Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 28, 2020

The impact of sanctions policy: More difficulties to come in 2020

The sanctions imposed on subsidiary ship owners that were part of the COSCO Shipping family in late 2019 by the Office of Foreign Asset Control (OFAC) were designed to weaken and push to historic lows the continuing trade in goods, especially oil, between China and Iran.

In an article last year, IHS Markit noted how the sanction restrictions on this trade route had dented the flow of crude oil between the two countries but had not completely shut it down.

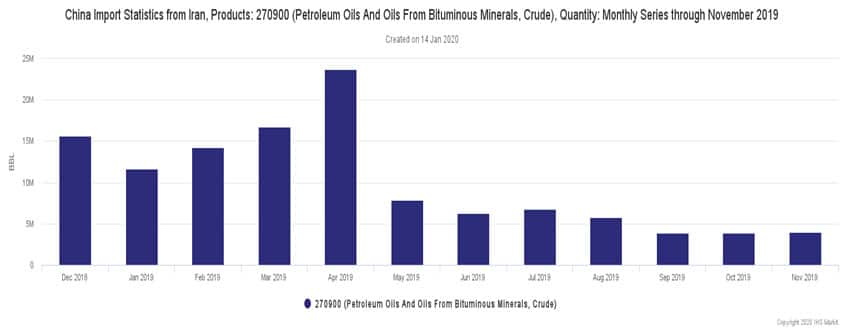

The chart below outlines the oil flows between the two countries. The major drop in Iranian exports between April and May occurred when US sanctions kicked back in and the Joint Comprehensive Plan of Action (JCPOA) was revoked. In September, the COSCO sanctions were implemented but still, despite dropping, the oil flow remains at a stubborn and persistent level. There is no cliff fall since September 2019.

Therefore, have the COSCO sanctions been successful in their intended aim. The short answer so far is 'No'. This is further compounded by an article that states a new, unreported plan that the US will issue in the coming weeks and months that will seek to apply pressure to the global trade finance chain of shippers, insurers, bankers, charterers, bunkerers and freight forwarders. These trade finance participants will face greater economic sanctions exposure in order to prevent the oil moving from Iran to China. Furthermore, the US will seek to continue to sanction any entity involved in the trade.

The article goes onto mention that the same organisations and individuals will need to pay much closer 'attention to when ship transponders are turned on and off, and steer clear of doing business with vessels with questionable histories.' A further aim of the US State Department is to reduce or close the ship-to-ship transfers at sea of crude oil, refined petroleum products and bulk goods.

Clearly, there will be no let up from the US on shutting down the oil flow. In 2019, OFAC issued a series of shipping advisories relating to North Korea, Iran and Syria, seeking to curtail the flow of goods to and from these countries. These ad-hoc measures created new pressures on financial institutions who had to interpret and understand such sanctions prior to introducing them into pre-existing sanctions policy programmes. Additionally, OFAC added many vessels to the SDN lists in the same period. There are nearly 600 vessels on OFACs watch-list, and this will be highly likely to increase in 2020.

In this context, what could we expect in the next 12 months?

- Even more focus on Shipping. Banks, shippers and others need to ensure that they have no internal weaknesses or holes in any of their due diligence procedures when it comes to screening vessels, vessel movements, vessel ownership and past vessel activities. Any gaps in a bank's sanctions programme regarding vessel screening requires serious attention in todays climate. No longer can vessels simply be evaluated through a search and find approach on a regulators watch-list.

- Enforcement action in 2020 will likely cover multiple actors and agents within a single transaction. Most OFAC penalties deal with a single institutions failure to conform with economic sanctions policies. This could be adapted and changed so that where goods have been loaded and shipped on sanctioned transportation, those involved such as the bank, shipper and insurer for example, could all be fined. In terms of overall penalty action, 2020 will have more similarities with 2019 rather than 2018. In 2018 only seven OFAC enforcements were issued, 2019 by comparison reached 26 actions with an overall settlement bill touching $1.3 billion. With an increased emphasis on shipping and other areas in global trade compliance, similar fines and industries that were targeted in 2019 will again characterize the next 12 months.

- Even greater scrutiny on the nature of goods and their shipment delivery, especially in Asia. The US-China tech war is probably of greater significance than the trade war. On the tech front, the ability of both countries wanting to ensure that their IP is protected, coupled with the US stance on ensuring that third party technology systems in other countries are not integrated with Chinese made or Chinese owned hardware, is a huge issue for trade. The US is also scrutinizing the import of US technology into China, especially via Hong Kong and other surrounding countries. Dual-use products of a technical nature will need to be monitored closely to ensure that export compliance laws are observed. For banks, the focus will be on understanding the type of technology and its intended end-use but also the ultimate end location and possibility of trans-shipment to China. Again this poses another significant challenge to trade finance banks who might not know at face value how highly sophisticated equipment in the semi-conductor industry can be used and in what types of product. On the other side of the coin and in response to US actions, China has published a draft version of its Export Control Law that seeks to restrict technology and other 'country sensitive' items for export. This draft law will likely restrict the export of cutting-edge technology, dual-use items and other strategic resources vital to Chinese technology services.

- As due diligence checks get more complex and more

intensive, regulators and government agencies will need to

assist.

Many local regulators such as the Hong Kong Monetary Authority (HKMA) and the Monetary Authority of Singapore (MAS) have been involved in initiatives to help banks and fintechs bolster their KYC and AML checks using AI and other key technologies. One area missed in the dash to utilise this state-of-the-art technology is the data and content that can help deliver actual insights. Digital standards and roadmaps alone can only deliver so much benefit, if there is a failure to correct the problems with todays trade-based datasets then the forward march of technology becomes curtailed. Where datasets are inconsistent or incomplete, they need to be enhanced. Initiatives to bring together customs data, defence data and others into the trade finance industry will provide a similar benefit as trade ecosystems and platforms do on the tech side. Knowledge of a whole range of dual-use and technology componentry will be key pieces of information for banks when financing deals in Asia and across the world.

The challenge of sanctions risk remains a firm item on the regulators radar and goes beyond the most obvious KYC/AML style checks that would have sufficed a few years ago. Today, banks and financial institutions need to be utilizing sophisticated data to identify and analyse where risk lies and how it can be managed effectively.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-sanctions-policy-more-difficulties-to-come.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-sanctions-policy-more-difficulties-to-come.html&text=The+impact+of+sanctions+policy%3a+More+difficulties+to+come+in+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-sanctions-policy-more-difficulties-to-come.html","enabled":true},{"name":"email","url":"?subject=The impact of sanctions policy: More difficulties to come in 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-sanctions-policy-more-difficulties-to-come.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+impact+of+sanctions+policy%3a+More+difficulties+to+come+in+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-sanctions-policy-more-difficulties-to-come.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}