Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Aug 20, 2024

By Matt Chessum

In recent weeks, borrowing activity in the price-sensitive short-term U.S. Treasury market has intensified. Despite mixed economic data, markets are currently pricing in a 100% probability of an interest rate cut in September. However, the magnitude of this cut remains uncertain. Some market participants anticipate that a slowing U.S. economy will prompt a substantial 50 basis point reduction, while others argue that recent strong retail sales figures reduce the likelihood of an imminent recession, thereby supporting the case for a smaller 25 basis point cut.

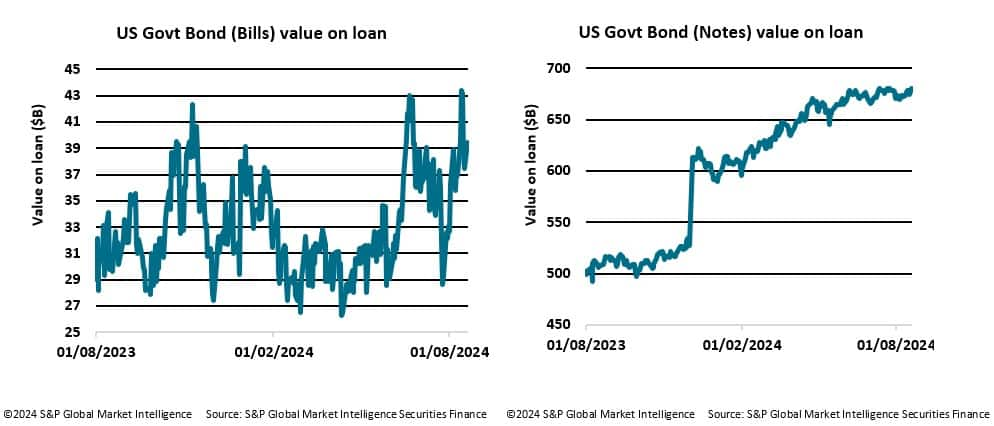

This uncertainty regarding the size of the forthcoming rate cut has led to an increase in the value of U.S. Treasury Bills (with maturities of less than one year) and Notes (with maturities of less than ten years) on loan. Fixed-income assets with shorter maturities are particularly sensitive to price fluctuations and often respond more acutely to any market mispricing. Investors are likely borrowing short-dated Treasuries in anticipation of various potential scenarios that may unfold in the coming weeks.

Anticipation of a smaller-than-expected cut

If some investors believe that the market is overly optimistic and expecting a large rate cut, they might short bonds anticipating that the actual cut will be smaller than expected. A smaller-than-expected cut could disappoint the market, leading to higher yields (and lower bond prices), making a short position profitable.

Market overreaction and correction

When there's uncertainty, markets can sometimes overreact to the possibility of a significant cut, pushing bond prices higher than what might be justified by economic fundamentals. If investors expect the market to correct after the actual rate cut decision is announced (especially if the cut is smaller or if there's no cut at all), they might short bonds in anticipation of falling prices.

Hedging against rate hike risks

In an environment of uncertainty, there's always a risk that instead of a cut, the central bank might choose to keep rates unchanged or even hike them if inflation or other economic data surprises to the upside (any hike seems unlikely in the current situation). Shorting bonds can be a way to hedge against this risk, as bond prices would fall if rates were not cut as expected or if there is an unexpected hike.

Yield curve dynamics

Uncertainty about the size of the rate cut can lead to varied expectations about the yield curve's shape. If some investors believe that a smaller cut or no cut will lead to a steepening yield curve (where long-term rates rise more than short-term rates), they might short shorter-term government bonds as part of a strategy to profit from this movement.

Contrarian play

In a highly uncertain environment, if the majority of the market is positioning for a large rate cut, a contrarian investor might short bonds on the expectation that the consensus view is wrong, and that either the rate cut will be smaller or that other factors will cause bond prices to fall despite the cut.

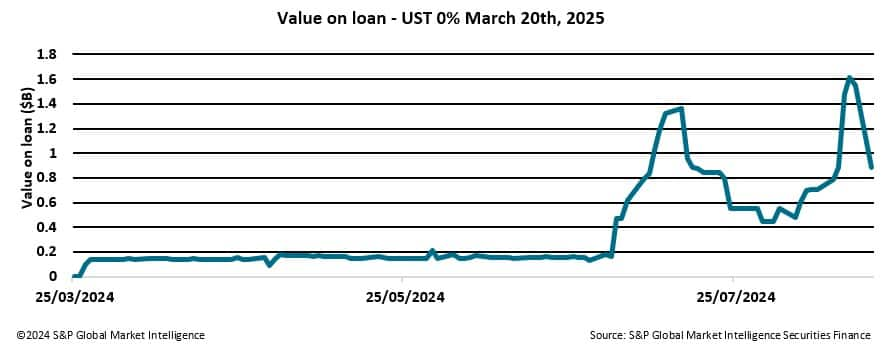

One of the most sought-after US Treasuries in the securities lending market is the 0% 03/20/25. Value on loan has been growing since the beginning of July with balances fluctuating with market activity. S&P Global Market Intelligence Repo Data Analytics also shows this issue trading special in the repo market with volumes peaking at all-time highs on August 14th at over $520B.

Regardless of the outcome of the September Federal Reserve meeting, prevailing market sentiment will continue to influence activity within the securities finance markets. The ongoing uncertainty surrounding the future trajectory of interest rates, along with speculation about the eventual terminal rate, is expected to heighten volatility in fixed income markets in the coming weeks and months. Investors are likely to continue positioning themselves to manage risk and potentially capitalize on market mispricing within this volatile and uncertain interest rate environment, leveraging the liquidity provided by the securities lending market.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.