Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 24, 2024

By Chris Rogers

Join us at the world's largest ocean container supply chain event

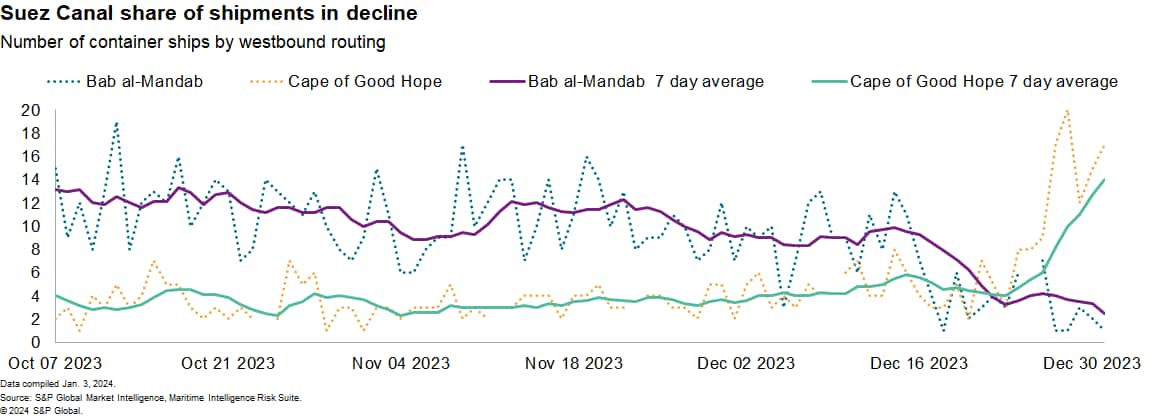

The termination of shipping via the Suez Canal most directly has an impact on supply chains connecting Asia and Europe. The alternative transit routes incur higher shipping costs and delays of around 10 days for Cape of Good Hope sailings, while the slower round-trip routes may require additional shipping capacity.

Consumer goods including toys, household appliances and apparel will face the largest impact. Within materials and components, a significant proportion of chemicals, flat-rolled steel and automotive wires and batteries are shipped via the route.

The implications of reduced shipping via the Suez Canal are not just limited to Europe-Asia supply chains. Shipping rates for container routes from North Asia to both the US East Coast, West Coast and east coast of South America have increased by a similar degree to Europe-bound routes.

In theory, the impact on North American supply chains should be fundamentally smaller than that on Europe given the availability of trans-Pacific routings to the US west coast. Yet, the Americas have also more directly suffered the effects of reduced shipping capacity via the Panama Canal. Shipping via the Suez Canal was a secondary option for liners looking to reduce their exposure to the Panama Canal.

The length of time to ship from Asia to the US East Coast via Panama or via Suez depend on the overall service string, or the number of interim ports. In any event, using the Cape of Good Hope instead of the Suez Canal could add a similar 10 days' time to an Asia-US East Coast route as an Asia-North Europe route.

Route removal: Canal shipping options limited, requires extra cost and capacity

Should the Suez Canal situation not be resolved in a timely manner, the container lines may choose to review their routing schedules to optimize the time at sea for the most-used port pairs. That could be as simple as cutting the number of voyage combinations or moving to more radical models of route construction.

Other shipping options for East Coast Americas/Asia supply chains may prove more practical, although they involve a different range of risks and could lead to higher costs, too. Shipping from Asia to the US west coast and then using rail or truck transportation may be limited in terms of capacity during the peak shipping season, as demonstrated during the pandemic when excessive consumer goods shipments led to diversions to the US east coast ports from the west.

An apparent preference for US west coast ports has already emerged once more. Our data shows US seaborne imports of leisure goods — toys and fitness equipment — headed to east coast ports fell to 40.5% of the total in December 2023 from 44.5% a year earlier.

Continued diversions via longer routes will require additional container shipping capacity. Elevated shipping costs and slower delivery times add to the case for reshoring sourcing away from Asia and closer to consumption markets, aka nearshoring. That could involve sourcing from the Atlantic Basin, particularly eastern Europe, Turkey or Africa from a cost perspective, or Mexico.

Such reshoring is not practical for all products, however, and takes a matter of years rather than months to deliver. With uncertainties regarding the upcoming elections in the US, firms may choose to endure the longer delivery times before making more radical sourcing decisions.

Timing matters: US east coast imports from Asia

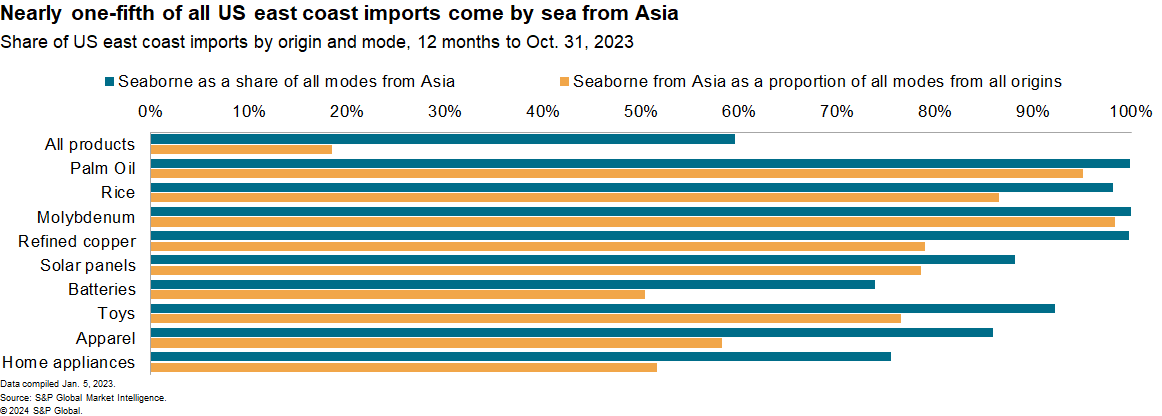

Shipments from Asia by sea to the US east coast — which will require shipments either via the Panama Canal, the Suez Canal or the Cape of Good Hope — accounted for 64% of all imports by sea to the US east coast, the rest being from the Atlantic Basin or Latin America.

Among food products with imports over $1.5 billion, Asia-to-US east coast by sea accounted for 95.1% of palm oil imports, 86.5% of rice shipments and 87.6% of grapes.

In the industrial materials sector, the route accounted for a significant ratio of imports of molybdenum, refined copper and alloys, and of cyclic hydrocarbons.

The renewable energy and automotive sectors may face challenges as more than half of solar panels and batteries are shipped via the route.

The short-term impact on the consumer goods sector is mitigated by seasonality, with a larger slice of annual imports arriving in the third quarter ahead of the peak shipping season. There's nonetheless a high exposure in consumer goods including toys, apparel, and vacuum cleaners and kitchen devices.

Food storage challenges: Asia's imports from the US east coast

US exporters to Asia will face just as many challenges as importers, with the added challenge that container-lines may choose to prioritize rapid returns over fully loading vessels if profit margins are low.

Food product exports are the most exposed to shipments from Asia by sea as a proportion of total exports including sorghum, soybeans, and wheat as well as refrigerated products such as poultry.

Chemicals-based supply chains may also face disruptions, with the routing accounting for nearly half of acyclic hydrocarbons and about one-third of ethylene polymers. Disruptions to the latter may have a compounding effect on intra-Asia flows given recent tariff increases by mainland China.

Among major manufactured goods, the automotive industry is one of the most exposed, with nearly one-third of US east coast exports of motor vehicles heading to Asia by sea. Model-typing may mean that alternative destinations may not be readily useable.

Shipments of oil and natural gas may also be affected. Yet, the global nature of energy trade may mean extra sales from the US to Atlantic Basin buyers can offset reduced purchases by those buyers from Middle East suppliers.

Uncertain delays for food supplies are particularly pertinent due to spoilage risks. For refrigerated freight an extra 10 days at sea may represent 10 days less saleable time depending on whether products are fresh or frozen. For bulk grains, crossing the equator twice, with resulting heating/humidifying cycles, may damage crop quality. Alternative supplies for many of the food products the US ships to Asia, such as soybeans, corn and pork, also rely on canal or cape crossings.

Learn more about our research themes for 2024

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.