Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 04, 2025

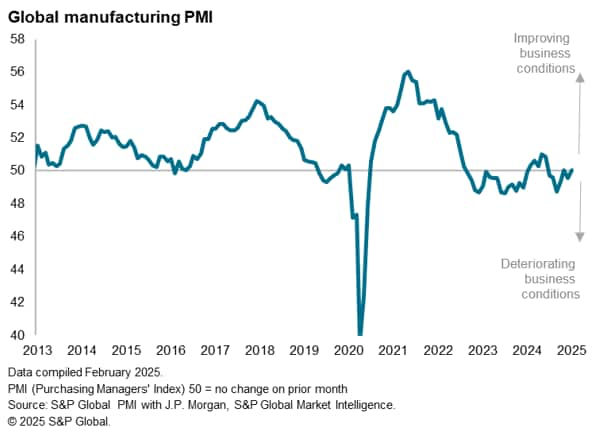

The global manufacturing sector nudged into expansion territory by the narrowest of margins in January. At 50.1, up from 49.6 in December, the Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, edged above the 50.0 no-change level to signal the first - albeit only marginal - improvement in operating conditions since last June.

Regional variations were again marked, however, with current and expected future business conditions improving most markedly in the US. Some support also continued to come from parts of Asia, notably in terms of improved export flows. Sentiment also picked up sharply in the eurozone amid a cooling of its manufacturing downturn.

January nevertheless saw increased job losses linked to cost cutting, in part reflecting heightened uncertainty relating to US tariffs, though US hiring picked up sharply to underline the diverging outperformance of the US.

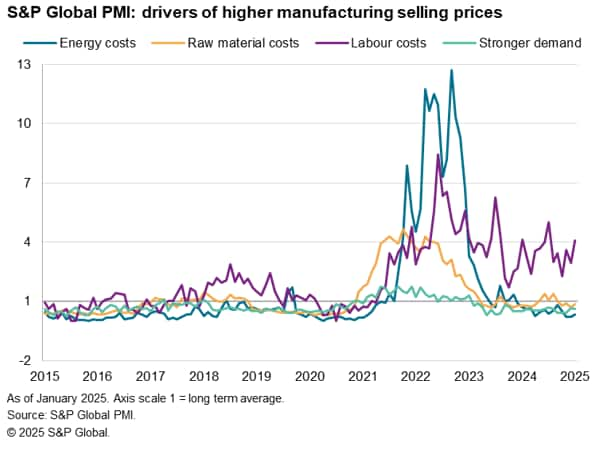

Global price pressures meanwhile edged higher, commonly associated with higher staffing costs.

Here are our top five takeaways from January's manufacturing PMI survey sub-indices, which provide a deeper insight into manufacturing business conditions by analysing varying trends of output, demand, trade, confidence, employment and prices.

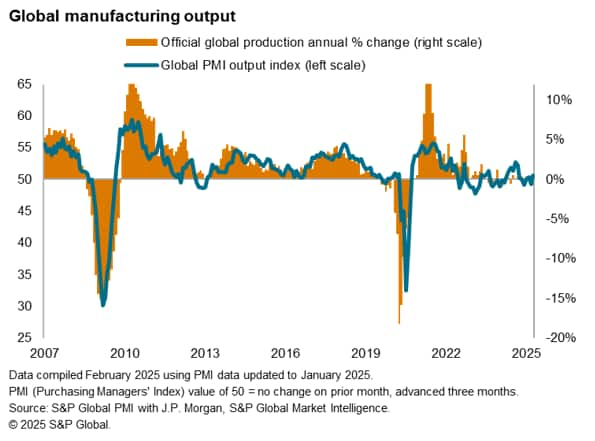

The PMI survey's sub-index of production, which tracks reported month-on-month changes in factory output, signalled a marginal rise in output in January for the third time in the past four months, the latest rise being the largest since last June by a modest margin.

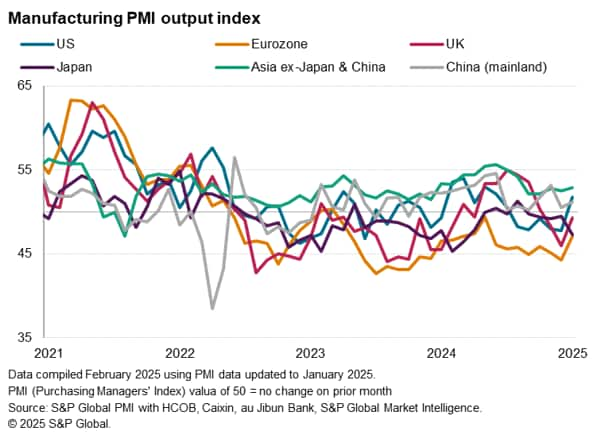

The most significant production change was seen in the US, which saw output growth hit a seven-month high, the upturn breaking a five-month run of continual decline at the end of last year.

Downturns meanwhile eased to marked degrees in both the eurozone and the UK. The eurozone production decline was the smallest since last May, with substantially weaker rates of contraction reported in both Germany and France, and to a lesser degree Italy, accompanying a slight expansion of output in Spain.

UK output, meanwhile, contracted for a third successive month. Although the decline was the slowest seen over this period, it contrasted markedly with the strong expansion recorded over the summer.

Growth also improved in mainland China, albeit remaining below recent highs seen late last year to remain among the weakest recorded over the past two years.

Japan was an outlier, in terms of its trend worsening as it reported the steepest fall in production since last March, extending the decline into a fifth successive month.

Asia excluding Japan and China meanwhile continued to lead the upturn, in turn led by India. Production notably edged back into growth for the first time in five months in South Korea, contrasting with slowdowns in Taiwan and the Philippines and renewed declines in Vietnam and Thailand.

Elsewhere, Australia reported a first increase in production since November 2022, but Brazil slipped back into a marginal decline.

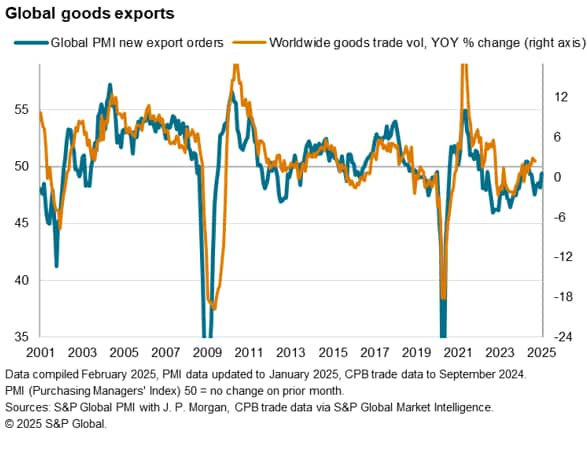

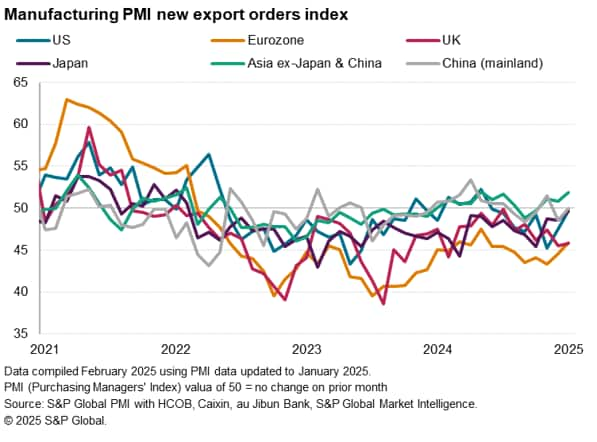

While the PMI's New Export Orders Index signalled an eighth successive monthly fall in global goods trade, the decline was the smallest recorded over this period to hint at a near-steadying of trade flows.

Excluding Japan and mainland China, Asian factories reported the second-largest rise in exports recorded by the PMI for nearly three years, and Japan's export downturn eased to register the smallest export loss for nearly three years. While exports also fell among mainland China's factories, the decline was only marginal.

Export downturns meanwhile also moderated in the US and eurozone, but remained largely unchanged in the UK on the steep decline seen in December.

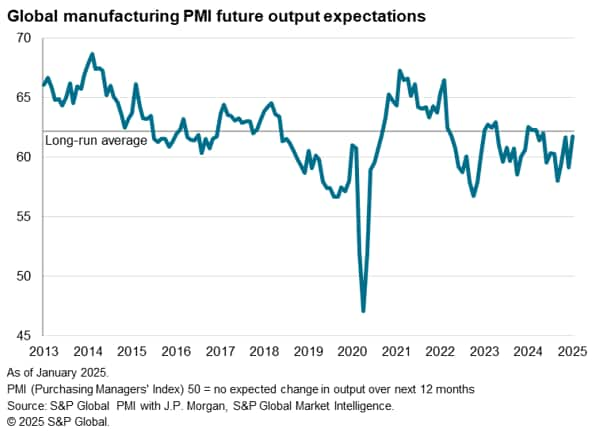

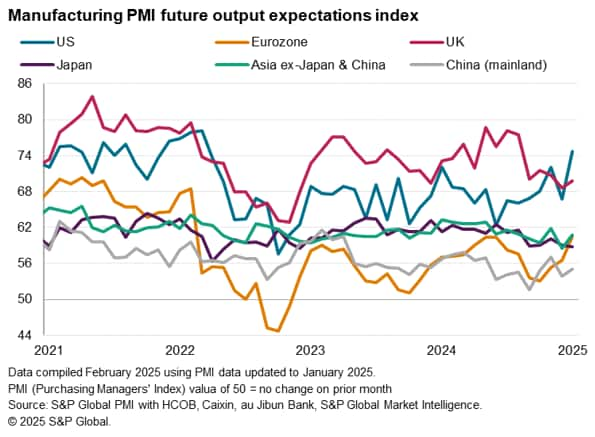

Manufacturing optimism has meanwhile whipsawed globally in recent months, with January seeing a revival after the dip seen at the end of last year. The overall level of sentiment is now back to its joint-highest in eight months and within a whisker of its long-run average.

A surge in optimism among US manufacturers welcoming the new Trump administration meant US firms are now more upbeat than those in Asia or Europe, with sentiment hitting a near-three-year high. At the other end of the scale, the lowest optimism among the world's major economies was recorded in mainland China. However, even here firms grew slightly more optimistic than in December, and markedly improved sentiment was also seen in the eurozone as well as the UK, albeit to a lesser extent. The survey data were captured prior to the announcement of tariffs on Canada, Mexico and China, however, with President Trump also warning of the potential for tariffs to be levied on the EU.

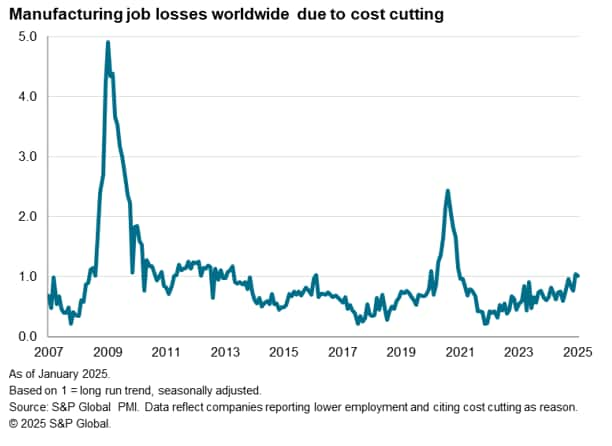

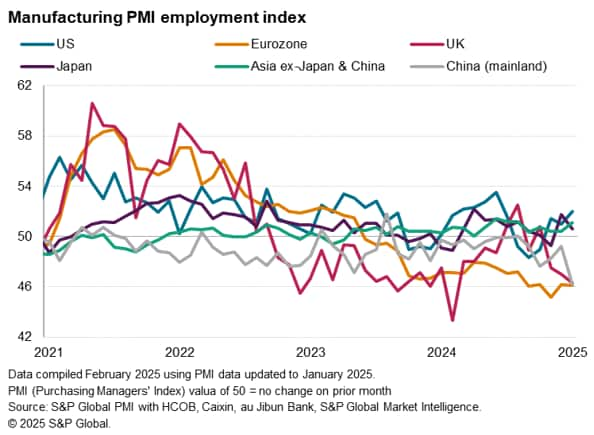

Despite a rise in overall new order inflows and the improvement in business optimism, factory employment fell worldwide at an increased rate in January, dropping for a sixth straight month and at the joint-fastest rate since the initial pandemic hit in early-2020. Besides the pandemic, the recent headcount drop is the joint-largest since September 2009, in part reflecting a growing focus on cost cutting through job losses.

Over the past two months, the tendency for manufacturers to cut employment due to cost cutting has risen to the highest recorded since December 2020. Besides the pandemic, such back-to-back monthly cost cutting of headcounts had not been previously seen since early 2013.

However, hiring conditions varied markedly. Most strikingly, while US factory job creation hit the highest since last June, accelerating beyond rates of increase seen in Japan and across Asia excluding Japan and China, job cutting in mainland China rose to the highest since February 2020. Europe meanwhile also saw steep job losses while job cutting in the UK accelerated to a 13-month high.

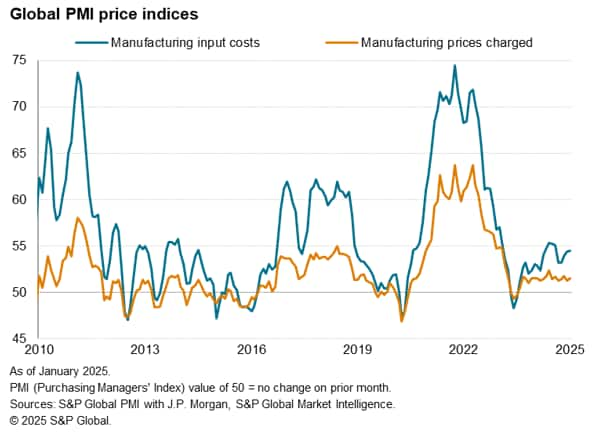

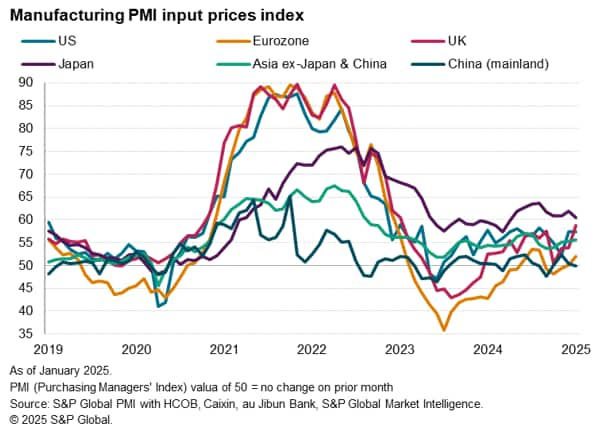

Global manufacturing input cost inflation edged up to a five-month high in January, but remains modest by historical standards. Likewise, selling prices also only rose slightly on average.

While firms reported sustained upward pressure on prices and costs from wages and salaries, energy and other raw material price pressures remained subdued, as did demand-pull price pressure.

Cost trends varied markedly around the world. Japan continued to report especially strong cost growth, in part reflecting higher import prices arising from the historically weak yen. However, cost growth jumped sharply to a two-year high in the UK, buoyed in particular by rising staff costs, and remained close to two-year highs in the US. Modest, but accelerating, cost growth was also seen in the eurozone, leaving mainland China as an outlier in reporting no rise in costs in January.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings