Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 27, 2023

By Andrew Birch and Jessica Leyland

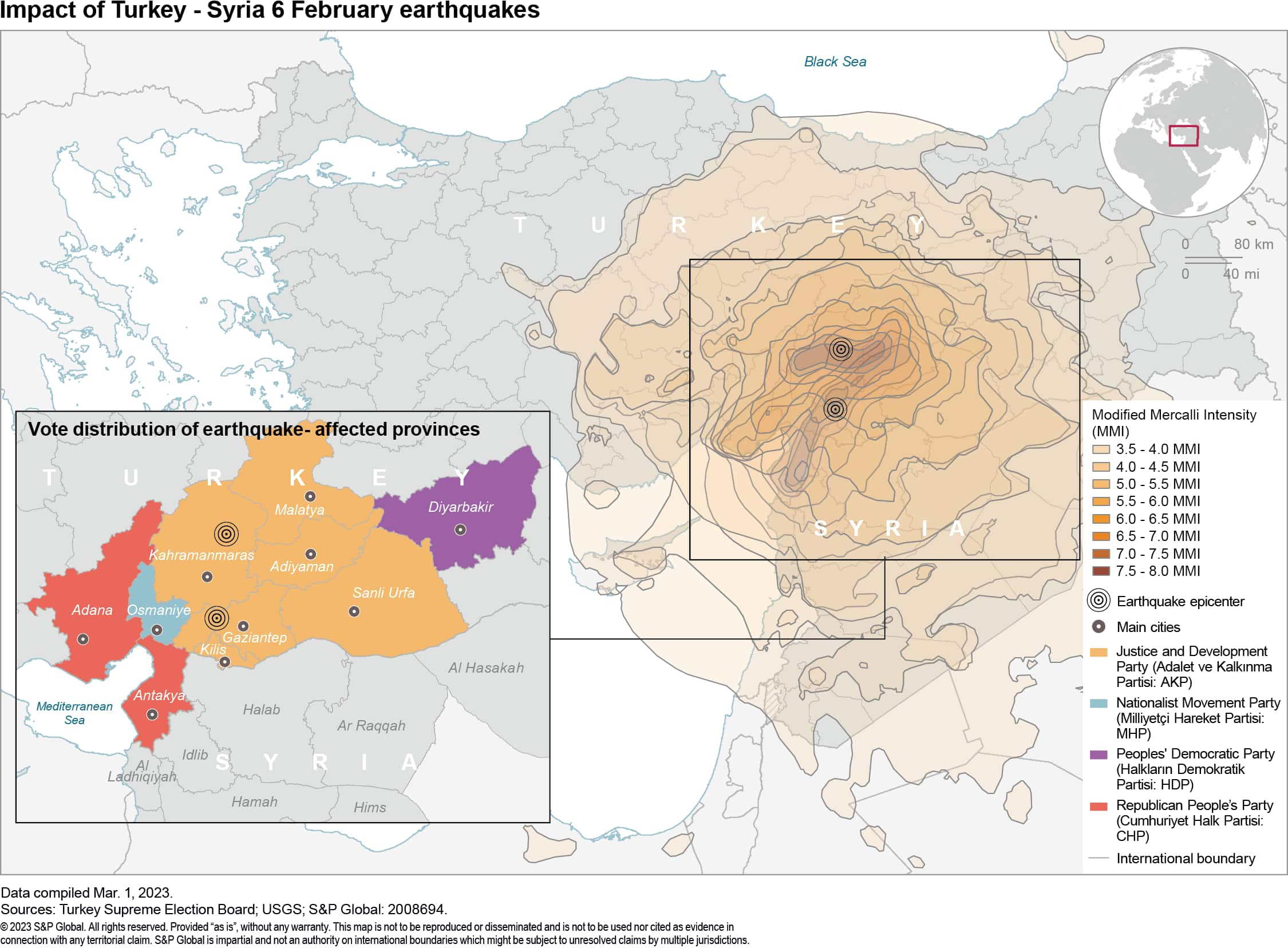

The Feb. 6 earthquake that impacted south-central Turkey and northern Syria is a humanitarian crisis that will devastate the region. The death toll from the earthquakes has reached over 43,000 in Turkey, and over 6,000 in Syria. Severe damage to infrastructure in Turkey has resulted in electricity, gas, fuel, and water shortages in the 10 provinces affected.

The impact to the national economy will be more limited, due to the remote location of the epicenter of damage and the massive government spending in the aftermath.

In the short term, the economic impact will be notable. After growing by more than 5% in 2022, headline GDP growth in 2023 will slow to closer to 2%, even as pro-growth economic policies remain in place throughout the first half of the year. The earthquake will limit potential growth in the first and second quarters more than previously anticipated. The impact will be much more severe on several individual industries such as steel, cement, food processing and textiles.

Outside of the vast human and social impacts of the earthquake, the biggest national economic impact will be on the fiscal deficit, with huge new outlays to rebuild the region in the offing. Increased government spending on reconstructing the region will partially offset the negative impact of weaker industrial activity and retail trade activity on the national economy.

Turkey's elections are currently scheduled for May 14, 2023. The Supreme Election Board has the authority to delay elections if it rules that voting is not possible in earthquake hit zones - as it did in 1996 - which would be perceived by the opposition as a government-led decision amounting to a coup, likely triggering widespread protests.

Damaged port

The biggest infrastructure/economic impact so far noted outside Gaziantep Province — the epicenter of the quake and the hub of Turkey's camps for Syrian refugees — was damage at the Iskenderum Port in Hatay Province. While regionally important, particularly for shipments to the Middle East and steel shipments, the port is not among Turkey's largest. The much larger and more critically important Ceyhan Port in Mersin Province avoided significant damage, with operations temporarily interrupted, but largely resumed by the end of the week.

The Turkish military appears to have now been fully deployed to earthquake zones, mitigating the risk of violence to citizens and aid workers while also aiming to prevent an increase in anti-government protests.

The Kurdistan Workers' Party (PKK)'s promise to stop targeting Turkish government forces to enable relief efforts is being upheld — there have been no incidents registered since the day following the initial earthquakes.

With the government committed to rebuilding the south-central part of the country, the unwinding of expansionary economic policies will not progress following the elections as previously anticipated, providing a rally of consumer activity later in the year.

The slow return of export demand, ongoing global supply chain problems, and still high input costs were already assumed to limit industrial production growth in 2023. The earthquake will add to those headwinds. Particularly hard hit will be those sectors previously noted — steel, cement, food processing, and textiles.

Implications for Syria

Earthquake aid to Syria is expediting Syria's de facto rapprochement with other Arab countries but continued US sanctions will prevent trade developing.

Since the initial earthquakes, Syrian President Bashar al-Assad has held calls with heads of state, including his first ever with Egyptian President Abdel Fattah el-Sisi, as well as the United Arab Emirates, Bahrain, and Jordan, from whom he has been isolated since the start of the Syrian civil war in 2011.

The government is also receiving aid from Saudi Arabia and the UAE, with cash donations facilitated by the US temporarily lifting sanctions related to earthquake relief on financial transactions with the Syrian government.

Although co-operation over disaster relief is underway, on Feb. 19, at a security conference in Munich, Saudi Arabia's Foreign Minister Prince Faisal said that a new approach to Syria was needed as isolation was not working.

It is likely that co-ordination and engagement will continue between these governments outside of earthquake relief, but it remains unlikely that the US will - notwithstanding extending sanctions relief past August 2023 for further earthquake-related operations - lift sanctions altogether, preventing a wider return of trade and bilateral engagement with regional neighbors.

Indicators of changing risk environment

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.