Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 13, 2023

A series of supply chain disruptions marked 2021. The disruptions caused record-high supplier delivery times and shortages of materials, which have limited industrial production and significantly contributed to record high inflationary pressures.

The greatest supply shortages were recorded in transportation, packaging, polyvinyl chloride (PVC), and polypropylene, while the greatest price pressures arose in transport, electrical items, semiconductors, and energy.

The disruptions in the transportation sector have eased more recently: Recovering passenger travel has increased the capacity for air transport of goods and easing port congestion has resulted in decreasing shipping costs. The Freightos Global Container Freight Index fell to US$2,300 as of Dec. 9, compared with US$11,100 in mid-September 2021.

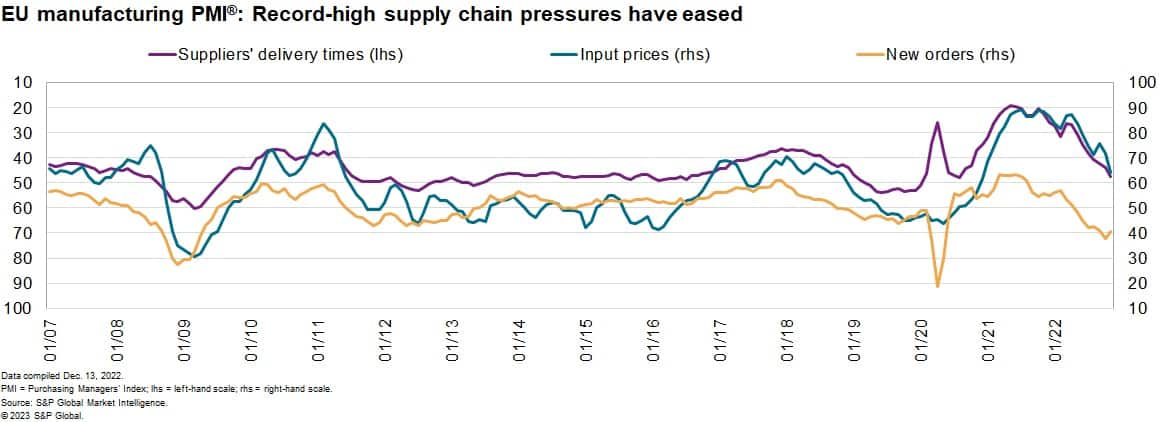

Easing supply chain pressures are evident in supplier delivery times, which have been rising at a slower pace recently. As a result, input prices are rising less rapidly. That trend coincided with a significant decrease in new orders in the European Union, according to PMI® surveys suggesting that lower demand has contributed to improved supply conditions.

Material shortages vs. labor shortages

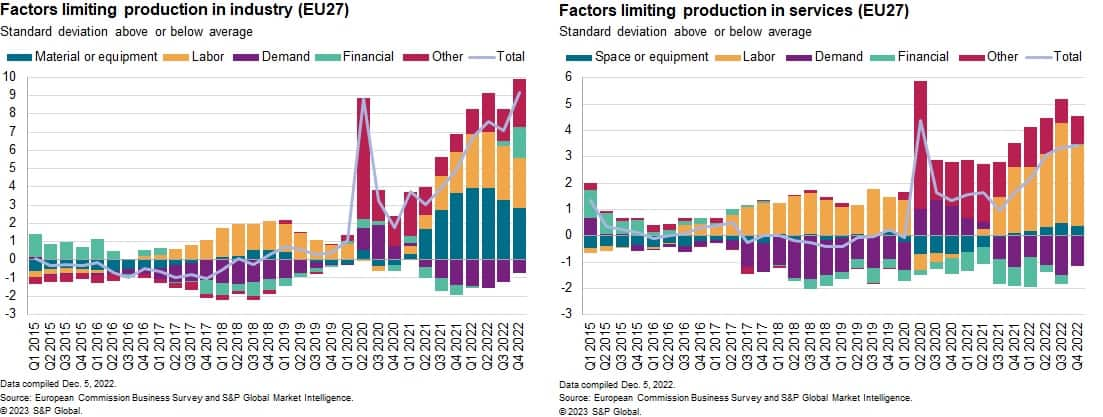

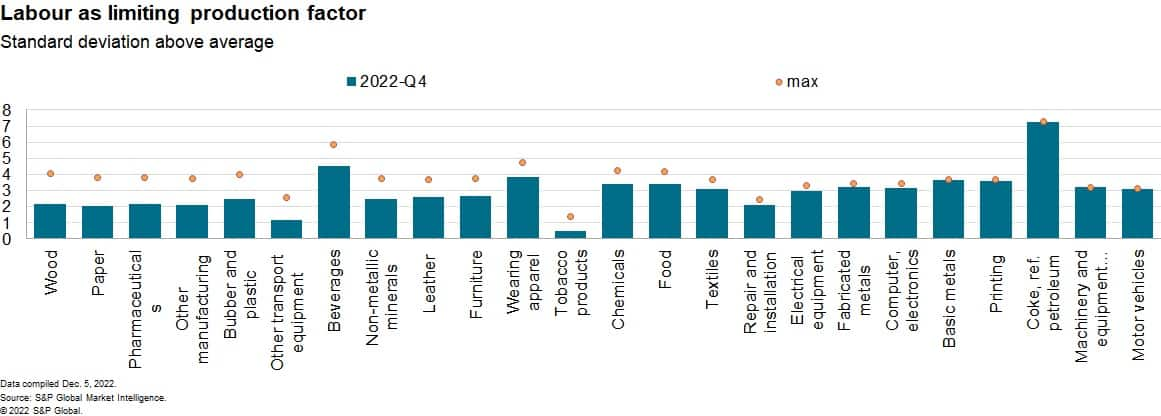

Shortages of materials or equipment, which reached record highs at the beginning of 2022, have decreased, according to the European Commission survey in both industry and construction. Labor shortages did not ease much even as demand weakened. Labor shortages remained one of the most important factors limiting production, especially in services.

Material or equipment shortages at the end of 2022 were close to their peak in only three manufacturing sectors, while labor shortages were at or close to peak in more sectors. In almost half of the sectors, labor shortages became the dominant factor limiting production.

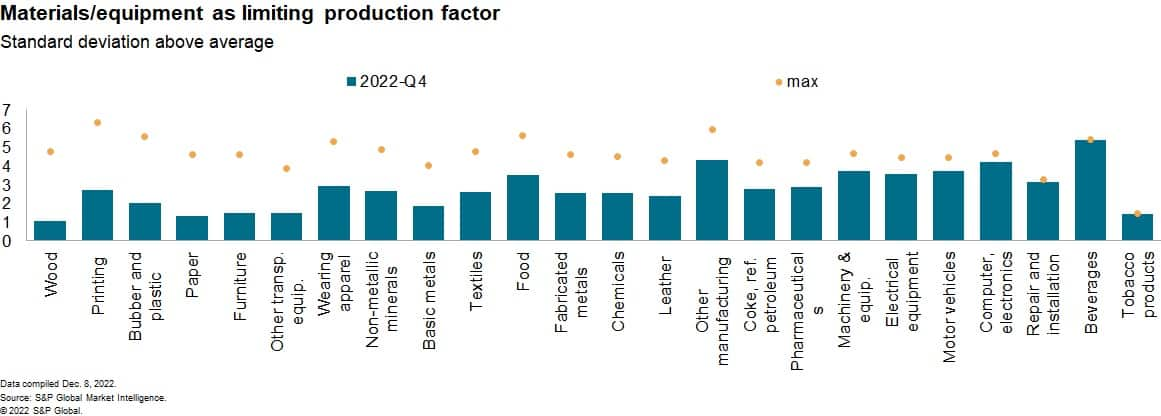

Material/equipment shortages have decreased most from their peak in wood, printing, rubber and plastic, paper, and furniture manufacturing. They remain elevated in motor vehicles, computer and electronics, repair and installation, and beverage manufacturing.

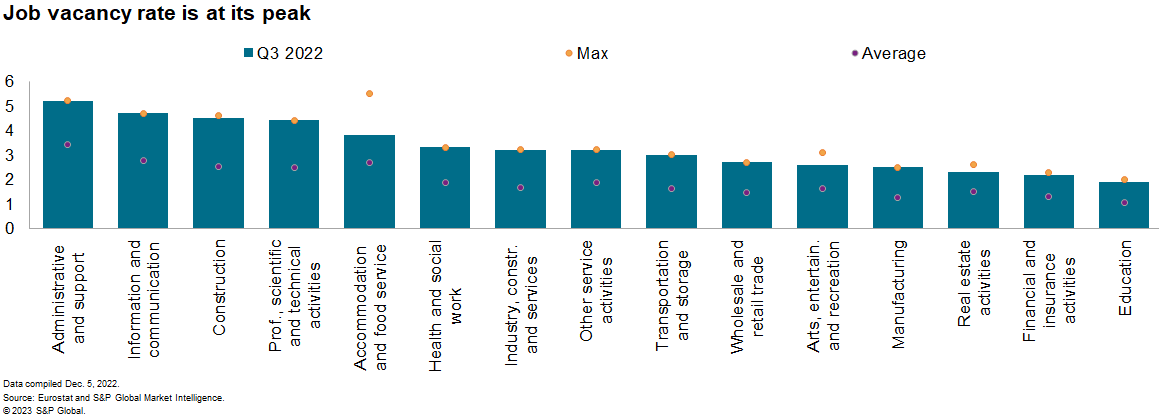

Labor shortages are at a peak or close to it in motor vehicles, machinery and equipment, refined petroleum products, printing, metals, and computer and electronics. Labor shortages are the main limiting factor in around half of the manufacturing sectors and in most of the service sectors.

Job vacancy rates are at a peak in most of the industries. They are the highest in administration and support, professional activities, information and communication, and construction.

Supply conditions appear to be improving amid decreasing demand: The difference between new orders and output has been decreasing together with the lower sum of new orders and backlogs of works.

Demand did not decrease at the same magnitude among the sectors. In general, the worsening of demand conditions for services was smaller. Demand conditions deteriorated only marginally for the software and services and biotech and pharmaceuticals sectors. A more significant decrease in demand was reported in the forestry and paper, metals and mining, and industrial services.

Supply conditions improved most for sectors including industrial services, autos, and metals and mining, which faced some of the highest decreases in demand.

Labor cost growth

The sectors that will be weathering the crisis better are likely to continue to face high labor shortages even in the recessionary environment. For example, the information and communication sector has recently recorded one of the highest job vacancy rates and demand for software and services did not decrease from February to November 2022, according to PMI™ data.

Rising salary costs for companies amid widespread labor shortages could result in more persistent inflationary pressures, especially if demand conditions do not deteriorate sharply.

Labor cost index growth in services for the eurozone was at a record high, reaching 5.1% year on year (y/y) in the first quarter of 2022. Growth eased somewhat in the second quarter to 4.5% y/y. Weak demand conditions are likely to continue limiting companies' ability to sustain high wage growth, and labor shortages are likely to persist.

In general, higher disruptions and shortages were recorded in the sectors with longer supply chains, such as autos, chemicals, machinery and equipment, and computer and electronics. These sectors, because of the structure of their supply chains, are likely to remain vulnerable to shocks in the future.

Additional shocks, such as pandemic-related restrictions in mainland China or increased geopolitical tensions globally, cannot be ruled out. In such cases, the sectors with the longest supply chains are likely to face higher pressure.

Climate change-related crises such as heat waves or floods could also join the reasons for future disruptions in global supply chains affecting the agriculture, fisheries, energy, and transport sectors.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.