Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 14, 2018

UK pay growth weakens despite further drop in unemployment

- Unemployment rate falls to lowest since 1975

- Employment growth slows

- Wage growth dips lower

The latest labour market snapshot paints a familiar picture, with low unemployment once again failing to stimulate faster pay growth.

The disappointing pay trend runs counter to expectations at the Bank of England and, alongside signs of the economy losing some momentum again at the start of the third quarter, will add to suspicions that interest rates will not rise again in the immediate future, and most likely not until a smooth route through the Brexit process becomes apparent.

Unemployment at lowest since 1975

First the good news: the unemployment rate fell to 4.0% in the three months to June, according to the Office for National Statistics, down from 4.2% in the three months to May to its lowest since 1975. The number of unemployed fell by 65,000 compared to the first quarter.

Employment also continued to rise, up by 42,000 in the second quarter and 313,000 higher than a year ago. Output per worker also showed an encouraging rise of 1.5%.

Weaker employment trend

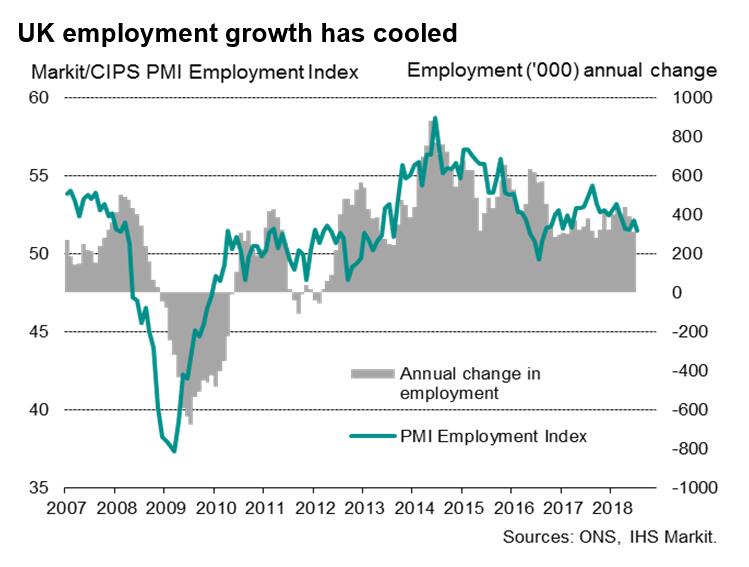

However, the three-month rise in employment was the weakest since the three months to October 2017 and compares with a 197,000 rise in the first quarter. The annual rise in employment was also the lowest since the third quarter of 2017.

A cooling employment trend is likely to have persisted into July. The three IHS Markit/CIPS PMI surveys collectively indicated the joint-weakest rise in employment for nearly two years in July. The survey responses showed that hiring slowed amid signs of intensifying concerns about the outlook, often linked to Brexit. The vast service sector saw a particularly weak rise in employment, according to the surveys, with net job creation running at the lowest since the referendum.

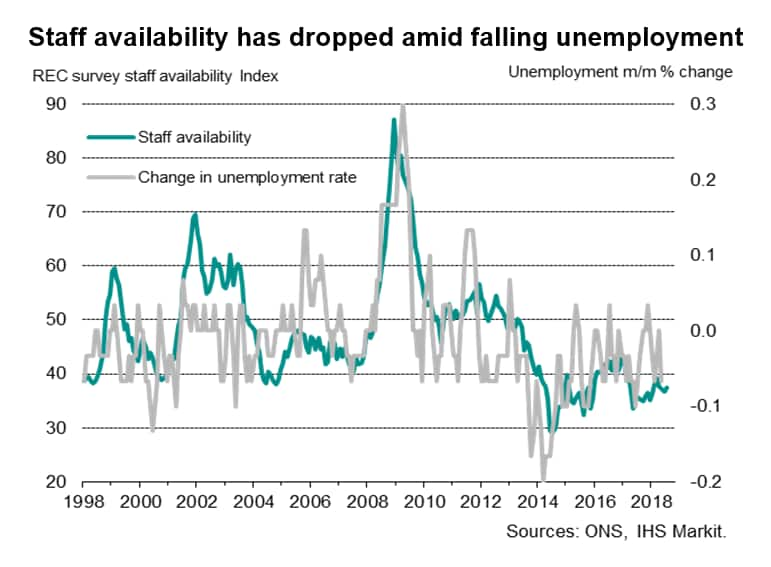

Given the low level of unemployment, the slowing in jobs growth could of course be simply a function of a lack of people to fill vacant jobs, which is something seen in recent recruitment agency survey data. The monthly REC survey of recruiters likewise showed signs of employment growth cooling in July, though the slowing in the number of people placed in permanent jobs to a nine-month low was in part due to difficulties finding suitable candidates.

More encouragingly, the recruitment agency survey found that demand for staff from employers had picked up in July, suggesting that underlying demand for staff remained solid and that the labour market remains tight by historical standards, which in turn hints at stronger pay pressures in coming months.

Stubbornly weak pay growth

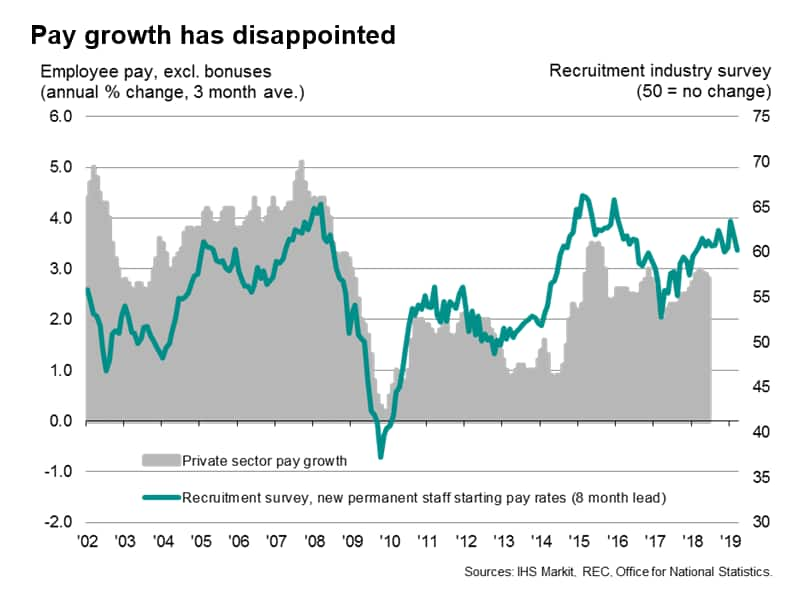

However, rising pay pressures remained frustratingly elusive in the second quarter, meaning earnings growth remained the major source of disappointment. Total pay growth dropped from 2.5% to 2.4% in the latest three-month period. After adjusting for inflation, total pay was up just 0.1% on a year ago in the second quarter.

Excluding bonuses, regular pay growth was 2.7%, its lowest since January and down from a recent peak of 2.9% in the first quarter. Regular pay growth slowed to 2.6% in the service sector, down from a recent high of 2.8% in the three months to April, and slipped to 2.3% in manufacturing, its lowest since the three months to last October. Bright spots were retail, hotels and restaurants, where pay growth lifted to a 15-month high of 2.7%, and construction, where pay was up 5.6%.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-weakens-despite-further-drop-in-unemployment-140818.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-weakens-despite-further-drop-in-unemployment-140818.html&text=UK+pay+growth+weakens+despite+further+drop+in+unemployment+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-weakens-despite-further-drop-in-unemployment-140818.html","enabled":true},{"name":"email","url":"?subject=UK pay growth weakens despite further drop in unemployment | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-weakens-despite-further-drop-in-unemployment-140818.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+pay+growth+weakens+despite+further+drop+in+unemployment+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-weakens-despite-further-drop-in-unemployment-140818.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}