Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 15, 2022

Singapore Economy Continues on Road to Recovery

Singapore's economy has continued to recover from the COVID-19 pandemic in the first half of 2022. The advance estimate of GDP for the second quarter of 2022 was up 4.8% year-on-year (y/y), after growth of 4.0% y/y in the first quarter. This follows GDP growth of 7.6% in 2021 as the economy rebounded from the impact of the COVID-19 pandemic. Singapore's manufacturing output grew by 13.8% y/y in May 2022.

Despite the economic disruptions caused by the COVID-19 pandemic, Singapore has continued to attract strong foreign direct investment inflows, notably into electronics and pharmaceuticals manufacturing. A number of new vaccine manufacturing plants are currently under construction in Singapore, including by Sanofi, BioNTech and Hilleman Laboratories.

Economic recovery continues

The Singapore economy grew by 4.8% y/y in the second quarter of 2022, according to the advance estimate of GDP released by Singapore's Ministry of Trade and Industry (MTI). However, second quarter GDP was unchanged on a quarter-on-quarter, seasonally-adjusted basis, compared to the 0.9% expansion in the first quarter of 2022.

Manufacturing output rose by 8.0% y/y in the second quarter, driven by rapid expansion in electronics and precision engineering output. Construction output grew by 3.8% y/y in the second quarter, with the easing of border restrictions having helped migrant labor inflows for the construction industry. The service sector also recorded expansion of 4.7% y/y in the second quarter of 2022. Growth in the food services sector was boosted by easing of pandemic-related restrictions on restaurants and other food outlets during the second quarter.

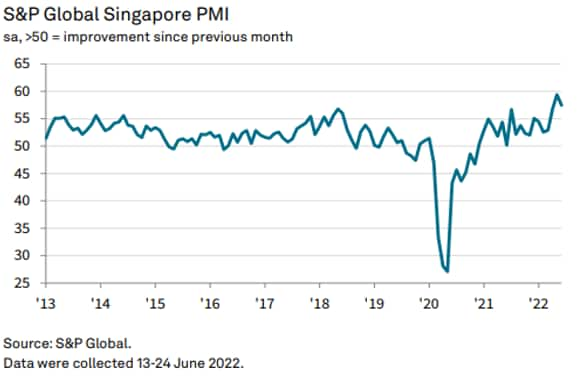

The headline seasonally adjusted S&P Global Singapore Purchasing Manager's Index™ (PMI™) had meanwhile posted 57.5 in June, still signaling strong expansion, albeit down from 59.4 in May. The latest headline reading marked a nineteenth consecutive month where the PMI printed above the 50.0 neutral threshold, to indicate protracted economic recovery from the severe economic impact of the COVID-19 pandemic in 2020.

In line with higher activity, the PMI showed order book volumes increasing at the second-fastest rate in the survey's history in June, with export orders up sharply. Singapore's total exports rose by 12.4% y/y in June, according to trade data from Export Singapore. Anecdotal evidence suggested that the continued loosening of COVID-19 restrictions improved overall demand conditions across Singapore's private sector.

Due to the importance of the electronics industry as a key sector for Singapore's manufacturing output and exports, the continued strength of global electronics demand is expected to continue to underpin expansion in Singapore's electronics sector in the second half of 2022.

In May 2022, Singapore's electronics exports continued to show strong growth, up 12.9% y/y. Exports of integrated circuits rose by 26.6% y/y, while exports of disk media products rose by 10.3% y/y. Exports of electronics products to Malaysia showed buoyant growth of 55% y/y, while electronics exports to the US were up 21% y/y and to South Korea by 20% y/y.

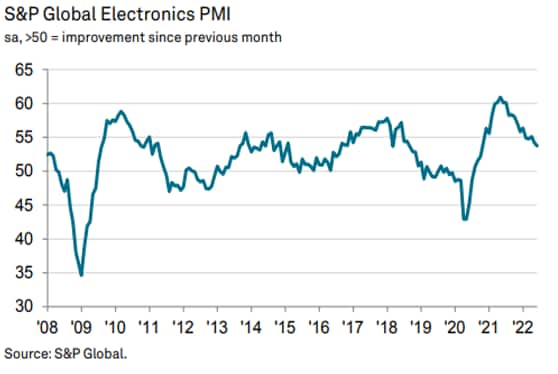

The headline seasonally adjusted S&P Global Electronics PMI has moderated during the first half of 2022, reaching a 20-month low of 53.7 in June, down from 54.2 in May. While still indicative of expansionary conditions in the global electronics manufacturing sector the latest data highlighted a further slowdown in growth, as both output and new orders rose at fractional rates.

June survey data highlighted a further softening of new orders growth at global electronics producers. Overall, new orders increased at the weakest pace since September 2020, leading some firms to restrict their purchasing activity.

However, ongoing supply issues for raw materials and other inputs and the recent Omicron COVID-19 waves in various industrial economies in East Asia have continued to impact on global electronics production.

The outlook for the global electronics industry in 2022 continues to be impacted by lengthy suppliers' delivery times, notably for supply of semiconductors. The S&P Global Electronics PMI Supplier's Delivery Times Index continued to post below the 50.0 no-change mark gain in June, signaling continued delays in vendor performance. Raw material shortages and issues with transport were often cited by survey respondents, with companies also commenting on continued disruption in China and strikes by workers in the supply chain. That said, the extent to which delivery times lengthened was the weakest since November 2020.

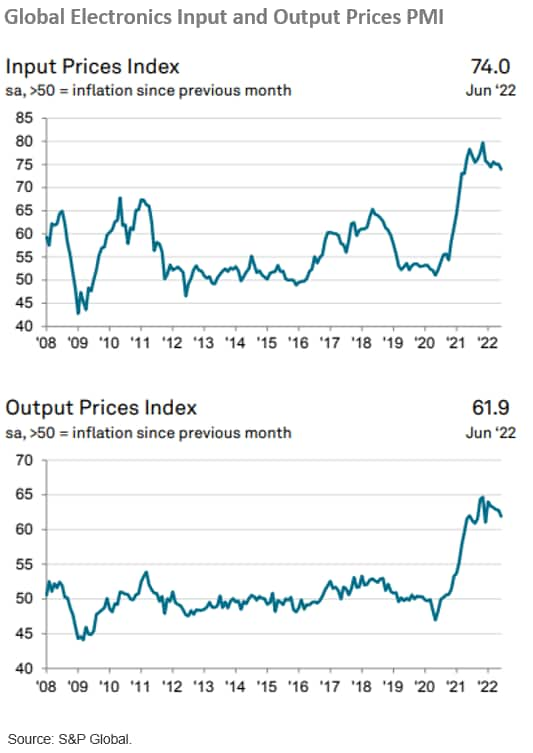

Global electronics producers faced another steep monthly rise in their average input costs during June. Anecdotal evidence highlighted a variety of inflationary sources including raw materials, energy and oil. Approximately 50% of survey respondents recorded higher operating expenses, compared to around 3% that noted a fall.

Rising inflation pressures

According to the latest S&P Global Singapore PMI survey, inflationary pressures persisted in June, largely driven by a faster rise in input costs which caused firms to raise selling prices at the fastest pace since data were first available in 2012.

The Singapore CPI also has shown increasing inflation pressures during the first half of 2022. The CPI reading for May 2022 showing an increase of 5.6% y/y, while the MAS Core Inflation measure rose to an average of 3.4% year-on-year in April and May. The MAS (Monetary Authority of Singapore) expects that inflationary pressures will remain elevated in the months ahead, with MAS Core Inflation projected to rise slightly above 4% in the near term. The MAS has raised its forecast for CPI-All Items inflation to a range of 5.0-6.0%, higher than the earlier forecast range of 4.5-5.5%.

Since October 2021, MAS has been on a path of gradual monetary policy tightening due to rising underlying inflation and sustained economic recovery. With inflation pressures continuing to rise, the MAS decide to tighten monetary policy further on 14th July, by re-centering the mid-point of the S$NEER policy band up to its prevailing level, but without changing the slope and width of the band. This policy move is intended to slow the momentum of inflation and ensure medium-term price stability.

Medium term growth drivers

There are significant uncertainties facing the global economy in the near-term, which continue to pose downside risks to Singapore's economic outlook for the second half of 2022 and into 2023. These include the ongoing global risks to world growth from the Russia-Ukraine war, as well as the impact of rising global inflation and monetary policy tightening by many central banks. China's mainland economy slowed sharply in the second quarter of 2022 due to the impact of pandemic-related restrictive measures in a number of major cities. The risk of new COVID-19 outbreaks in China also remains a key uncertainty for the near-term outlook, after China's economy slowed sharply in the second quarter of 2022 due to the impact of restrictive measures in several large cities to contain COVID-19 outbreaks.

Taking into account these various downside risks to the outlook, Singapore's GDP growth is projected by the MTI to come in at the lower half of the 3-5% forecast range for the 2022 calendar year.

However, the Singapore economy has made significant progress towards normalisation of its economy during the first half of 2022, notably through the reopening of international borders. This is helping to boost international tourism flows as well as supporting the gradual recovery of the Meetings, Incentives, Conferences and Exhibitions industry. Substantial lifting of COVID-19 related restrictions has also boosted the food services industry, with restaurants and cafes showing a strong rebound in activity levels. The manufacturing sector is also continuing to show sustained expansion, buoyed by strong electronics exports.

Singapore has also attracted significant new foreign direct investment inflows into the manufacturing sector. Singapore remains a leading Asian hub for advanced manufacturing industries such as electronics and pharmaceuticals.

Due to supply chain disruptions and severe delays in supply times for key components in the global electronics industry during the COVID-19 pandemic, electronics firms are increasingly diversifying their supply chains. Southeast Asia is an important part of the global manufacturing supply chain, notably for the electronics and automotive industries, which also helps to boost Singapore's role as an exporter of electronics products to other ASEAN nations. Electronics multinationals have announced major new foreign direct investment into Southeast Asian nations, including Singapore, Vietnam and Malaysia since 2020, as global demand for electronics has risen strongly. New foreign direct investment continues to flow into Singapore from global electronics multinationals. GlobalFoundries will open a new semiconductors plant in Singapore in 2023, creating an estimated 1,000 new jobs.

Singapore will also continue to be a leading APAC hub for biomedical manufacturing, notably for pharmaceuticals. The COVID-19 pandemic has triggered a number of major new investments into vaccine manufacturing in Singapore, as APAC regional demand for vaccines is projected to grow rapidly. Sanofi is building a new vaccine facility in Singapore that will open in 2025, while Hilleman Laboratories as well as BioNTech also establishing vaccine manufacturing plants in Singapore.

Despite the impact of the COVID-19 pandemic, Singapore's medium-term growth outlook remains favorable, supported by its role as a leading international financial services hub as well as an Asia-Pacific hub for shipping, commercial aviation and logistics. These competitive advantages have also continued to support Singapore's attractiveness as a regional headquartering hub for global multinationals.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economy-continues-on-road-to-recovery-july22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economy-continues-on-road-to-recovery-july22.html&text=Singapore+Economy+Continues+on+Road+to+Recovery+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economy-continues-on-road-to-recovery-july22.html","enabled":true},{"name":"email","url":"?subject=Singapore Economy Continues on Road to Recovery | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economy-continues-on-road-to-recovery-july22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore+Economy+Continues+on+Road+to+Recovery+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economy-continues-on-road-to-recovery-july22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}