Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 27, 2020

Singapore remains resilient to pandemic shocks

- PMI hints at rebound in economic activity in third quarter…

- … boding well for economy to return to positive growth during 2021-22

The Singapore economy has been hit by multiple shocks during 2020 from the impact of the protracted lockdown on domestic consumption and business activity, as well as the collapse of the tourism industry due to international travel bans. The Singapore Ministry of Trade and Industry (MTI) has sharply revised down its GDP forecast for calendar 2020 to a range of -5.0% to -7.0%.

Utilising its deep fiscal reserves, the Singapore Government has deployed massive fiscal stimulus measures to support domestic demand, helping to support many segments of the economy that are experiencing severe downturns, including tourism, retail trade, commercial aviation and construction. Despite the severe economic shocks, Singapore has remained resilient, continuing to position itself as the Asia-Pacific region's leading international financial centre.

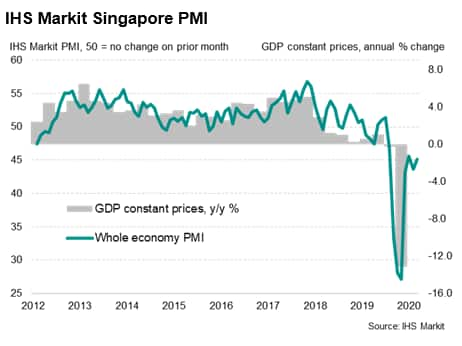

Extended lockdown triggers severe recession

The Singapore economy entered a severe recession in the first half of 2020, as GDP contracted by 13.3% on a year-on-year (y/y) basis in the second quarter, worsening from the 0.3% contraction in the previous quarter. The fall in GDP was due to the lockdown "Circuit Breaker" measures implemented from 7th April to 1st June 2020 to slow the spread of the COVID-19 pandemic in Singapore, as well as weak external demand amidst a global economic downturn caused by the COVID-19 pandemic. Although lockdown measures have been eased subsequently, many restrictions still have continued to impact upon economic activity during the second half of 2020.

The easing of lockdown measures has resulted in a sharp rebound in economic activity in the third quarter. Based on advance estimates for the third quarter of 2020, the Singapore economy expanded by 7.9% on a quarter-on-quarter (q/q) seasonally adjusted basis, although when measured on a year-on-year basis, the economy contracted by 7.0%.

In the second quarter of 2020, the manufacturing sector shrank by 0.8% y/y and by 9.1% q/q, while the construction sector contracted by 59.9% y/y and 59.4% quarter-on-quarter, since most construction activity stopped during the lockdown period. Construction firms were also affected by manpower disruptions arising from additional measures to curb the spread of the COVID-19 virus, including movement restrictions at foreign worker dormitories. Services sector output slumped by 13.6% y/y and by 11.2% quarter-on-quarter, due to the severe impact of the lockdown and travel bans across many segments of the services economy.

In the third quarter of 2020, the easing of lockdown measures resulted in a rebound in construction activity, which rose by 38.7% q/q, albeit still contracting by 44.7% y/y. Manufacturing posted a moderate rise of 3.9% quarter-on-quarter, and was up 2.0% y/y. Easing of restrictions also boosted the services sector in the third quarter of 2020, as it grew by 6.8% q/q although still posting a severe contraction of 8% y/y.

IHS Markit PMI rebounds in third quarter

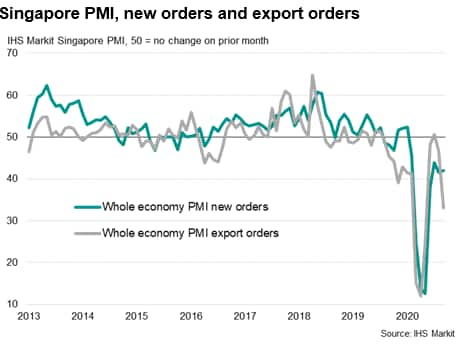

The "circuit breaker" measures that were introduced in April resulted in widespread closures of non-essential businesses as the government acted to stem the spread of the COVID-19 pandemic. This was the key factor causing activity to fall at a survey-record rate in April. Lockdown measures also had a considerable impact on demand, which plummeted. As lockdown restrictions were eased from June onwards, the IHS Markit Singapore PMI has rebounded.

The latest survey data showed that the IHS Markit Singapore Purchasing Managers' Index™ (PMI) rose from 43.6 in August to 45.1 in September. Despite the improvement, the PMI still signalled a contraction in economic activity. However, the average PMI reading for the third quarter was notably higher than that seen in the second quarter, representing a rebound from the peak impact of the COVID- 19 pandemic.

Business activity continued to contract in September, with reduced output concentrated in sectors relating to accommodation & food services as well as administrative & support services. Underlying data showed that construction activity returned to growth as project sites were permitted to restart and workers being cleared to resume work. Manufacturing output was also broadly stable.

The latest manufacturing output data for September showed a strong rebound, rising 24.2% y/y. This reflected very rapid expansion in biomedical manufacturing output, which rose by 89.8% y/y, with pharmaceutical output up 113.6% y/y. Electronics output also showed strong growth.

However, the transport engineering sector contracted sharply, down 35.8% y/y, with aerospace engineering down 44% y/y due to the disruption in global air transport, while the marine and offshore engineering segment recorded a decline of 40.9% y/y, reflecting the slump in the global oil and gas sector.

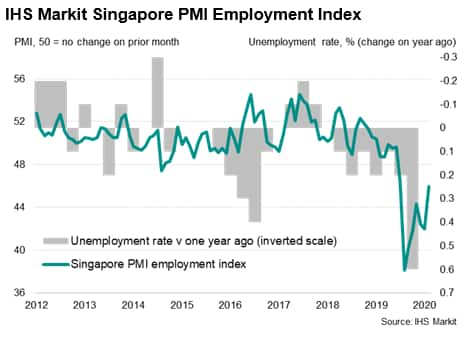

With total output and sales still showing contraction, firms continued to reduce headcounts as part of efforts to control costs and remain viable, albeit with the rate of job losses easing in September.

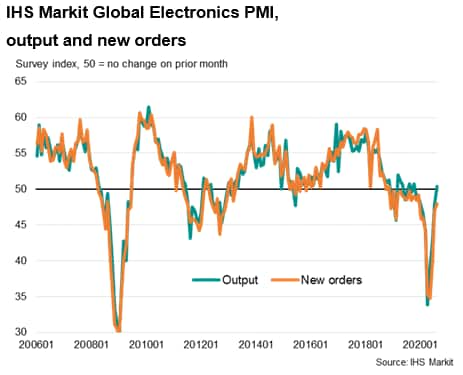

Singapore's electronics sector recovers from lockdown slump

As the impact of the pandemic widened in the Asian region during April, the headline IHS Markit Global Electronics PMI fell to 43.3 in April, down from 48.6 in March, to signal a sharp deterioration in business conditions faced by electronics manufacturers. The April reading pointed to the fastest decline since April 2009, with many businesses temporarily closed amid the global COVID-19 outbreak.

In addition to supply side disruptions to electronics output, widespread lockdowns of retail businesses in many major markets worldwide also disrupted consumer demand for electronics goods as well as products that have significant electronics components, such as autos. Extended periods of lockdown in major electronics manufacturing hubs worldwide resulted in disruption of industrial production and consumption, impacting on global electronics supply chains.

However, since April, the IHS Markit Global Electronics PMI has showed significant improvement, with the headline index rising to 51.1 in September, the first expansion in business conditions for 13 months. Underlying data showed positive expansion in September for the consumer, communications and industrial electronics subsectors.

Reflecting the global rebound in the global electronics sector as lockdowns eased in many key markets, Singapore's electronics sector output grew 30.1% in September 2020 on a year-on-year basis. The electronics sector's expansion mainly reflected very strong growth of 37.4% y/y in the semiconductors segment, which is by far the largest sub-sector of Singapore's electronics cluster, supported by demand from cloud services, data centres and the 5G market. Overall, output of the electronics cluster grew by 7.0% year-on-year in the first nine months of 2020.

Fiscal stimulus measures

The Singapore government has announced massive fiscal stimulus measures amounting to an estimated SGD 100 billion to try to mitigate the negative economic impact of the global pandemic and lockdown measures on the economy. This will result in 2020 overall budget deficit being the largest in Singapore's history since independence.

However, Singapore has one of the strongest fiscal positions of any nation in the world, with no net government debt in 2019. Singapore is drawing up to a total of SGD 52 billion from past reserves this financial year, which will fund a large proportion of the fiscal stimulus measures. While the total size of Singapore's reserves is a matter of national security and therefore not disclosed, the nation maintains deep financial reserves which have been carefully built up, invested and managed over decades.

Consequently, despite the large-scale fiscal stimulus measures due to the exceptional global crisis caused by the pandemic, Singapore's fiscal credentials remain extremely strong, without any net government debt even after this year's drawdown of past reserves. By way of comparison, the UK public sector net debt excluding public sector banks hit 103.5% of GDP in September 2020, while for the Euro Area, at the end of the second quarter of 2020, the government debt to GDP ratio increased to 95.1%.

Medium-term economic outlook

Due to the protracted lockdown of the domestic economy and the worldwide slump in export orders, the highly export-oriented Singapore economy has experienced a severe recession in 2020. The shutdown of international air travel worldwide has also resulted in the collapse of Singapore's tourism sector and the commercial aviation industry. Unlike larger nations like China and Japan, domestic tourism within Singapore cannot play a significant role in mitigating any protracted disruption of international tourism. Singapore's role as a key APAC hub for conferences and conventions is also likely to be disrupted for an extended period of time. The Singapore meetings, incentives, conferences and exhibitions industry accounted for around 22% of tourist receipts in recent years.

Globally, low oil prices have forced oil and gas companies to reduce spending, especially on new projects. Singapore's marine and offshore engineering sector is expected to face a renewed period of weak economic conditions, after having only recently emerged from protracted recessionary conditions following the 2014-2016 oil price slump.

Consequently, despite the substantial fiscal stimulus measures deployed by the Singapore government to mitigate the economic shockwaves, the headwinds to economic recovery are considerable. Moreover, a key downside risk to the near-term outlook would be from any new waves of COVID-19 cases, which could result in renewed tightening of lockdown restrictions, further dampening the path of economic recovery.

Without a COVID-19 vaccine that has completed Phase 3 clinical trials yet, there is significant uncertainty over how the COVID-19 situation will evolve in the coming quarters, and correspondingly, the trajectory of the economic recovery in both the global and domestic economies in the near-term.

However, based on the assumption that COVID-19 vaccines will be deployed during the course of 2021 in many countries worldwide, the pandemic is expected to gradually be brought under control. This is expected to allow the Singapore economy to return to positive growth during 2021-22. GDP is forecast to grow by 3.7% in 2021, strengthening to a more rapid pace of 6% in 2022 as the economy recovers from the pandemic.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-remains-resilient-to-pandemic-shocks-Oct2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-remains-resilient-to-pandemic-shocks-Oct2020.html&text=Singapore+remains+resilient+to+pandemic+shocks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-remains-resilient-to-pandemic-shocks-Oct2020.html","enabled":true},{"name":"email","url":"?subject=Singapore remains resilient to pandemic shocks | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-remains-resilient-to-pandemic-shocks-Oct2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore+remains+resilient+to+pandemic+shocks+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-remains-resilient-to-pandemic-shocks-Oct2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}