Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 18, 2018

By Julien Rey

Why is LIBOR being discontinued?

To date, financial markets across the globe have been heavily reliant on Interbank Offered Rates (IBORs) to value financial instruments. A significant proportion of derivatives transactions and commercial loans are relying on IBORs for settlement and payoff calculations.

Since the last financial crisis in 2007, regulators and financial market participants have questioned the reliability and robustness of these benchmark rates. The publication of IBORs relies on a number of financial institutions ("LIBOR submitters") who submit daily their best estimate for these benchmarks. This process is subject to oversight and largely based on expert judgment.

To remedy these issues, most financial jurisdictions have taken steps to reform their existing benchmark rates in line with the Financial Stability Board (FSB) and the International Organization of Securities Commissions (IOSCO) Principles for Financial Benchmarks.

Finding another benchmark

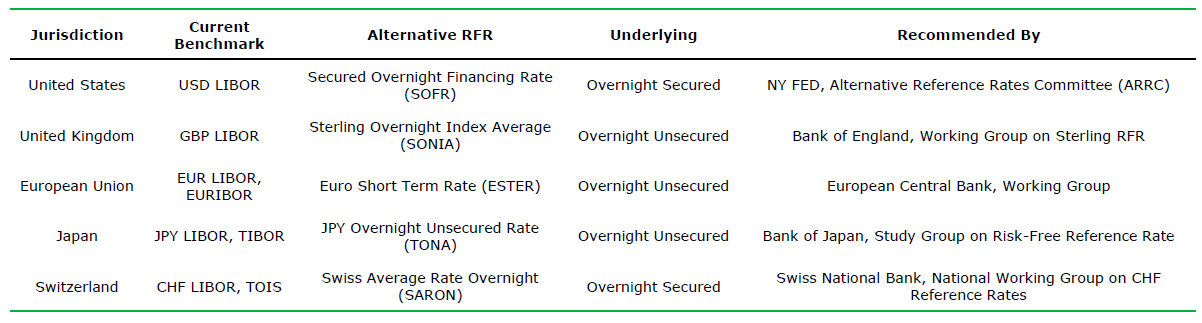

Across jurisdictions, committees are working on alternative Risk Free Rates (RFRs) to replace IBORs with the underlying promise of better governance and oversight around major interest rate benchmarks. Regulators and central banks along with industry experts from leading financial institutions are driving these discussions.

At the time of writing, these are the RFRs chosen in each of those main jurisdictions:

Although all RFRs are overnight rates, some jurisdictions have suggested unsecured funding (UK, EU, Japan) rather than secured funding alternatives (US, Switzerland).

One of the arguments for choosing an unsecured rate over a secured alternative is that although an uncollateralized transaction includes the credit risk of parties involved, this is negligible for overnight terms. The Bank of Japan (BoJ) has demonstrated this in its consultation paper.

Global timelines

Andrew Bailey, Chief Executive of the Financial Conduct Authority (FCA), announced last year that the FCA would no longer require banks to submit LIBOR data after 2021.

However, the adoption of alternative RFRs is expected to take years as the financial and regulatory communities discuss transition plans from IBORs to RFRs.

SOFR, the preferred alternative to USD LIBOR

In the United States, the Federal Reserve Board and the Federal Reserve Bank of New York formed the Alternative Reference Rates Committee (ARRC) tasked with choosing a viable alternative to USD LIBOR.

In March 2018, the ARRC released its second report summarizing the choice of the Secured Overnight Financing Rate (SOFR) as its recommended alternative to USD LIBOR.

An extract from this report reads: "SOFR is a fully transactions based rate that will have the widest coverage of any Treasury repo rate available and it will be published on a daily basis by the Federal Reserve Bank of New York beginning April 3, 2018. Because of its range of coverage, SOFR is a good representation of the general funding conditions of the overnight Treasury repo market. As such it will reflect an economic cost of lending and borrowing relevant to a wide array of market participants active in these markets, including broker dealers, money market funds, asset managers, insurance companies, securities lenders and pension funds."

Technical details on SOFR

The SOFR rate is one of three reference rates that the New York Fed had announced its intention to produce in November 2017:

FRBNY published SOFR for the first time on 3rd April 2018 at a level of 1.80%. This benchmark benefits from an extensive independent oversight, including a robust production platform, dedicated staff, geographic dispersion and regular review by oversight bodies.

Bank of NY Mellon and DTCC are responsible for collecting the trade data required for the publication of SOFR based on the prior day's trading activity. FRBNY applies a trimming methodology for all bilateral trades: the bottom 25th percentile of the distribution of rates traded is removed to ensure smaller and special transactions are filtered out. The fixing is the volume-weighted median of the remaining transactions.

What is next for SOFR?

On 7th May 2018, CME launched two SOFR based futures contracts:

Bilateral swaps referencing SOFR should start trading in Q3 2018.

By the end of the year, LCH and CME will provide clearing for these instruments:

With additional liquidity, market participants will be able to build a term structure for SOFR, which in turn should enable trading in more complex financial instruments. However, this is not expected before 2019.

Lack of clarity in terms of deadlines

All large regulatory initiatives have a deadline (Mifid, FRTB, Dodd Frank); SOFR does not and this could be a problem for market participants. All banks have set up working groups straddling businesses and reporting to the CEO, CFO or COO. However, the lack of firm deadlines can make it difficult to budget and prioritize projects accordingly.

Liquidity and lack of term structure

Empirically, SOFR has been more volatile than FedFunds, OIS or LIBOR and subject to seasonality (intra-month jumps due to treasury settlements). Although this is a good thing as it reflects actual market liquidity more precisely than existing benchmarks, SOFR will require a term structure to be usable more widely for pricing financial instruments. Such term structure will only be available with a liquid underlying market, which is currently non-existent.

Convexity risk and unknown cashflows

For traders, the convexity risk arising from SOFR daily fixings vs. existing liabilities on 1M, 3M or 6M fixings can be pushed out to market participants with appetite for this type of risk.

For treasurers and cash flow managers, SOFR will be arrear based daily compounded with coupon payment unknown until 2 business days prior to settlement vs. LIBOR set in advance and coupon known early. This will require careful cash flow management and will - at least initially - add some complexity to the lifecycle and settlement of vanilla products such as swaps. It will also entail changes to mark-to-market valuation approaches.

Challenges for commercial banking and the loans market: repapering of contracts

Although financial markets are going to be heavily impacted by a move to SOFR, they are largely expected to cope. The largest impact will be on commercial banking and the final consumer. Repapering all loans and mortgage contracts will be a very time consuming exercise and the final consumer will require education on the new benchmark.

Some people have drawn a parallel to the adoption of the Euro in Europe at the beginning of the century. The main difference here is the lack of willingness from the public sector to make statements about SOFR. Very few people outside of the financial markets are aware that LIBOR is going away soon.

Maintaining a synthetic LIBOR after 2021?

Some market participants are looking at other options. For example, maintaining a synthetic LIBOR (also referred to as a "zombie LIBOR or "sunsetting LIBOR") which would allow a smoother transition from LIBOR to SOFR, with the two rates existing alongside each other until all LIBOR denominated transactions are novated or unwound, a task that is expected to be hugely significant on both the sell and buy-side.

ISDA and syndicated loan market associations are currently consulting with the industry to assess the need for a synthetic LIBOR or at least a SOFR topped up with a credit component. This would seem like a sensible option to adopt giving firms the time they need to transition to the new rate.

Related posts:

IBORs, new benchmarks series - Focus on SOFR

SOFR and alternative RFRs - Market update

For more information and to be notified of new content on IBORs new benchmarks, please register your interest.