Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

PUBLICATION — Apr 29, 2024

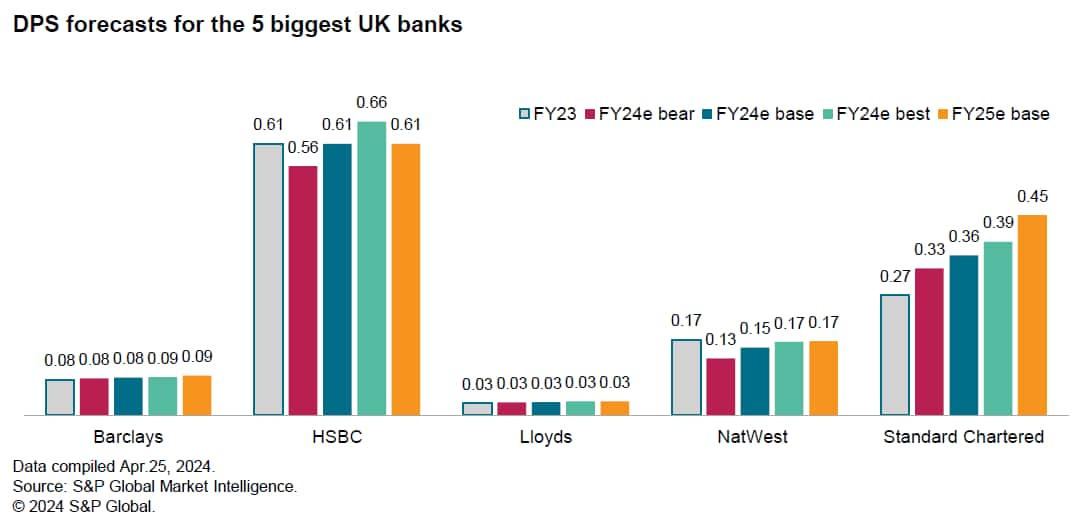

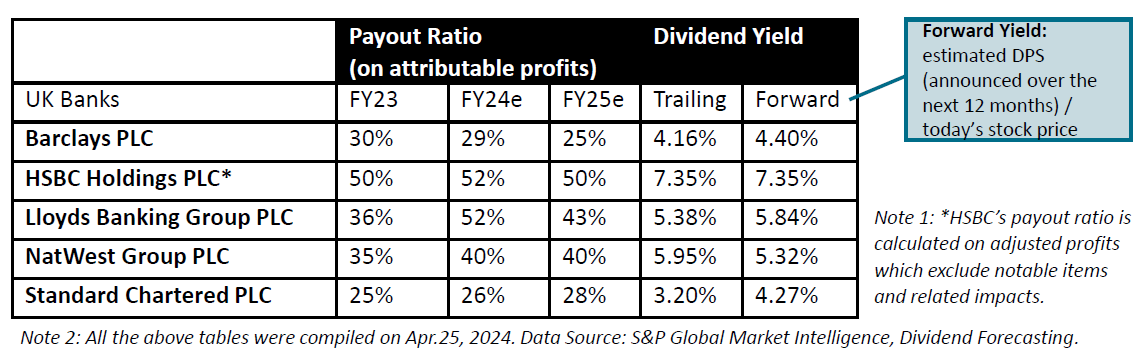

UK banks are on track to report their FY24 Q1 results. As of April 25, 2024, Lloyds and Barclays have affirmed their 2024 guidance. As expected, net interest income (NII) has been slipping in the wake of lower inflation across Europe. However, the main drags on profits come down to other factors such as the new application of the BOE levy, high severance charges, and sluggish performance in investment banking businesses. The banking sector has been employing structural hedge to mitigate interest rate risk and stabilize NII over time. As a result, analysts anticipate a rebound in net interest margin in the upcoming quarters, implying sustained NII support for banks' profits as well as capital allocations. Dividends were buoyed in 2023, which, together with buybacks, were returned by more than £27 billion by the five biggest lenders. Will banks sacrifice robust yet sliding profits to boost dividends even further? Or will dividends retreat from their record highs?

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.