Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 19, 2024

By Chris Rogers and Michael Zdinak

Learn more about our data and insights

The back-to-school shopping season is the second-most-important time of year for many retailers, behind only the winter holidays. Last year, retailers hauled in over $984 billion in sales ahead of the new school year, up 3.6% from 2022.

This year, S&P Global Market Intelligence expects solid wage gains and easing prices to encourage shoppers to shake off their inflation fatigue. Back-to-school sales are forecast to grow 2.9% in 2024, passing the $1 trillion mark. That's still below the pre-pandemic average of 3.7% — and well below the inflated rates coming out of the pandemic — but in line with sales last year.

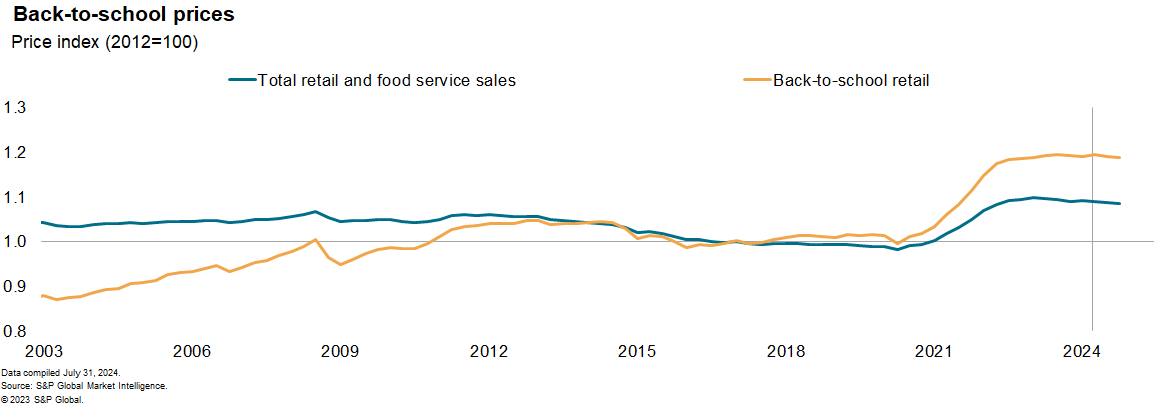

The slowdown is not as worrisome as it may first sound, since lower retail inflation slows the growth of current dollar sales. In our forecast, retail prices fall 0.7% this year, meaning real retail sales — current-dollar sales adjusted for the change in retail prices — are expected to grow 3.6% in 2024, and outpace real sales growth in 2023.

We look for retail prices to fall 0.7% this year, after rising 5.9% in 2022 and 0.6% last year, and for real back-to-school retail sales to grow 3.6% in 2024, outpacing real sales in 2023.

Supply chain activity

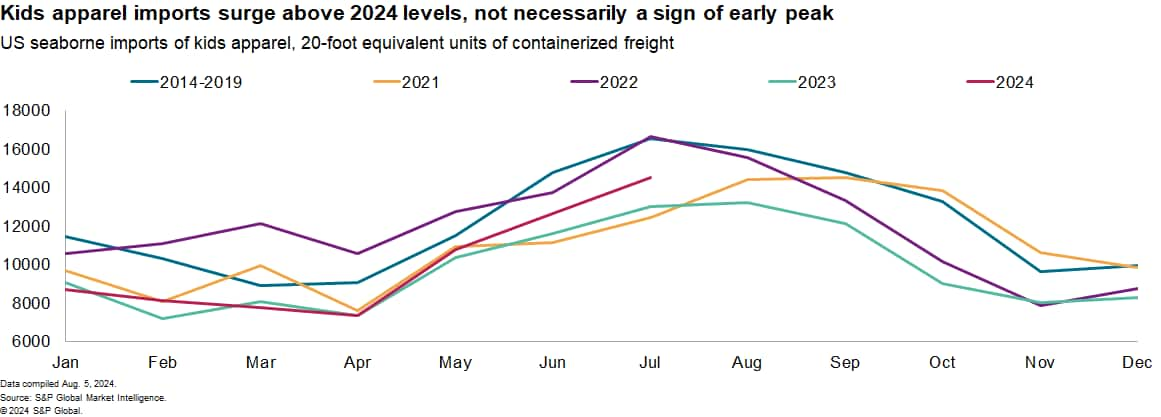

Peak shopping seasons require peak shipping seasons. The back-to-class season, running from late June through August, covers a cluster of electronics, apparel, furniture, and school supplies. Supply chain activity for back-to-school products including kids' apparel, dorm furniture, and school supplies increased year over year from April to July, driven by a mix of demand factors and early shipping due to supply chain challenges.

A mixture of demand factors including a stabilization period after destocking in 2023 may have led retailers to increase their global purchases of products on a year over year basis. Firms have also had to contend with a protracted period of supply chain challenges, including disruptions to shipping in the Red Sea and the threat of strikes at US east coast ports, which may have led them to ship earlier than normal.

With detailed macroeconomic trade data for the US typically only published with a six-week lag, bill-of-lading based shipping data can provide an early guide to the performance of products and firms involved in back-to-school products.

US seaborne imports of kids' apparel — the largest individual category of household spending during the back-to-class period, according to the National Retail Federation — rose by 7%. School supplies experienced a 15% increase, and dormitory furniture accessories imports climbed by 21%. Electronics spending remained depressed post-pandemic, with a notable shift back to airfreight for transportation.

Spending on other categories is somewhat smaller, with spending on school supplies like backpacks and stationery representing 16% of K-12 back to school products while dorm furniture represented 14% of back-to-college spending.

School supplies experienced a 15% year over year increase in US seaborne imports in the April to September period. The expansion was back-end loaded in the period, including an increase of 36% in July thanks to a 53% jump in backpack imports while books and pens slowed to 8% in July. Precise imports of dormitory furniture are difficult to isolate in trade data, though imports of accessories rose by 21% year over year in the April to July period including desk lamps and quilts and bedding.

Consumer sentiment

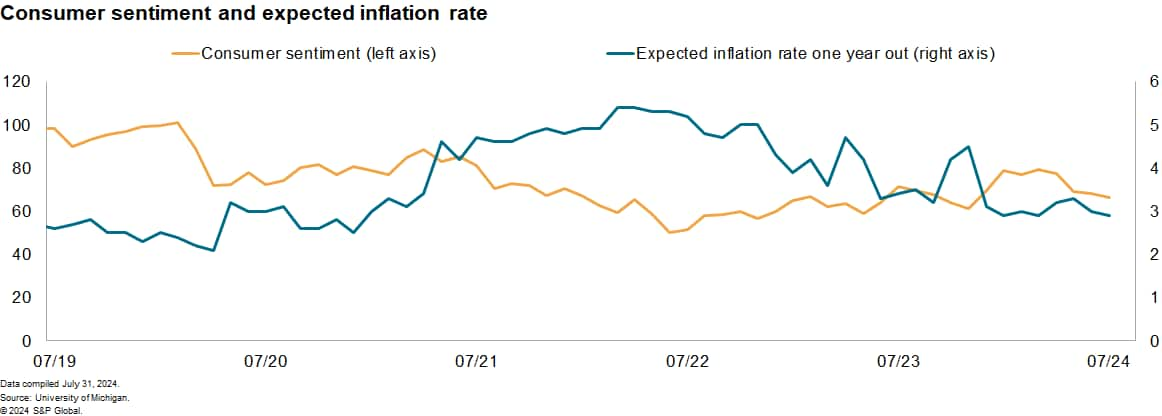

Much of the uncertainty facing retail has its roots in the push-and-pull of prices and wages in recent years, and a preoccupation with if or when the current expansion may end. Our forecast in recent months has been stable, and consistent with our view that the US economy is transitioning to a period of below-trend growth.

The slowing in growth that we expect reflects ongoing drag from past Fed tightening, stricter bank lending standards, diminished tailwinds, a strong dollar, and a soft outlook for equity values. In our forecast, below-trend growth leads to a rise in unemployment, helps slow inflation, and enables the Federal Reserve to begin cutting interest rates later this year.

For consumers, however, a rate cut tomorrow is not a lower interest rate today. Faced with resurgent prices, and the prospect that interest rates would remain higher for longer, sentiment soured earlier this year. Heading into the second half of 2024, it's clear consumers like neither past inflation nor the high interest rates used to combat it.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.