Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 27, 2021

By Kangwei Yang and Wilson Mak

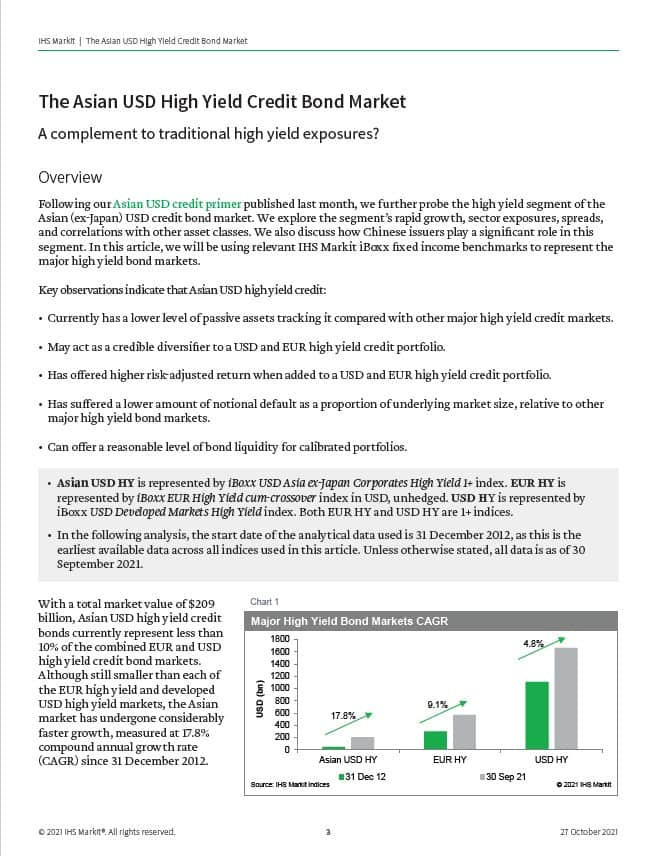

Following our Asian USD credit primer published last month, we further probe the high yield segment of the Asian (ex-Japan) USD credit bond market. We explore the segment's rapid growth, sector exposures, spreads, and correlations with other asset classes. We also discuss how Chinese issuers play a significant role in this segment. In this article, we will be using relevant IHS Markit iBoxx fixed income benchmarks to represent the major high yield bond markets.

Key observations indicate that Asian USD high yield credit:

Posted 27 October 2021 by Kangwei Yang, Director - Indices, S&P Dow Jones Indices and

Wilson Mak, Analyst - Indices, S&P Dow Jones Indices

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme

Location