Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 18, 2023

By Ken Wattret

1. Inflation will moderate further.

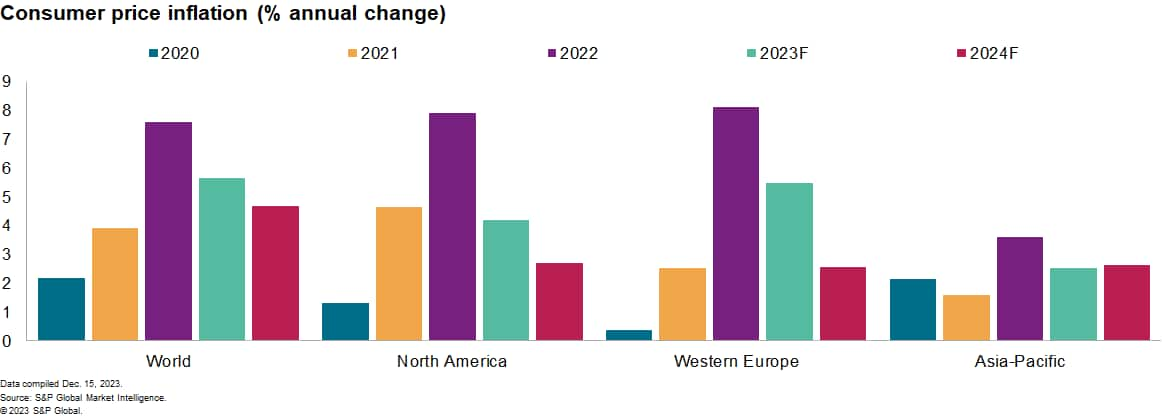

The sharp initial decline in global consumer price inflation from late 2022 stalled in mid-2023, reflecting a rebound in energy prices and sticky core inflation, particularly for services. The downward trend has resumed and is expected to continue through 2024. S&P Global Market Intelligence analysts forecast annual global consumer price inflation at 4.7% in 2024, down from an estimated 5.6% in 2023 and a peak of 7.6% in 2022. Lower consumer price inflation rates in 2024 compared with 2023 are forecast across most regions.

2. Growth in North America and Western Europe will fall short of its potential.

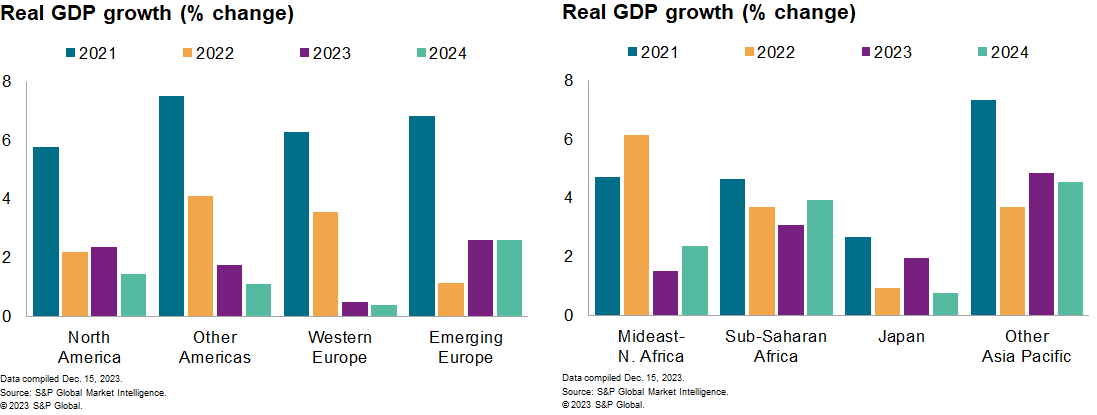

This is consistent with the goal of bringing inflation back to target rates. Weaker annual real GDP growth rates are forecast across all the largest regions in 2024 compared with 2023. Global annual real GDP is forecast to grow at a slower pace in 2024 - 2.3% compared with an estimated 2.7% in 2023 - although strength in some regions including Asia Pacific will help to avert a global hard landing.

3. Mainland China's economy will recover slowly.

Mainland China's economy will be supported by more accommodative policy, a gradual improvement of private-sector confidence, and an expected bottoming out of the housing market downturn. We forecast annual real GDP growth in mainland China of 4.7% in 2024, down from an expected 5.4% in 2023.

4. Policy rates will be cut in advanced economies from mid-year.

With confidence building that consumer price inflation rates will fall back to target, monetary policy pivots are predicted by mid-2024. Rate cuts will begin once concerns about underlying price pressures have abated. Quantitative Tightening (QT) by the world's major central banks will continue.

Check out our latest Economics & Country Risk podcast episodes

5. Emerging markets will get an earlier start on easing cycles.

The central banks that are already easing generally tightened their monetary policies relatively early, keeping inflation expectations stable and second-round effects in check. In Latin America, for example, inflation rates have fallen relatively rapidly, while labor market conditions are generally not tight. Easing cycles that are already under way in Chile, Brazil and Peru are forecast to continue in the period ahead, with rate cuts also forecast in Mexico in the first half of 2024.

6. The US dollar will depreciate.

The depreciation will be reinforced by a relative slowing of both US real economic growth and inflation as well as the overhang of a current-account deficit which, as a share of US GDP, is unsustainably high. The yen is expected to appreciate against the US dollar more strongly than many of its peers during 2024, in tandem with the forecast divergence of monetary policy.

7. Financial headwinds to growth will persist.

We expect the lagged impact of higher interest rates and the quickly waning effect of COVID-19-related support measures to weigh more heavily on debt servicing capacity in 2024. That is likely to drive NPLs higher in most regions. Banks will likely maintain a more cautious stance to lending as a result, requiring higher collateral, and restricting credit to lower quality borrowers. Credit growth is expected to come in below trend in most countries, dampening growth.

8. Declines in residential house prices in Western Europe have further to go.

Tight credit conditions and rising borrowing costs will continue to drive prices down in 2024. The speed and intensity of the correction among economies varies, depending on the imbalances accumulated in the last decade in each housing market as well as mortgage rate fixation periods.

9. A busy electoral calendar will create policy uncertainty.

Geopolitical factors will remain an important source of risk and uncertainty surrounding our economic forecasts, potentially aggravated by important elections taking place across an unusually large number of countries. Election campaigns will set the policy agenda across several important emerging economies, including India and Indonesia in the spring and Mexico in midyear, with elections to the European Parliament also scheduled in June. Uncertainty about the outcome of the US election, along with the policy implications, will likely be a hindrance to economic prospects.

10. The energy transition will support growth in the US and Canada.

US fiscal policy has turned somewhat stimulative again as the incremental funding in the Infrastructure Investment and Jobs Act begins to support actual construction, as Inflation Reduction Act subsidies for green energy projects supports a huge rise in construction of electrical manufacturing and related facilities, and as the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act similarly boosts production of US fabrication plants. These policy initiatives are one of various factors leaning against a US recession. In Canada, climate initiatives have already been in place in Alberta and Saskatchewan with the existence of eight operational carbon capture facilities. New, similar projects are in the planning stages or under construction.

Learn more about our economic data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.