+as+export+slide+deepens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-recession-extends-into-august-030919.html","enabled":true},{"name":"email","url":"?subject=US manufacturing recession extends into August as export slide deepens | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-recession-extends-into-august-030919.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturing+recession+extends+into+August+as+export+slide+deepens+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-recession-extends-into-august-030919.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}