Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 02, 2023

By Rob Marshall

The need: Supporting renewables in developing and emerging countries

The 2022 UN Climate Change Conference (COP27) featured significant debates on how private investment can support energy transition in developing and emerging nations.

Achievement of these countries' development goals will require a significant expansion of power generation and transmission networks. Renewables are the preferred pathway for fulfilling these goals and mitigating climate change, and private investment is needed to build out that infrastructure.

The challenge: More expensive money and lower returns

The Economics and Country Risk group of S&P Global Market Intelligence estimates that between January and July 2022, trends in global financial markets increased the cost of equity for renewable power investments from 4.27% to 5.73%.

This 1.46% rise coincided with increasing pressure on the expected rates of return from renewable power generation. Two forces are at work there: higher equipment cost due to supply chain disruption and shortage of critical material, and the winding back of generous power tariffs.

As a result, the gap has narrowed between expected rate of return from investing in renewables and the hurdle rate of return, based on the cost of capital, that these projects must reach. Private companies are now more likely to reject investment projects that only a year ago might have been approved.

The risk: A 'triple whammy'

Several companies that we have talked to have described these two negative trends as a "double-whammy." We believe that some companies may be transforming this into a "triple-whammy" by increasing the safety margin added to the hurdle rate used to evaluate projects in developing and emerging economies.

Companies face additional risks when developing and operating economic assets in these countries, when compared to similar activities carried out in the USA and Europe. Accordingly, when setting the hurdle rate for new investments in these locations, companies will add a country risk premium (CRP) to the estimated cost of their equity capital.

However, between January and July 2022 a source used by many companies to set the CRP raised its value by an average of 2.05% in 38 countries in Latin America, Asia, and Africa — considered potential destinations for renewable power investment. Adding this to the equity cost rise of 1.46% results in a 3.51% hike in the hurdle rate for investments.

Our approach: A fine-tuned model

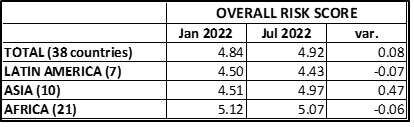

Since 1996, we have evaluated in different countries the probability of events occurring that can have a negative effect on cash flows and return on business investment. Table 1 shows for the same 38 countries the results of these assessments in the same period; the overall rise is very small.

Table 1

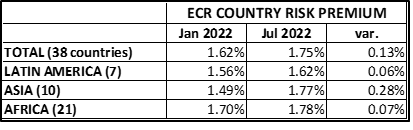

We have calculated expected losses in cash flow and NPV in each of the 38 locations, using the event probabilities and definitions together with a dynamic model of cash flows for an investment in a 100MW wind farm. The results are summarized in Table 2; the average CRP rise is only 0.13% compared to 2.05% in the source cited earlier.

Table 2

What's next for success?

The International Energy Agency (IEA) sounded an alarm about the prospects for a successful energy transition, has stated that "despite having two-thirds of the global population, emerging and developing economies, excluding China, account for less than one-fifth of global investment in clean energy."

The high cost of capital is one of the key barriers, according to the IEA. The Paris-based body has launched an initiative called the Cost of Capital Observatory to provide more information on this problem.

Our case study underlines the danger that companies and financial institutions may be overstating the business investment risks associated with renewable energy investments in emerging economies and are using inappropriate tools to estimate cost of capital. At stake is the success of the energy transition.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location