Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 06, 2024

The PMI surveys from S&P Global brought news of a welcome combination of solid economic growth and cooler selling price inflation in July.

However, growth is unbalanced with robust service sector gains contrasting with a near-stalled picture for the goods-producing sector.

Furthermore, although selling price inflation moderated, the surveys saw some upward pressure on costs, growth of which remained elevated by historical standards.

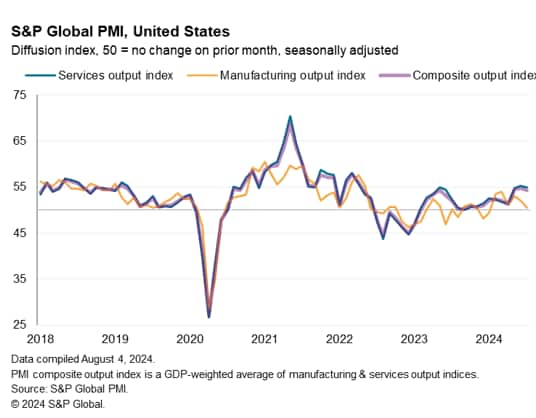

July saw another strong expansion of business activity in the service sector, according to S&P Global's PMI surveys, which over the past three months has enjoyed its best growth spell for two years.

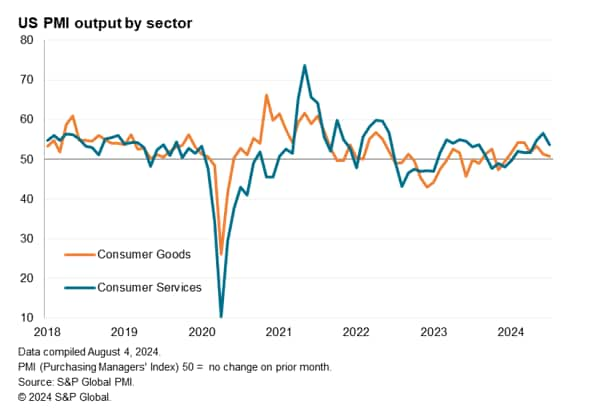

The robust service sector growth contrasts with the deteriorating picture seen in the manufacturing sector in July, where output came close to stalling.

While manufacturers are reporting reduced demand for goods, this in part reflected a further switching of spending from consumers towards services such as travel and recreation. However, healthcare and financial services are also reporting buoyant growth, fueling a widening divergence between the manufacturing and service economies in recent months.

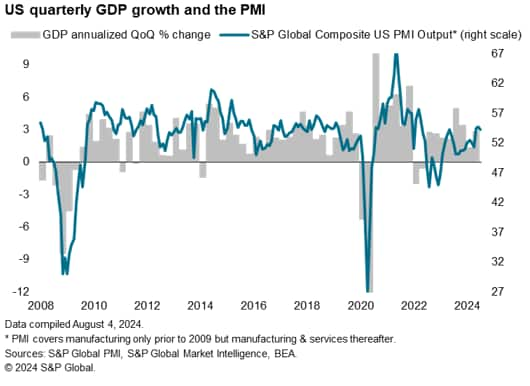

Thanks to the relatively larger size of the service sector, the July PMI surveys are indicative of the economy continuing to grow at the start of the third quarter at a rate comparable to GDP rising at a solid annualized 2.2% pace. While that is below the 2.8% recorded in the second quarter, according to official first estimates, it still represents a healthy upturn and compares favorably with recent signs of stalling growth in the eurozone during July.

Although the headline S&P Global US PMI Composite Output Index fell for a second month from 54.8 in June to 54.3 in July, the latest reading was the third highest recorded over the past 14 months, and is marginally above the survey's long-run average of 54.2.

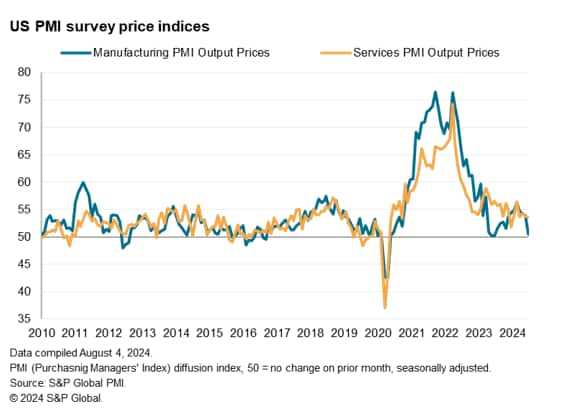

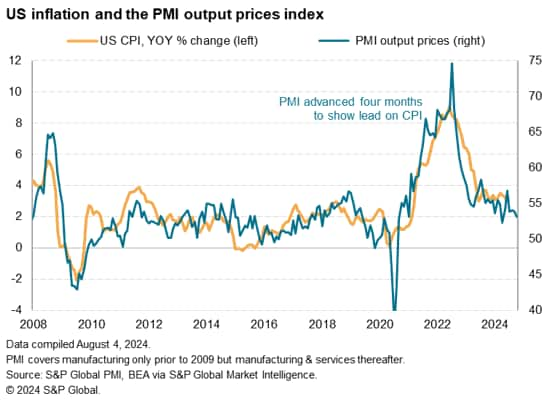

A further cooling of selling price inflation in the service sector meanwhile brings encouraging news for the Fed. Average prices charges rose at the slowest rate since January, hinting that inflation rates are moderating again after ticking higher in the spring. The latest rise was in fact the second-lowest since June 2020.

Combined with a near-stalling of price increases in the manufacturing sector, the softer rise signaled in the service sector survey data point to average prices charged for goods and services rising at a slower rate which is indicative of consumer price inflation moving closer to their 2% target.

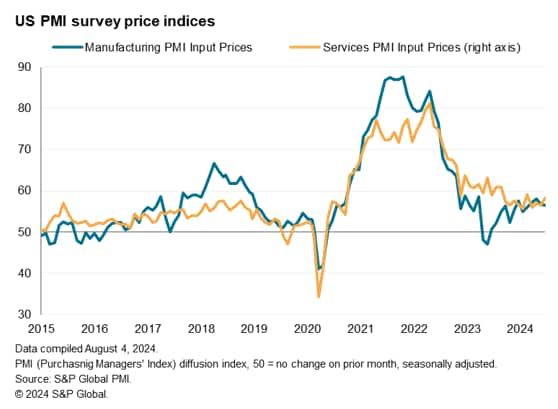

If there is a blot on the inflation landscape it comes from the survey data on firms' costs. In particular, input cost inflation in the service sector, which is dominated by wages and salaries, rose at an increased rate in July, rising at a pace well above the pre-pandemic average. Similarly, manufacturing input costs also rose at a solid pace, albeit in the case of manufacturing the rate of increase was slightly below the pre-pandemic average. Policymakers will likely be eager to see these cost pressures soften before being confident of inflation falling sustainably to target.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.