Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 11, 2024

By Ari Ashe

BNSF Railway, CSX Transportation and J. B. Hunt Transport Services were the top-performing domestic intermodal providers in the second half of 2023, according to a Journal of Commerce survey of shippers and intermodal marketing companies (IMCs).

The survey that comprised the Intermodal Service Scorecard, which had 240 respondents, was conducted via SurveyMonkey between Sept. 1 and Oct. 31, with the Journal of Commerce soliciting additional commentary from shippers in November and December.

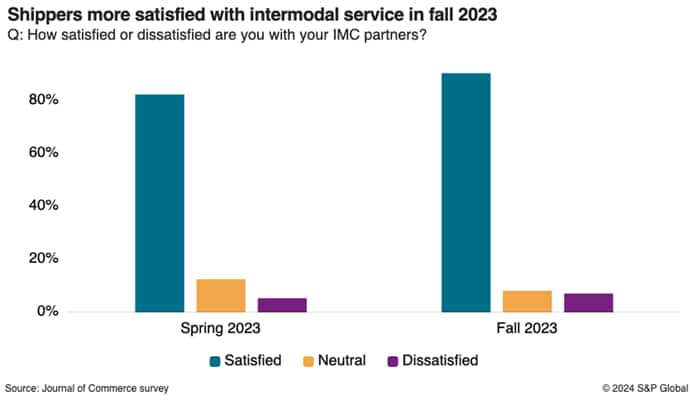

The total percentage of shippers and IMCs who were satisfied with rail service grew from the prior survey last spring. Nearly three out of four IMCs were satisfied with the North American Class I railroads, up from 45.3% last spring. Just under 85% of shippers were satisfied with their IMCs, up from 82.1%.

The survey results are a signal that both railroads and IMCs such as Hub Group, J. B. Hunt and Schneider National are meeting or exceeding customer expectations.

"The railroads have improved on collaboration and creativity compared with years prior," one survey respondent wrote. "I have faith in both CSX and Norfolk Southern Railway … decent cultures there."

Not all reviews of the railroads were positive, as other respondents worried the rails focus too much on shareholders and not enough on shippers. Nevertheless, 61.2% of respondents said railroad service was better in the back half of 2023 compared with the front half.

High service scores amid growing demand

BNSF and CSX each received top marks, depending on how the data is viewed. CSX received 38.8% of the vote for "top performer" compared with BNSF's 24.5%, taking first and second place, respectively. When IMCs graded each railroad on key performance indicators, however, BNSF was first and CSX second in five of six categories.

Railroads received higher scores while handling more domestic intermodal loads. Railroads moved a combined total of 1.44 million domestic containers in October and November and were on pace to move a total of 2.1 million boxes in the fourth quarter, up 5% year over year. The International Association of North America (IANA) has not yet released December figures.

For 2023, the railroads hauled about 8 million domestic containers, down about 1.5% from the prior year. However, that could be considered a second-half recovery as volume fell 6.4% year over year between Jan. 1 and June 30, according to IANA.

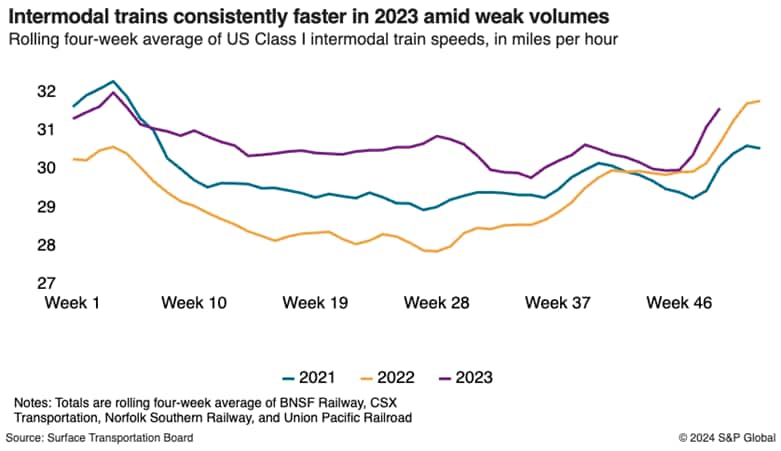

Intermodal trains traveled an average of 30.5 miles per hour between July 1 and Dec. 31. That was slightly down from the average of 30.8 miles per hour between January and June, but up from an average of 29.5 miles per hour between July and December 2022, according to the US Surface Transportation Board.

Although IMCs responded positively on service, they said pricing was a major concern, with 64.6% indicating their shipper clients converted more business to trucking in 2023.

The average shipper choosing intermodal over long-haul trucking saved 26.4% on contractual business and 17.4% on spot market business across the US in the fourth quarter, according to the Journal of CommerceIntermodal Savings Index. While the figures are approximately in line with historical averages, there were lanes of less than 1,200 miles in which trucking rates were cheaper than intermodal rail. Depressed trucking rates also mean shippers located more than one hour from a rail terminal may have also found intermodal to be more expensive than trucking.

J. B. Hunt, small IMCs score high with shippers

Among IMCs, J. B. Hunt and smaller IMCs traded first and second place in most categories. The Journal of Commerce defines a small IMC as one with fewer than 10,000 containers, or a non-asset broker.

J. B. Hunt received 57.6% of the vote for "top performer" while smaller IMCs received 29.7%.

"J. B. Hunt is a consistent partner that comes through all the time, as needed, and has been a fantastic partner for years," one shipper wrote.

Still, shippers rated smaller IMCs first and J. B. Hunt second in five of six key performance indicators. One reason for the results is likely how shippers judge what is most and least important.

Shippers said customer service was most important and price competitiveness was second. Smaller IMCs tend to excel in customer service because they can deliver a personalized approach that may not always occur with larger companies. However, a company such as J. B. Hunt can offer better rates than the smaller IMC and has a larger supply of containers.

"Our IMC communicates well and is a great long-term partner, so while their rates may be a little higher, their service is excellent," wrote another shipper. "The IMC is extremely adaptable and quick to my needs as a shipper in a very competitive environment."

The five smaller IMCs that received high scores were Alliance Shippers, NFI Industries, C.H. Robinson Worldwide, Mode Transportation and Prime Inc.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?