Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 07, 2021

US consumer goods producers report highest capacity constraints

US Sector PMI data showed that more sectors clocked growth in November compared to the prior month, although goods-producing industries appear to remain shackled by supply issues. As a result, price pressures persisted, carrying implications for monetary policy while the US economy grapple with the COVID-19 Omicron variant uncertainties.

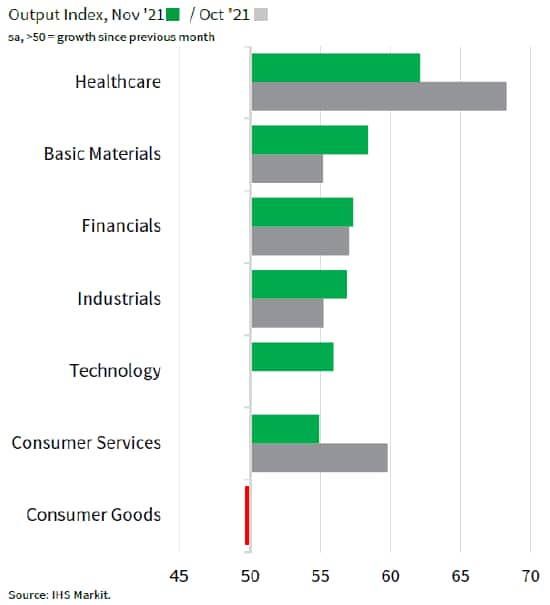

Six of seven sectors tracked registered output growth

The latest IHS Markit US Sector PMI™ revealed that six of the seven broad sectors tracked by the surveys reported higher output in November, up from five in October, with the Technology sector having returned to growth. Healthcare continued to lead the sectors, which perhaps comes as no surprise amid the slight pick-up in COVID-19 cases across the US.

Consumer Goods, on the other hand, persisted as the worst performer and remained in contraction. Worryingly however, rather than being demand led, the lowered output had been a reflection of the lingering supply chain crisis.

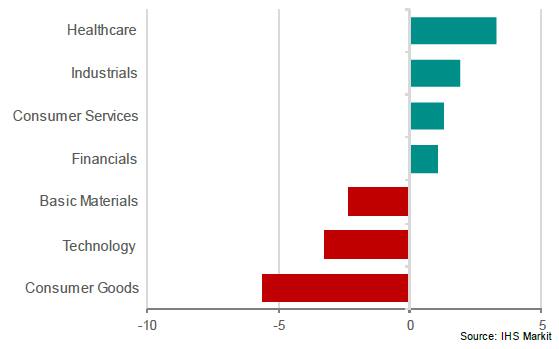

Goods-producing sectors reflect severe demand-supply gap

It had been noted that global manufacturing, despite being supported by rising Asian output, had continued to face issues of supply shortage and price pressures and that these were most prevalent across regions such as the US and Europe.

Studying the US Sector PMI sub-indices performance, one would find that output had indeed been lagging demand primarily across goods-producing sectors including most notably Consumer Goods but also Technology and Basic Materials. This is an important issue as highlighted in our IHS Markit US Manufacturing PMI report. Despite some of these supply chain problems having eased in November, the extent to which production growth had been constrained is consistent with manufacturing acting as a drag on the economy during the fourth quarter. Similarly for US sectors, this will be something to continue scrutinising given the potential drag this could pose to output and thereby corporate earnings going into 2022.

As it is, our IHS Markit Investment Manager Index had demonstrated in early November that while risk sentiment improved towards consumer discretionary, industrial and basic materials sectors, supply line worries continued to limit the enthusiasm towards these to some extent.

US sectors output minus new orders indices

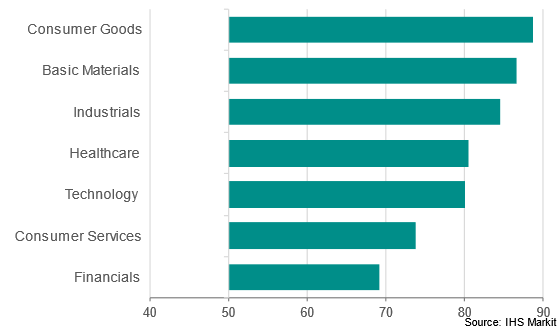

More severe price pressures seen for goods-producing sectors

Of no surprise here, the demand-supply imbalance had thereby proven it is a sellers' market as input prices surged across all seven sectors. This was most notable amongst the goods-producing sectors, led by the Consumer Goods sector in November.

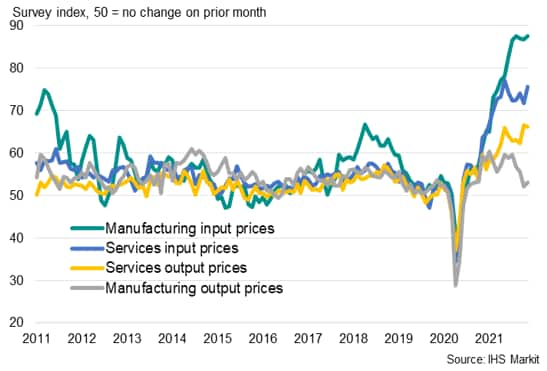

Meanwhile, consistent with the global trend, service sectors had similarly experienced higher costs, driven by higher material prices, energy prices and staff costs. This is also observed through the wider US manufacturing and services PMI price indices.

Although IHS Markit continue to view the issue of soaring inflation rates, particularly in the West, as a bigger problem in the short-term with headline inflation rates set to moderate from 2022 as supply bottlenecks clear and pent-up demand dissipates, the potential "second round" effects - whereby current elevated inflation rates could feed through to higher wages - should not be ignored. The potential for this to become a bigger problem will continue to be watched through the mix of US sector performance going forward.

US sectors input price indices

US manufacturing and services price indices

US Sector PMI data implications

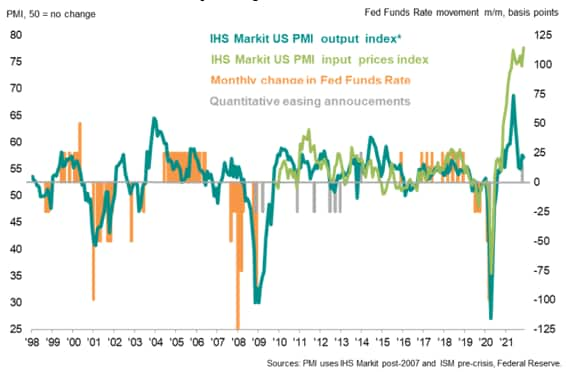

Amid the onslaught of supply chain woes, prices have been shown to remain elevated and the recent US central bank rhetoric also adopted a hawkish-tilt. Fed chair Jerome Powell in his end-November speech noted that the Fed will look to drop the "transitory" view towards inflation while highlighting that tapering of asset purchases may be accelerated, inviting questions on interest rate hikes that are expected to follow.

While recent price performances perhaps draw added attention with regards to the risk of rising interest rates, the slowdown in output growth warrants caution with any lift-off plans. Fed chair Jerome Powell's comments also took the market by surprise at a time when the COVID-19 Omicron variant was reported to be spreading, with the latest news pointing to more US states reporting the presence of the variant.

Even if the assumption of the vaccines holding their efficacy rates against the new Omicron variant is proven to be true, manpower disruptions with this potentially more virulent variant remains a lingering concern particularly for the US which is already facing a tight labour market. Not to forget that the demand-supply imbalance may also further worsen if the market deems there to be risks with the current shortages issues.

US PMI vs. FOMC policy decisions

All said, the US Sector PMI data will need to continue to be watched closely going forward for the differentials in sector performance to provide a more detailed picture of US economic performance. The relevance to equity investments had been displayed using a sub-set with the national sector data, but the logic similarly applies with watching relative momentum to derive better signals for one's investment strategies.

Jingyi Pan, Economics Associate Director, IHS Markit

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-goods-producers-report-highest-capacity-constraints-dec21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-goods-producers-report-highest-capacity-constraints-dec21.html&text=US+consumer+goods+producers+report+highest+capacity+constraints+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-goods-producers-report-highest-capacity-constraints-dec21.html","enabled":true},{"name":"email","url":"?subject=US consumer goods producers report highest capacity constraints | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-goods-producers-report-highest-capacity-constraints-dec21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+consumer+goods+producers+report+highest+capacity+constraints+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-consumer-goods-producers-report-highest-capacity-constraints-dec21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}