Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 05, 2022

By Daejin Lee

Third-quarter 2022 Dry Bulk Utilization Index is now available through the Freight Rate Forecast

Volatile path to lower freight rates in near term before recovering in late 2023 with regulation impact on supply and gradual demand recovery

Summary

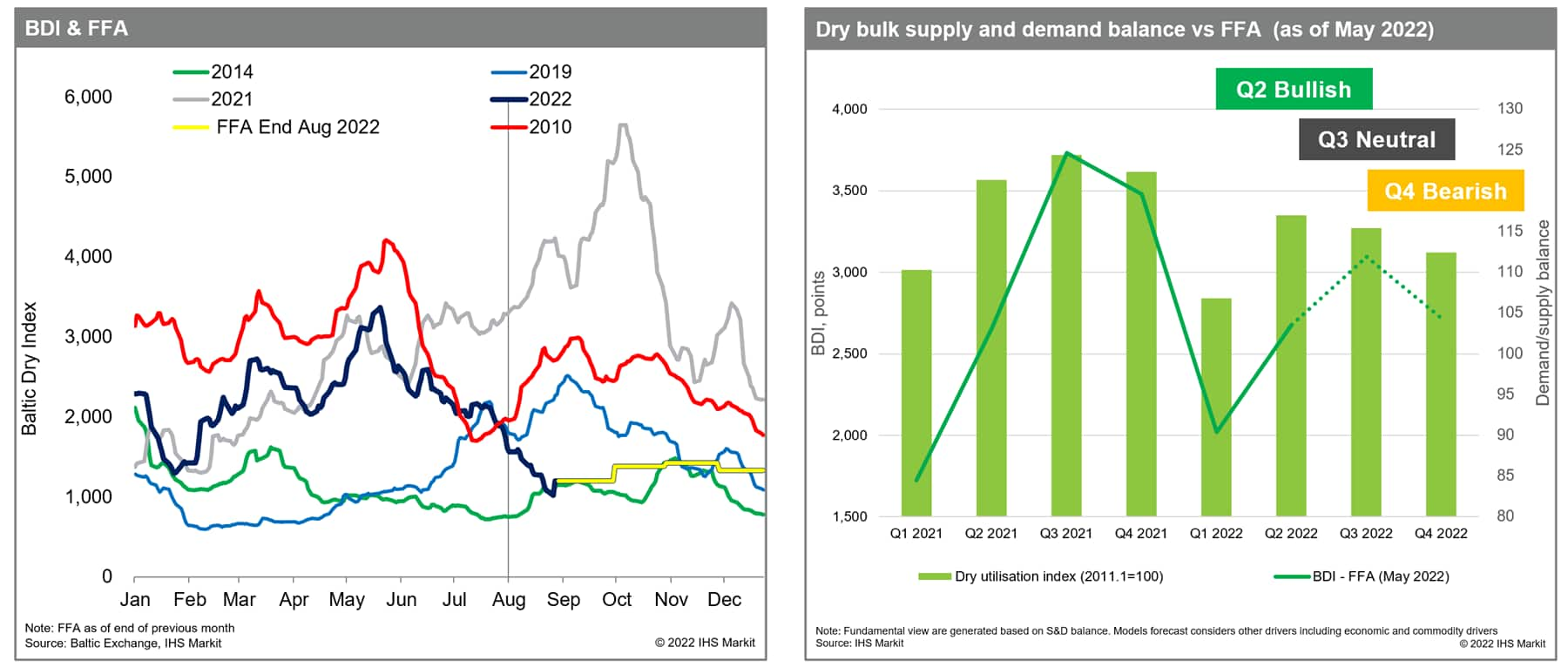

Dry bulker earnings have continued to fall over the last three months after a brief rebound in the early third quarter of 2022. The seasonality pattern fell to that of 2014 which we observed as being the low case scenario of market (2010 as base-case scenario of seasonal trend). Typical seasonality of the market indicated that dry freight rates would peak again in the third quarter of 2022 as can be seen in the FFA assessment at the end of May 2022; however, our fundamental analysis and forecast of the previous FRF long-term outlook (May 2022) showed that the second quarter would be the peak of 2022. Therefore, in previous edition, we outlined several downside risks from the later part of the third quarter of 2022, including:

As of end of August 2022, it seems all risk factors turned out to be worse than expected.

Although we expect some seasonal improvements in dry bulk market in the coming months, volatile path to lower rates is expected in the absence of high congestion, slower-than-expected economic growth with continued weakness in mainland China's real estate sector in the near-term. Eventually, overall dry bulk freight rates may return to the level that we have seen in pre-pandemic period in the coming months. However, limited supply growth driven by regulation and lack of new building order will help to market to recover in the second half of 2023 and 2024. In this context, we predict the Baltic Dry Index (BDI) is expected to fall about 20 to 30 percent on the year to average about 1,300-1,400 points in 2023 before recovering to average about 1,400-1,500 points in 2024. Earlier-than-expected change in mainland China's 'zero-COVID' policy or ceasefire agreements in the Russia-Ukraine war would remain the major upside risks, while strong domestic coal production and faster declining container market with global recession remain as major downside risks in the medium and long-term.

Chart1. Typical seasonality of market indicated dry freight rates would peak in the third quarter; however, fundamental analysis (May 2022 outlook) showed Q2 would be the peak of 2022

For more insight suscribe to our complimentary commodity analytics newsletter

Posted 05 September 2022 by Daejin Lee, Director, Shipping Analytics and Research, S&P Global Commodity Insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?