Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 16, 2020

Tracking Vessel Activity at Key Ports throughout COVID-19

Using vessel port callings data to gain early insight into how global trade is affected by COVID-19

COVID-19 has engulfed the globe spreading from Asia, throughout Europe to the America's. A virus with such widespread impacts as this is unprecedented, as are the subsequent lockdowns enforced by governments globally. As countries begin to open-up and a new kind of normality returns. The question of how to track the impact, recovery and new opportunities arising from COVID-19 is becoming vitally important.

The impact on the shipping industry has been widespread, whether that is the complete freezing of the cruise ship industry, the implications to crew trapped on board vessels or delays in ports as social distancing is introduced. The shipping industry also has implications for other industries, such as the impact of tanker flows on crude oil trades, fishing vessels on the fishing industry or container ships for consumer goods. An analysis of activities in ports can give a good indication of the severity of COVID-19 impacts and the potential improvements.

Overall Impact

A selection of top countries and ports were selected from across the globe to allow tracking of port activity in the different regions.

Full countries analysed (All ports, all vessels): APAC - China, Japan, South Korea, India. AMER - United States, Brazil. EMEA - France, UK, Germany, Russia

Specific Ports analysed (Vessel types - Tankers, Bulkers & Containers): APAC - Port Klang (Malaysia), Port Mundra (India), Port Headland & Newcastle (Australia). AMER - Vancouver (Canada). EMEA - Rotterdam (Netherlands) & Hamburg (Germany)

Looking at Figure 1 shows how port callings have changed throughout 2020 compared to 2019 given the presence of COVID-19. The callings in 2020 are expected to be higher than 2019 due to increases in AIS coverage and port zoning improvements. The values in 2019 and 2020 are similar in January and February with 2020 slightly higher as expected but in March to May the values in 2020 drop below that of 2019 showing a decrease in activity. This may reflect the large proportions of the globe under lockdown from March onwards. Regional analysis (Figure 2) shows that APAC (China, South Korea, India & Japan) saw the biggest decrease in February. In the Americas region (US & Brazil) the biggest hit was shown in April. Europe regions (UK, France, Germany & Russia) show the smallest changes month-on-month.

Figure 1: Number of port callings and difference for 2019 v 2020. Countries included (All ports & Ship types) are Brazil, China, France, Germany, India, South Korea, Japan, Russia, United Kingdom and United States. Source: IHS Markit Maritime Data

Figure 2: Month-on-Month Percentage change in port callings per region during COVID-19. APAC - China, South Korea, India, Japan. AMER - US & Brazil. EMEA - UK, Germany, France & Russia Source: IHS Markit Maritime Data

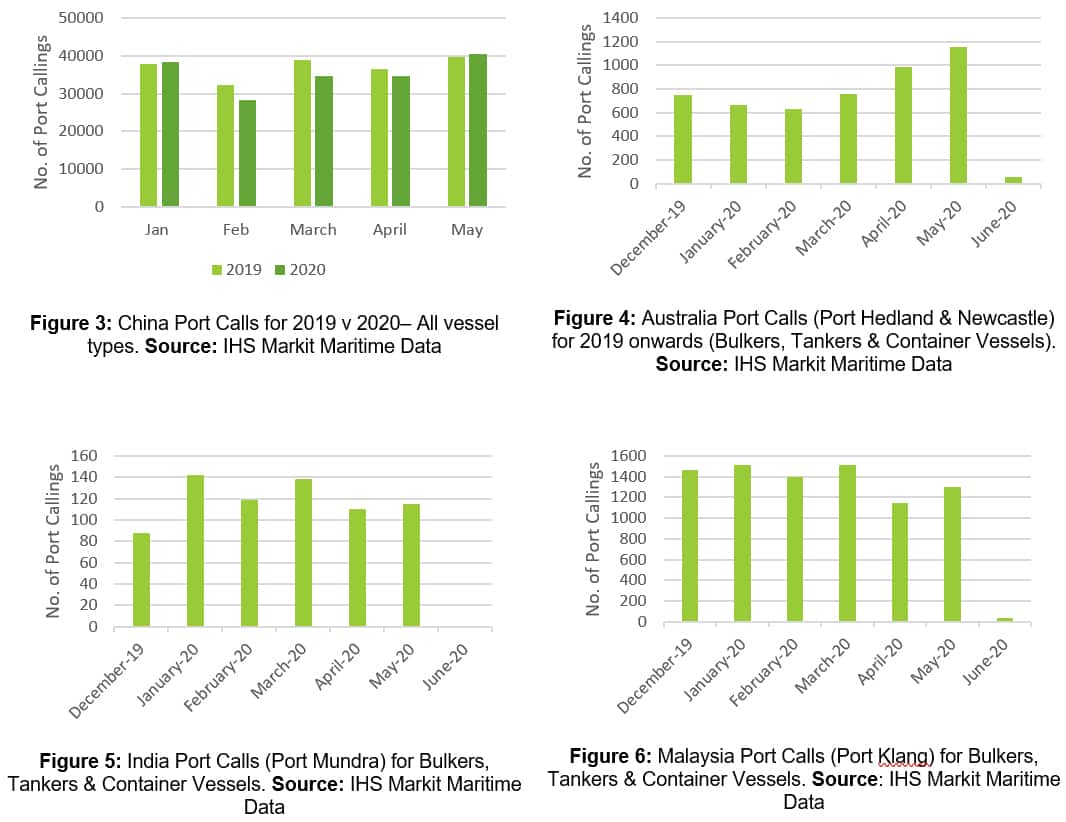

Analysis of Asia Pacific Region

Selecting four countries within the Asia Pacific region (China, Australia, India & Malaysia) allows analysis of how this region is responding to the COVID crisis. For China, as the first country affected by COVID-19, we expect to see the earliest start to recovery. As we can see (Figure 3), China saw a decrease in port callings in February followed by a recovery in May coinciding with a start of lockdown on the 23rd January and lifting on 4th April. The levels in May have returned to 2019 levels indicating a positive recovery from COVID-19.

Given China's major role in many industries, the situation in China can have a major effect on other countries and regions. Looking at select ports in Australia (Figure 4), a country who exports a large amount of coal and iron ore to China on bulk carriers, the number of vessel callings increases significantly from February to May in line with the recovery and increased production in China as lockdown eased. This is at odds with the strict Australian lockdown which started on 23rd March, suggesting that activity at these ports in Australia is largely influenced by demand and hence conditions in China. This increase in activity is large and not consistent with trends in previous years.

In India a strict lockdown was announced on the 25th March. That lockdown remains largely in place other than in 'containment zones' which have achieved a good level of containment of the virus. Usually port calls at Port Mundra peak in April and May however, this year it appears the lockdown has affected this with a decrease in these months observed (Figure 5). At Port Mundra, the port callings are mainly container vessels and bulk carriers.

For Malaysia (Port Klang) port callings are down in April and May. For Malaysia lockdown started 18th March and was slightly eased on 4th May hence, the port calls seem to reflect the expected decrease in activity during the lockdown and subsequent slight recovery as strict measures are lifted (Figure 6). Malaysia's port callings are dominated by container vessels which suggests a high impact on the consumer goods market as this country recovers.

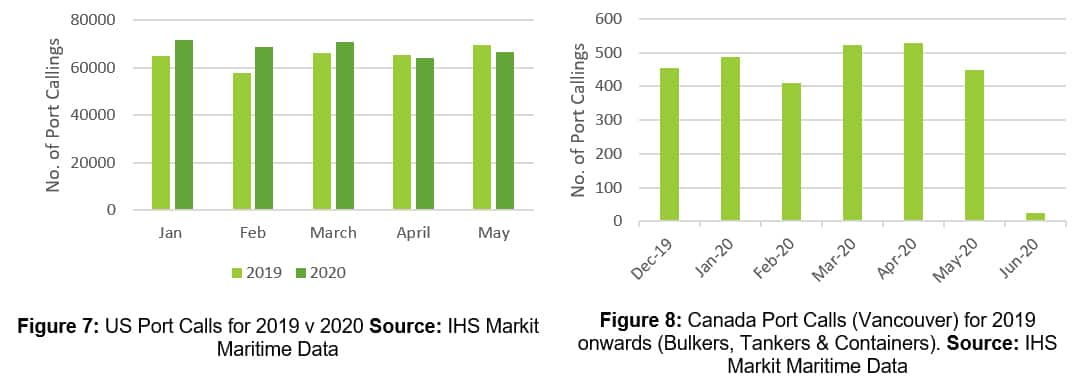

Analysis of Americas Region

The response to COVID-19 in the Americas region is complex and has at times been controversial. Lockdowns were introduced on a state by state basis, while the broad response focused on border security and enforced quarantine on return from travel. It was mid to late March before any significant lockdowns were placed in the US. In the US it seems that the normal seasonal decrease in February was observed followed by a drop of port callings in April and May to below the 2019 levels. This suggests that US port activity has been affected by COVID-19, however, considering the lack of a country wide lockdown as seen in other countries the response may vary from port to port. The situation in the US is also layered with added complexity due to the US-China trade war and the Phase 1 trade deal signed in January which was set to potentially change import and export activity. How this will impact the US and China is still yet to be seen given the overriding COVID-19 factor.

In Canada strict travel restrictions and quarantine were introduced relatively early compared to the number of cases in Canada at the time. This swift action has been successful in maintaining a low death toll. Vancouver also seems to have remained resilient with relatively high levels of calls in March & April suggesting a lower impact of COVID-19.

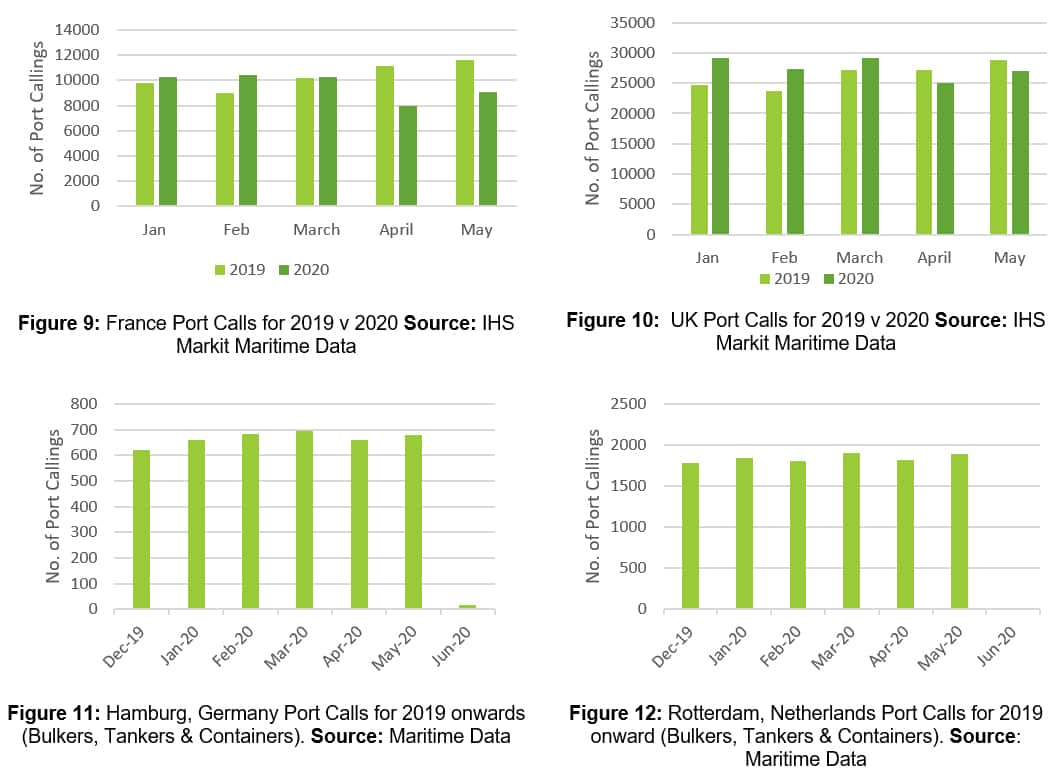

Analysis of European Region

In Europe the spread of coronavirus was rapid with strict lockdowns introduced. Due to the nature of Europe, a lot of trade is possible via land transportation modes. This may explain why the port callings changed by the smallest amount compared to other regions (Figure 2). However, there is still key port activity within Europe that is worth analysis. For the UK and France (Figure 9 & 10) a decrease in port callings is observed in April and May falling below the levels previously observed in 2019. This coincides with the start of a lockdown at the end of March. There is a small recovery in May which may reflect some of the lifting of lockdown rules. Observing this in the coming months will be key to assessing recovery.

For specific ports (Hamburg & Rotterdam), the trend seems to be continued with dips in April during lockdown. Hamburg was showing a steady increase from December through to March before the decrease. Meanwhile Rotterdam has not shown any dips below normal levels. Overall, the decreases and impact observed in these key ports appears to be less significant than in the other regions.

In summary, the impact of COVID-19 on the shipping industry was most felt in April when a large proportion of the world was on some form of lockdown. In most regions it is too early to tell if a recovery has already started. Continual observation of port callings information over the following few months will be key in highlighting any recovery or long-term slow down of the shipping industry and the other industries that are in turn impacted.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-vessel-activity-at-key-ports-throughout-covid19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-vessel-activity-at-key-ports-throughout-covid19.html&text=Tracking+Vessel+Activity+at+Key+Ports+throughout+COVID-19+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-vessel-activity-at-key-ports-throughout-covid19.html","enabled":true},{"name":"email","url":"?subject=Tracking Vessel Activity at Key Ports throughout COVID-19 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-vessel-activity-at-key-ports-throughout-covid19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tracking+Vessel+Activity+at+Key+Ports+throughout+COVID-19+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-vessel-activity-at-key-ports-throughout-covid19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}