Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

blog — 15 Apr, 2024

By Ravi Amin

In the aftermath of Russia’s invasion of Ukraine, the EU, US, Japan, the UK and others collectively applied trade embargoes to specific "high-priority common items," "critical items" and "battlefield items" to stop the proliferation of Western-made components ending up in Russian-manufactured military items.

The Financial Crime Enforcement Network (FINCEN) under the US Treasury Department and the Bureau of Industry and Security (BIS) under the US Commerce Department, as well as the EU, also specified high-risk transshipment areas known to be facilitating the reexport of Western-made components to Russia, mentioning Armenia, Brazil, Georgia, India, Israel, Kazakhstan, Kyrgyzstan, Mexico, Nicaragua, Serbia, South Africa, Taiwan, Tajikistan, United Arab Emirates and Uzbekistan.

In the context of the above, this paper will provide an analysis on the trade flow of certain US components into those transshipment points in the last two years to assess whether Russia is profiteering from importing reexported US components.

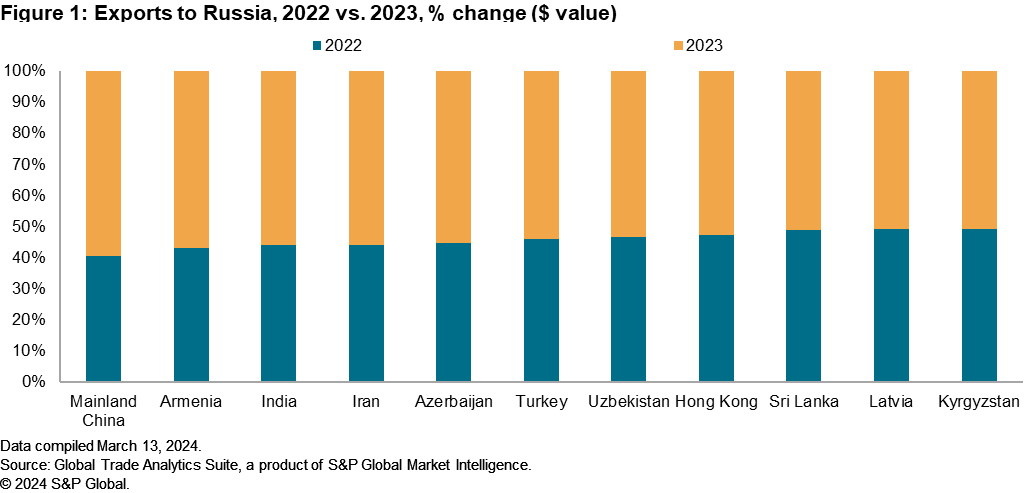

To understand which assumed transshipment points could be used to facilitate trade with Russia, it is important to first understand the impact sanctions have had on Russia’s ability to import goods from other countries. S&P Global Market Intelligence extracted data from customs agents and national statistical authorities to highlight individual country exports to Russia. Figure 1 highlights the percentage change in value of goods (US dollars) exported to Russia, comparing 2022 against 2023. The data show countries with historically strong trade ties to Russia continued the trend, with mainland China and India increasing overall value of exports by more than 45% and 25%, respectively, in the year following the invasion. Neighboring countries to Russia and those with no enforced sanctions on the country to date, such as Armenia, Azerbaijan, Iran, Turkey and Uzbekistan, all expanded their trade exports to Russia in 2023.

To date, The Customs Control Committee of the Ministry of Finance in Kazakhstan has not provided provide full disclosure on its trade activity with Russia for every month in 2023, and therefore is a noted exclusion from the above analysis. Data analyzed from 2022 indicated Kazakhstan was the fifth-largest trade partner of Russia, with total exports valued at more than $5.5 billion, predominantly exporting iron, steel and radioactive chemicals. Another noted exclusion is the UAE, since its customs authorities do not provide Market Intelligence with trade data. However, Market Intelligence can still provide analysis on its trade flow by looking at the mirror trade of countries importing and exporting goods from the country.

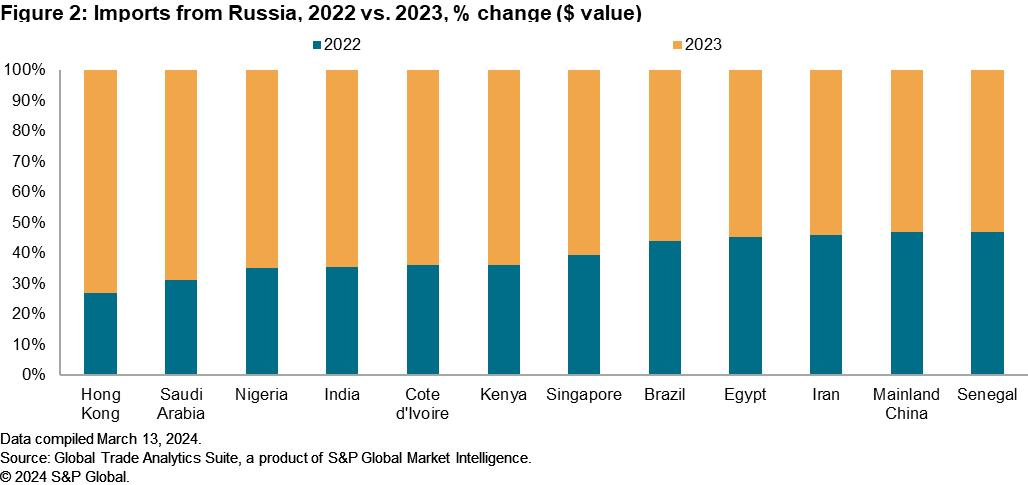

Data were also evaluated to assess the countries that had expanded their imports from Russia in the last two years. Figure 2 highlights the percentage change in value (US dollars) of goods imported from Russia, comparing 2022 against 2023. Nigeria, Cote d’Ivoire, Kenya, Egypt and Senegal increased their imports from Russia in 2023, with Egypt being the 10th-largest importer of Russian-produced goods globally. The shift in 2023 toward countries importing goods such as iron, steel, cereals, wood and petroleum could be considered against trend, as Africa is renowned for its intraregional trade network. This is highlighted when considering that the goods imported and classified under "HS Code Chapter 27: Petroleum and mineral oils" are readily available in oil-rich countries such as Algeria, Angola and Nigeria.

Hong Kong exponentially increased its imports from Russia in 2023. The main contributor of this increase was the import of "HS Code Chapter 71: Natural pearls and precious stones," the import value of which in 2023 was approximately $8.7 billion, almost a 200% increase on the previous year. Specifically, Hong Kong increased its imports of Russian gold, platinum and diamonds, eclipsing the total value of imports by the UAE, the previous largest importer of those Russian-produced goods. To date, Hong Kong has not sanctioned Russia and remains one of Russia’s key trade partners for goods relating to electronic and communications equipment, specifically semiconductors and microchips. The US government has reacted to an increase in certain countries continuing to trade these types of goods with Russia in the last six months. In December 2023, the US president instated the Executive Order 14114, promising the enforcement of secondary sanctions on any foreign financial institution known to be facilitating Russia’s war efforts in Ukraine, either by helping Russian entities to circumvent sanctions by processing their transactions or by facilitating payments of potential dual-use goods and technologies. In January 2024, US government officials met with multiple financial institutions in Hong Kong, again reminding them of the repercussions of facilitating Russia’s war efforts. In February 2024, the EU also added a "no reexport to Russia" clause in its guidance to member states, advising them to incorporate this official terminology in all trade transactions. Regional regulators are actively continuing to clamp down on any perceived illicit trade activity with Russia, with more guidance, advisory notices and enforcement expected throughout 2024.

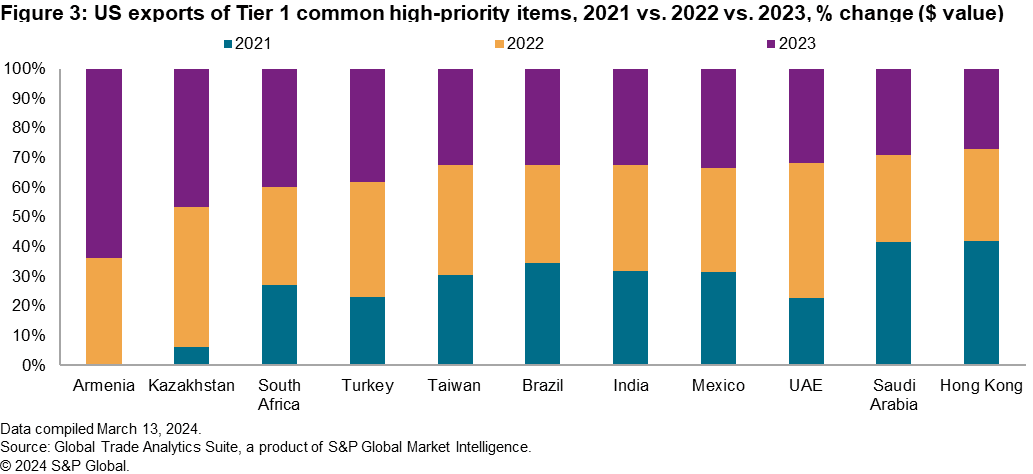

In February 2024, the EU, in coordination with the US, the UK and Japan, enforced further sectoral sanctions on Russia, aiming to curtail its military production. The addition of Tier 4.B. and five new HS codes to the existing 45, covering microelectronics, wireless communication equipment, navigation equipment and different types of electronic manufacturing equipment; it included computer numerically controlled manufacturing equipment, machinery for milling, boring and drilling, and metal machining equipment. Market Intelligence trade data were used to analyze each tier of common high-priority Russian items to understand the year-on-year change in value (US dollars) of US-manufactured items being exported to high-risk transshipment hubs, followed by an analysis to see whether those same countries were reexporting those goods to Russia.

Figure 3 shows the year-on-year percentage change for the last three years of US-manufactured Tier 1 items, valued in US dollars, exported to countries known to be high-risk transshipment hubs. Armenia and Kazakhstan exponentially increased the imports of these goods during 2022 and 2023 compared with 2021, where they reported almost no trade. Three of the high-risk transshipment hubs in Figure 3 were in the top 10 list of importers of US-manufactured Tier 1 items, including Brazil and Taiwan; Mexico was the largest importer, reporting approximately $11.9 billion in imports value. The export of goods classified under "HS Code 854231: Processors and controllers, electronic integrated circuits" to the countries in Figure 3, accounted for the largest year-on-year percentage from both 2021 to 2022, and 2022 to 2023.

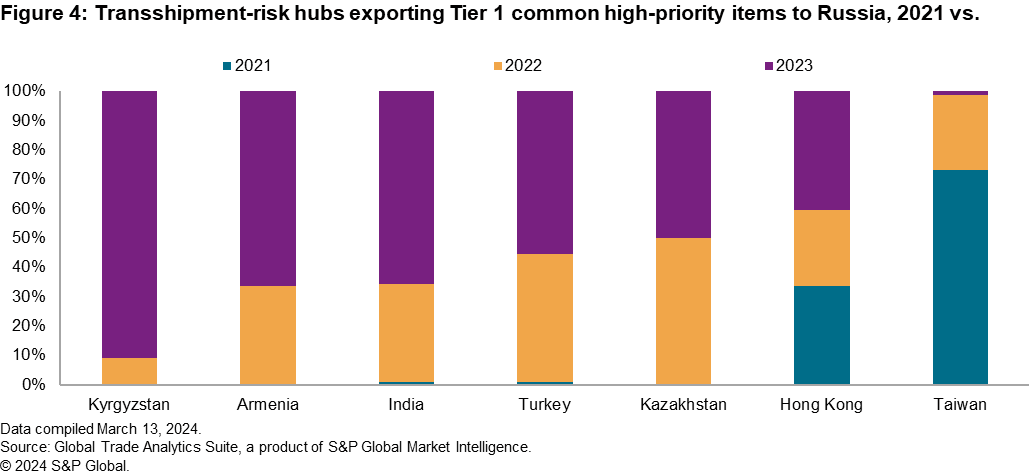

The same countries were then analyzed to compare their trade activity with Russia for Tier 1 items. The largest exponential increase in exports of Tier 1 items to Russia came from Armenia, India, Turkey and Kazakhstan. In 2023, Armenia and Kazakhstan exported approximately $25.5 million and $18.3 million worth of Tier 1 items, respectively, whereas in 2021, there was almost no reported trade. Goods classified under "HS Code 854239: Electronic integrated circuits" were the most exported in 2023; these are goods that could be used for military surveillance, communications and weaponry. South Africa and Brazil did not export Tier 1 items to Russia pre- or post-invasion and therefore were not included in Figure 4. As for Taiwan, the aggregated value of exports to Russia decreased year on year following public disclosures from the country's ministry of foreign affairs to align with Western regulators in strongly condemning Russia's activities and, in turn, enforcing similar sanctions to Western regulators. Kyrgyzstan was not listed as a large importer of US-manufactured items of the Tier 1 classified goods, although the country reported exponential increments in exports of those same goods to Russia. Market Intelligence trade data identified Kyrgyzstan's large trade partner for importing those goods was Hong Kong, a country with no enforced trade embargoes on Russia to date.

Click here to download the full complimentary paper where we go over Tier 2 to Tier 4.B and more:

Subscribe to our complimentary Global Risk & Maritime quarterly newsletter for the latest insight and opinion on trends shaping the shipping industry from trusted shipping experts.

Whitepaper

Whitepaper