Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 07, 2018

The best defense is a good risk off-ense

Research Signals - October 2018

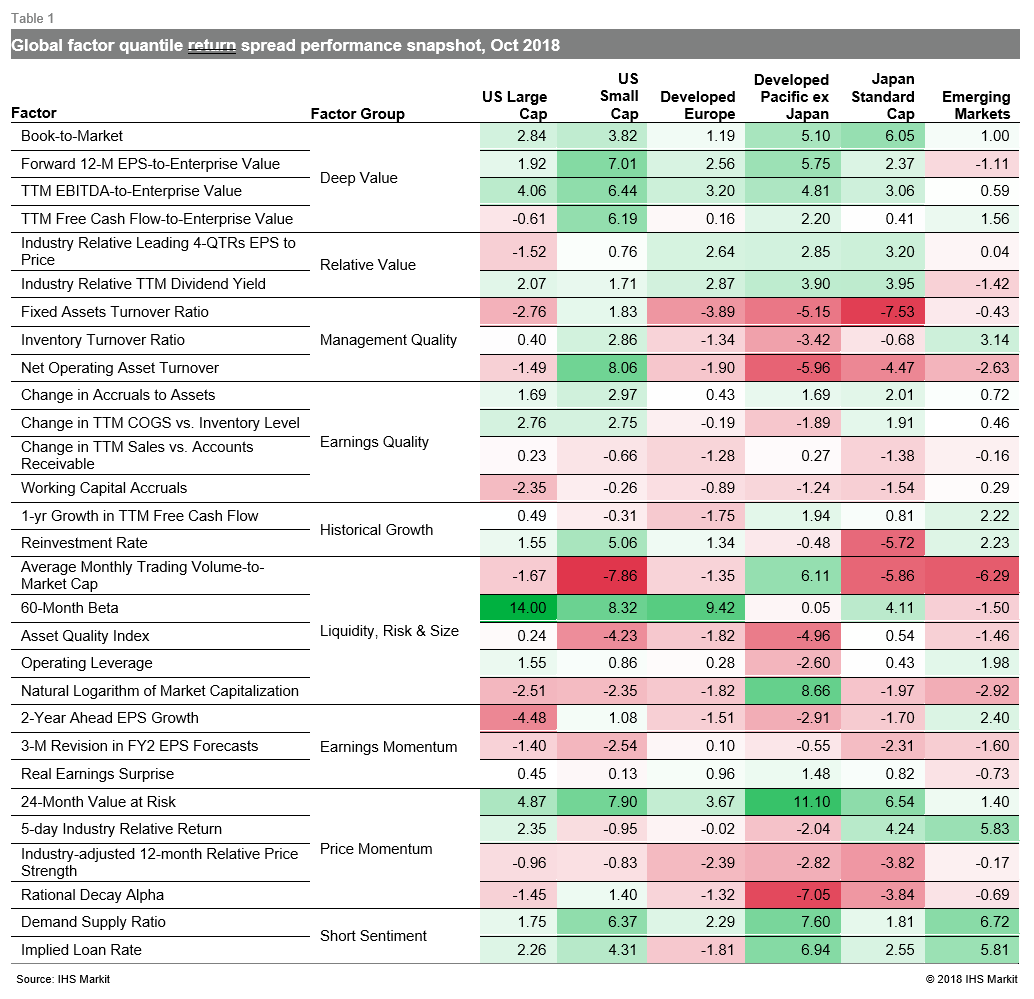

The month of October has witnessed some of the worst stock market corrections in history and this year saw it live up to this tendency toward volatility. As such, volatility-based metrics were successful signals in general, as demonstrated by positive performance from low beta in each of our developed market coverage universes (Table 1). Market participants will now wait to see if confidence can be restored from concerns of rising interest rates, trade wars and contracting growth outside the US, as confirmed by the slowdown in the J.P.Morgan Global Manufacturing PMI to a near two-year low.

- US: 60-Month Beta posted a significant double-digit spread performance among large caps, a level not seen since January 2016

- Developed Europe: Industry Relative TTM Dividend Yield sat alongside 60-Month Beta as positive indicators for the month

- Developed Pacific: 24-Month Value at Risk was a significant signal, especially in markets outside Japan, while Reinvestment Rate was a negative indicator in Japan

- Emerging markets: Large caps outperformed, as captured by Natural Logarithm of Market Capitalization, along with signals from the securities lending market such as Demand Supply Ratio and Implied Loan Rate

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-best-defense-is-a-good-risk-offense.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-best-defense-is-a-good-risk-offense.html&text=The+best+defense+is+a+good+risk+off-ense+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-best-defense-is-a-good-risk-offense.html","enabled":true},{"name":"email","url":"?subject=The best defense is a good risk off-ense | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-best-defense-is-a-good-risk-offense.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+best+defense+is+a+good+risk+off-ense+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-best-defense-is-a-good-risk-offense.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}