Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 27, 2023

By Chris Rogers

Corporate financial data and discussions of procurement and inventory matters are an important component of understanding supply chain operations. The current corporate earnings season, focused on performance in the calendar third quarter of 2023, may provide signals of current and future strategies and expectations.

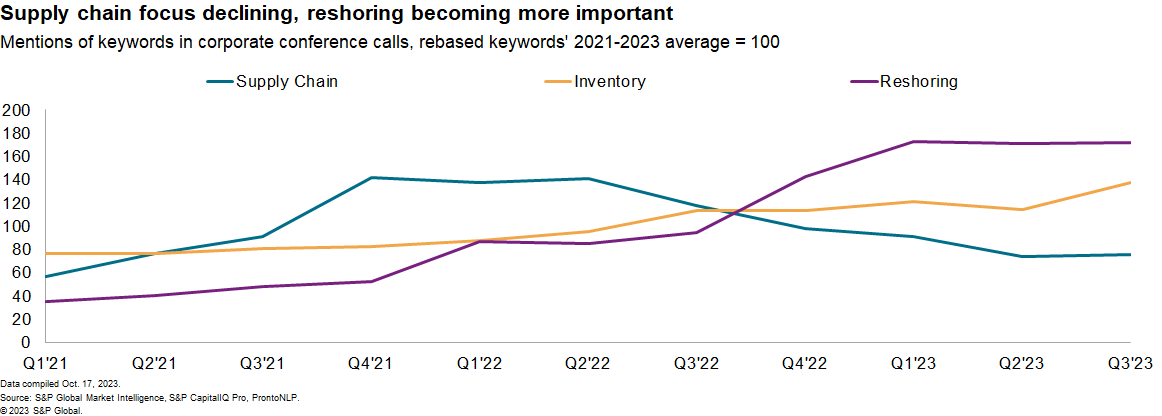

Analysis of company earnings calls using S&P Capital IQ Machine Readable Transcripts and ProntoNLP's natural language processing toolkit show the mentions of "supply chain" issues has declined to three-quarters of their 2021-2023 average during calls held in the third quarter of 2023. With 2,900 companies having mentioned the topic during the third quarter there's still a wide-ranging focus on the state of supply chains.

The reduced mentions of supply chains as a topic likely reflects the passing of the worst of congestion in logistics networks after a slide in demand for large- and heavy consumer goods such as home appliances and furniture.

Related topics have become more commonly mentioned, including inventory and reshoring, which are associated more with longer-term plans than short-term turmoil. Mentions of reshoring have soared to 172% of their three-year average. In absolute terms, though, that only equates to 3% as many mentions as for supply chain more broadly.

Net positivity

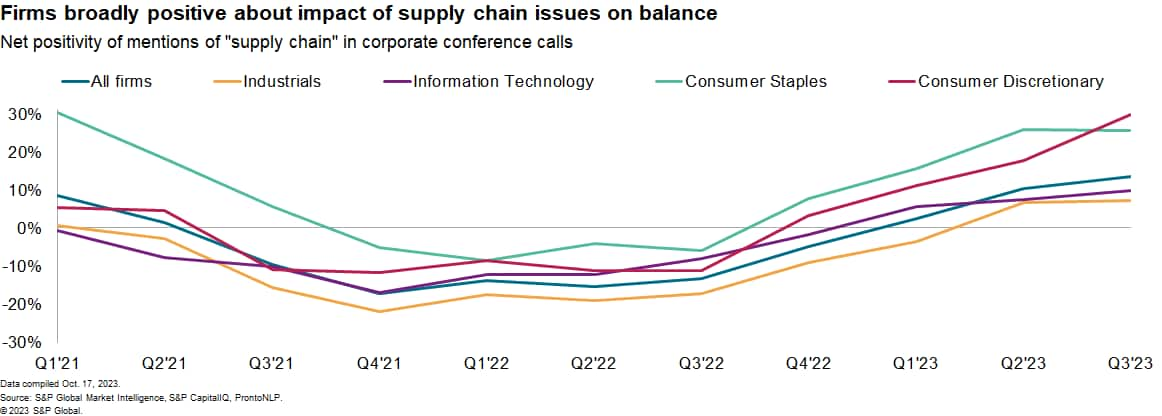

The normalization of supply chain operations is shown by a return to historic peak-season shipping patterns for consumer goods. The normalization of supply chains and resulting reduction in costs and loss of revenue has acted as a positive support to corporate performance.

By using natural language processing tools to determine positive and negative phrases around supply chain mentions, we can examine whether the issue is helping or hindering firms' performances. The ratio of positive comments to negative comments provides a measure of "net positivity." Note that not all mentions are clearly positive or negative, with an average of 65% of mentions being "directional."

Supply chains became a drag to corporate performance across most sectors in calls held during the third quarter of 2021, based on the proportion of language becoming net negative as a proportion of positive mentions.

A return to net positivity came in the first quarter of 2023. As of the third quarter of 2023, net positivity (proportion of mentions that were positive versus negative) reached 14%. That was the highest level since the first quarter of 2021.

The industrials sector, including capital goods manufacturers and building materials suppliers among others, remained negative until the second quarter of 2023 and retain the lowest net positivity among the major global sectors in calls held in the third quarter of 2023.

The consumer staples and consumer discretionary sectors had the highest proportion of net positivity in the past quarter. That may reflect the dual importance of narrow profit margins and the need to ensure sales on a timely basis.

Sign up for our Supply Chain Essentials newsletter

Inventory strategies

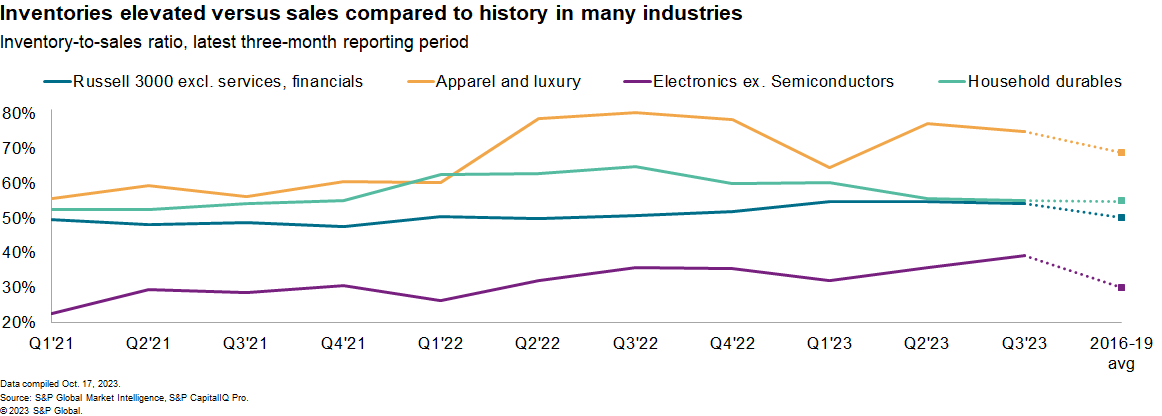

Discussions about inventory balances have increased markedly over the past 12 months. That likely reflects falling demand, rising interest rates, smoother supply chain operations and post-pandemic era strategic decision-making, as discussed in Time, tariffs and tracking: Fourth quarter 2023 supply chain outlook.

The discussions have likely had to explain an acceleration in inventories relative to sales, which can prove costly in a high interest rate environment. The inventory-to-sales ratio of the Russell 3000 index of companies was 54.1% in the three months to Sept. 30, 2023. That was down from a peak of 54.8% but still above the 50.1% prevailing in 2016 to 2019. That's the result of elevated electronics and apparel inventories, while household durables have returned to historic levels.

Shipping data suggests consumer discretionary firms are reducing their imports, partly to manage inventories down further. The downturn in inventories of consumer goods can be seen in part from the slowdown in trade in such goods, using our bill-of-lading data, which updates on a daily basis. US seaborne imports of the five large consumer discretionary goods sectors fell by 14% year over year in the third quarter of 2023. That marked a slowdown from 25% in the second quarter.

The rate of improvement accelerated in the month of September, with the total down by 2% year over year. The stabilization versus a year earlier may be a sign that the destocking process is coming to an end.

Manufacturers have continued to reduce their stocks of finished goods, likely reflecting the anticipation of continued lower demand for inventories from retailers.

The S&P Global Purchasing Managers' Index (PMI) for inventories from all manufacturers has been below 50, indicating a month-over-month decline since November 2022. The most recent reading of 48.5 compared with 49.2 a month earlier indicates an acceleration in the rate of decline of inventories.

At the sector level, that may reflect a return to declining inventories in the household and personal goods sector. The computing sector remained in decline for a 27th straight month, albeit at a slightly lower rate in September than a month earlier.

Learn more about our Supply Chain Console

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.