Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 04, 2018

UK construction growth on shaky foundations as sentiment slides and orders fall

- Construction PMI holds steady at 52.5 in May

- New order inflows fall back into decline

- Business optimism suffers largest monthly decline in six years

- Hiring slows and use of sub-contractors falls

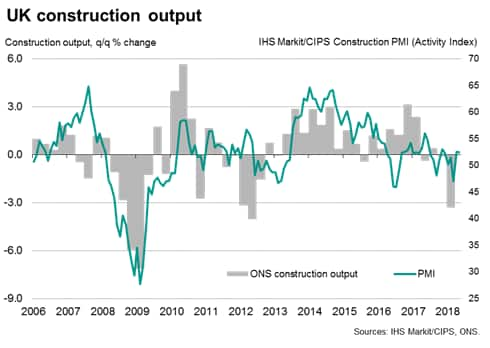

UK construction activity increased in May, but growth looks set to lose momentum in coming months, as new orders fell back into decline, employment growth slowed sharply and future expectations slumped to an extent not seen for six years.

The IHS Markit/CIPS Construction PMI held steady at 52.5, unchanged on the April reading which had been the highest since last November. Respondents indicated that activity in both April and May had been buoyed by the need to catch up on work that had been disrupted by bad weather in March.

However, even with the rebound seen so far in the second quarter, the PMI survey data are indicative of the construction sector growing only very modestly.

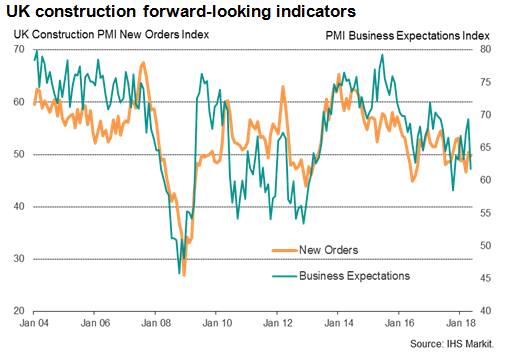

What's more, growth may fade in coming months due to a lack of new work. Inflows of new orders fell slightly in May, down for the fourth time in the past five months, and suggesting that the brief upturn in April was merely a short-lived weather related improvement.

Companies have responded to the lack of new work seen so far this year by pulling back in their hiring. Job growth slowed markedly to a four-month low in May, and the use of sub-contractors fell for the first time since last November.

Adding to the gloom was a steep decline in business expectations about future activity levels, which slid to the second-lowest level since February 2013, having suffered the largest monthly decline seen over the past six years. Companies cited increased business uncertainty, often linked to Brexit, a lack of appetite for investment and signs of a wider slowdown in business growth so far this year.

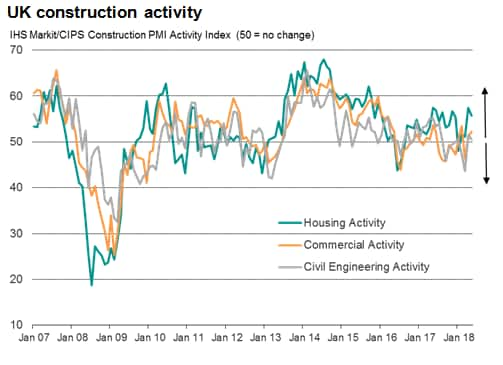

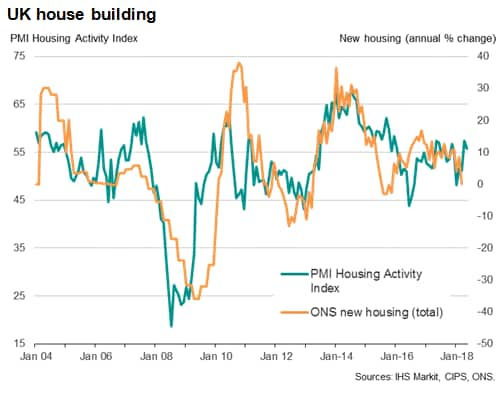

Looking at activity by sector, residential house building enjoyed the strongest expansion of the three areas covered by the construction PMI, and is enjoying its best quarterly expansion since late-2015. Commercial building activity growth accelerated slightly but remained subdued, having failed to gain any significant momentum since the EU referendum. Civil engineering growth meanwhile slowed to near-stagnation.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-construction-growth-on-shaky-foundations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-construction-growth-on-shaky-foundations.html&text=UK+construction+growth+on+shaky+foundations+as+sentiment+slides+and+orders+fall+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-construction-growth-on-shaky-foundations.html","enabled":true},{"name":"email","url":"?subject=UK construction growth on shaky foundations as sentiment slides and orders fall | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-construction-growth-on-shaky-foundations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+growth+on+shaky+foundations+as+sentiment+slides+and+orders+fall+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-construction-growth-on-shaky-foundations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}