S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

BLOG — Jul 19, 2023

By Chris Rogers

The FIFA Women's World Cup 2023 in Australia and New Zealand brings a focus onto a rapidly expanding part of the football (soccer) world.

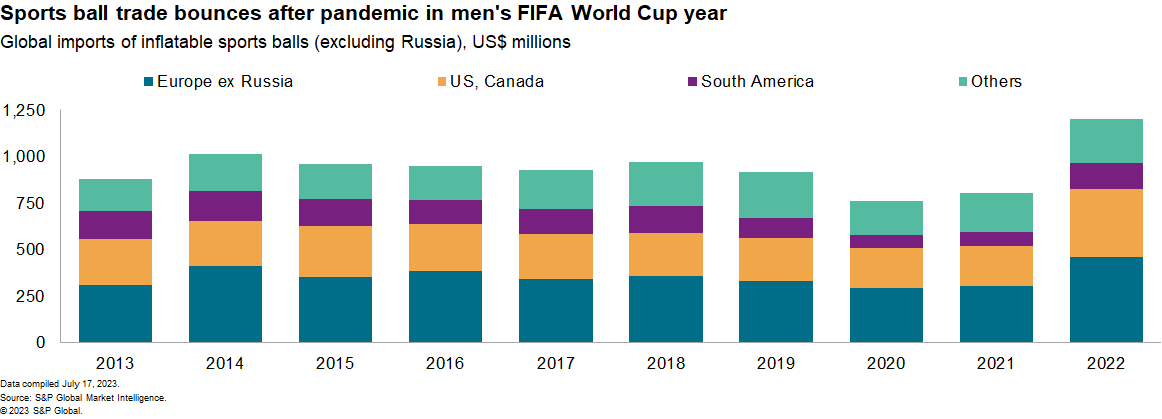

Global trade in inflatable balls, including those used in other sports such as rugby, basketball and American football and incorporating both premium and basic brands, climbed by 50% year over year in 2022 to $1.20 billion.

There's evidence of elevated demand in World Cup years. (The men's FIFA World Cup was held in November 2022.) Shipments in 2022 were nevertheless still 24% higher than in 2018. The fastest rates of growth were booked by shipments to South America, which rose by 91% year over year in 2022.

Inflation has played a part in the rise in the value of imports. The US imported 24.4 million soccer balls in the 12 months to May 31, 2023. The average import price of $4.35 per ball had increased by 9.0% year over year over the same period.

The costs of materials have actually fallen. S&P Global Market Intelligence analysis shows that prices for the constituents of polyurethane, used in ball coverings, have declined steadily since peaking in second quarter 2022. Higher prices may reflect more shipments of higher-priced, branded balls.

Balanced game: Sourcing profile for inflatable balls

The supply chains for sporting goods are not as simple as they may first appear, as discussed in "Returning service: Tennis ball supply chains(opens in a new tab)."

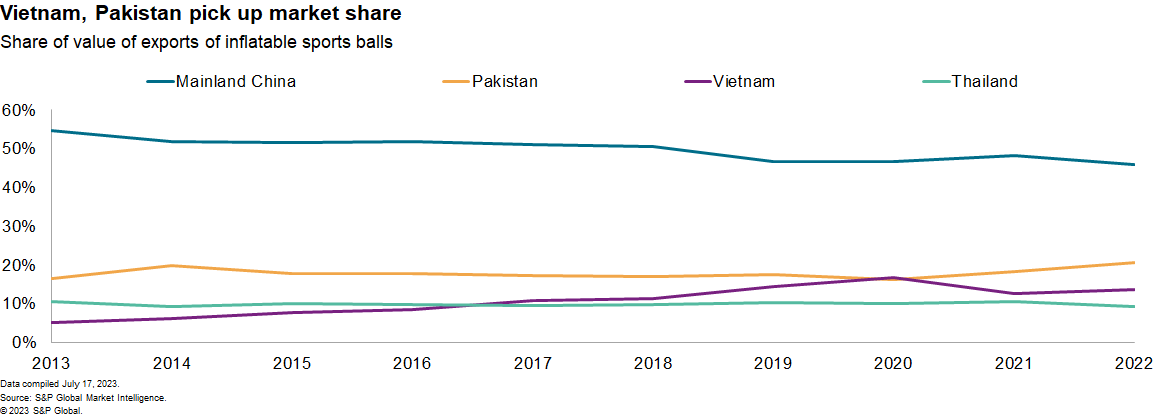

The production of inflatable balls is labor intensive(opens in a new tab), leading producers to focus on lower labor cost regions in recent years. For example, FIFA's official match ball for the 2022 World Cup was made(opens in a new tab) in Pakistan.

Based on importers' data, mainland China accounted for 46% of all inflatable ball shipments in 2022, compared with 55% in 2013. Much of that lost share shifted to Pakistan, which accounted for 21% of shipments in 2022, compared with 16% in 2013.

The shift in production away from mainland China to Pakistan and Vietnam may bring lower costs, but also brings a different operational risk profile. Market Intelligence assessments show that the operational risks of operating in Pakistan are higher than those for mainland China in the categories of infrastructure and labor strike risks.

Final whistle: Materials and recycling challenges

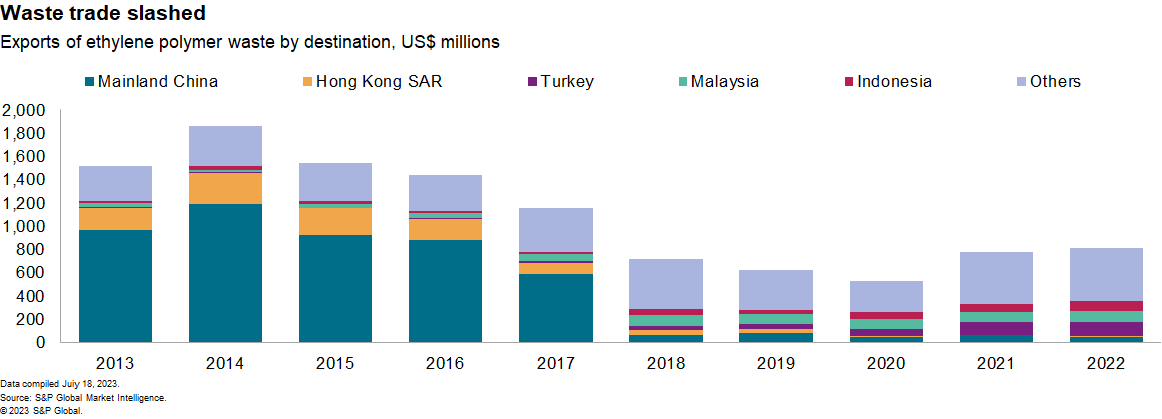

Market Intelligence trade data shows that at least 420 million inflatable balls across all sports were shipped in 2022, representing a large potential waste stream.

Recycling is complicated due to the composite nature of inflatable balls. There are early signs of take-back programs run by ball suppliers such as Wilson Sporting Goods Inc's program(opens in a new tab) in Australia.

Even if take-back programs become more widespread, there is still the matter of recycling non-sorted plastics.

The use of plastic-waste derived oil (PDO) in producing new polymers is getting underway, including a new project(opens in a new tab) in Saudi Arabia using non-sorted plastics.

Global exports of waste from polymers of ethylene were valued at $813 million in 2022. That was down by 43% compared with 2016, due in part to a change in import policies for waste in mainland China.

This research was produced with the help of Michael Dall from S&P Global Market Intelligence's Pricing & Purchasing service team.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.