Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 01, 2018

UK manufacturers report slower growth and rising prices

- PMI data signal robust manufacturing growth persisting into January, though expansion slows

- Strong output, export, order and payroll gains

- Price pressures intensify

PMI survey data showed the UK manufacturing sector struggling at the start of 2018 with a combination of slower growth and intensifying price pressures, albeit with future optimism riding higher and rising exports helping to offset softer domestic demand.

Slower, but still robust, growth

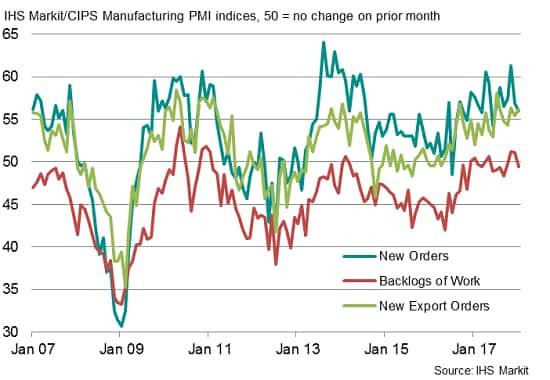

The IHS Markit/CIPS Manufacturing PMI fell for a second successive month in January, down from 56.2 in December to a seven-month low of 55.3 in January. Output growth waned to the slowest for six months and growth of new orders hit the lowest since last June. While the expansions of both remained robust, the latest increases were among the weakest seen since the dip caused by the EU referendum in 2016.

Of note, export growth picked up in January, suggesting a weaker increase in domestic demand was the principal driver of the softer rise in total new orders seen during the month.

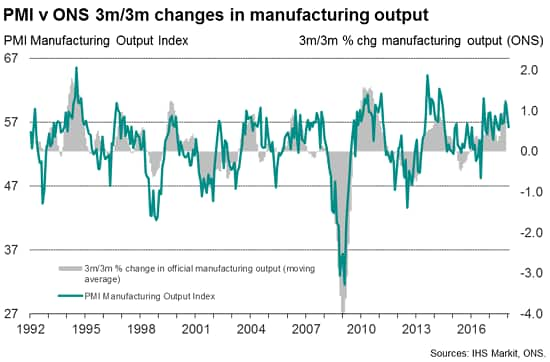

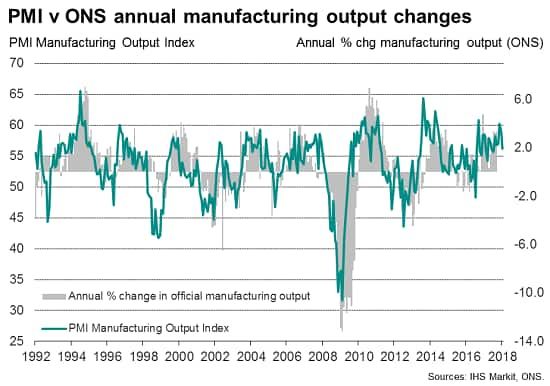

The slowing leaves the overall rate of expansion consistent with the official (ONS) measure of manufacturing output growing at an equivalent quarterly rate of 0.6% in January. While relatively solid, that would represent a marked slowing compared to the average rate of growth seen in the second half of 2017 and suggests manufacturing could make a much reduced impact on economic growth in the opening months of 2018. In recent quarters, manufacturing has been the fastest growing sector of the economy.

Moreover, a further slackening of output growth is hinted at for February, as the weaker rise in overall new work meant backlogs of orders fell for the first time in three months in January.

Brighter outlook

More encouragingly, business optimism about activity levels in a year’s time perked up for a third successive month in January, rising to the highest since September 2015. The brighter outlook in many cases reflected expectations of stronger demand from overseas markets.

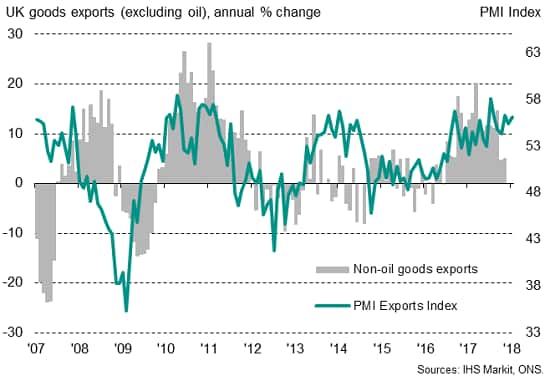

Sterling link to export gains

The strength of UK exports has occurred alongside a marked pick up in the eurozone economy, which is the UK’s largest trading partner. PMI data suggest eurozone growth accelerated further to a 12-year high in January, which should help to boost imports of UK-produced goods.

Manufacturing order books

A concern is that export growth has been on a steadily improving trend since the 2016 vote to leave the EU, which triggered a depreciation of sterling. The recent appreciation of the currency (at least against the US dollar) therefore poses a downward risk to future export growth, though history suggests that the strength of demand across major trading partners is likely to play the larger role in determining export trends.

UK goods exports (non-oil)

Upward price pressures

The January survey also brought news of intensifying price pressures.

Input price inflation accelerated sharply during the month, with the prices index jumping over ten points to reach 76.8, its highest since February of last year. Supplier price hikes, often linked to demand running ahead of supply, were exacerbated by a marked increase in the price of oil during the month.

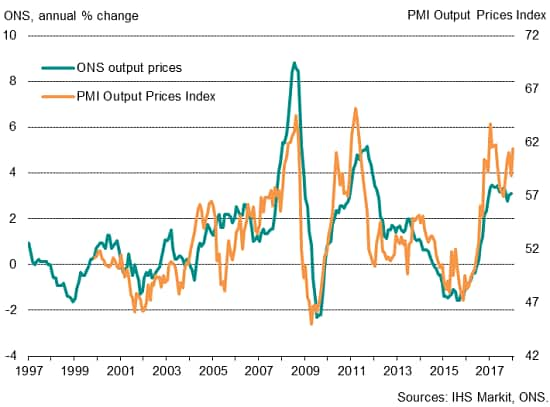

UK factory gate prices

Higher costs fed through to higher factory gate prices, with average prices charged rising at the steepest rate since last April.

Looking ahead, the appreciation of sterling against the US dollar is likely to help alleviate some of the recent upward inflationary pressure on commodity prices.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-slower-growth-rising-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-slower-growth-rising-prices.html&text=UK+manufacturers+report+slower+growth+and+rising+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-slower-growth-rising-prices.html","enabled":true},{"name":"email","url":"?subject=UK manufacturers report slower growth and rising prices&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-slower-growth-rising-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturers+report+slower+growth+and+rising+prices http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturers-report-slower-growth-rising-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}