Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 08, 2021

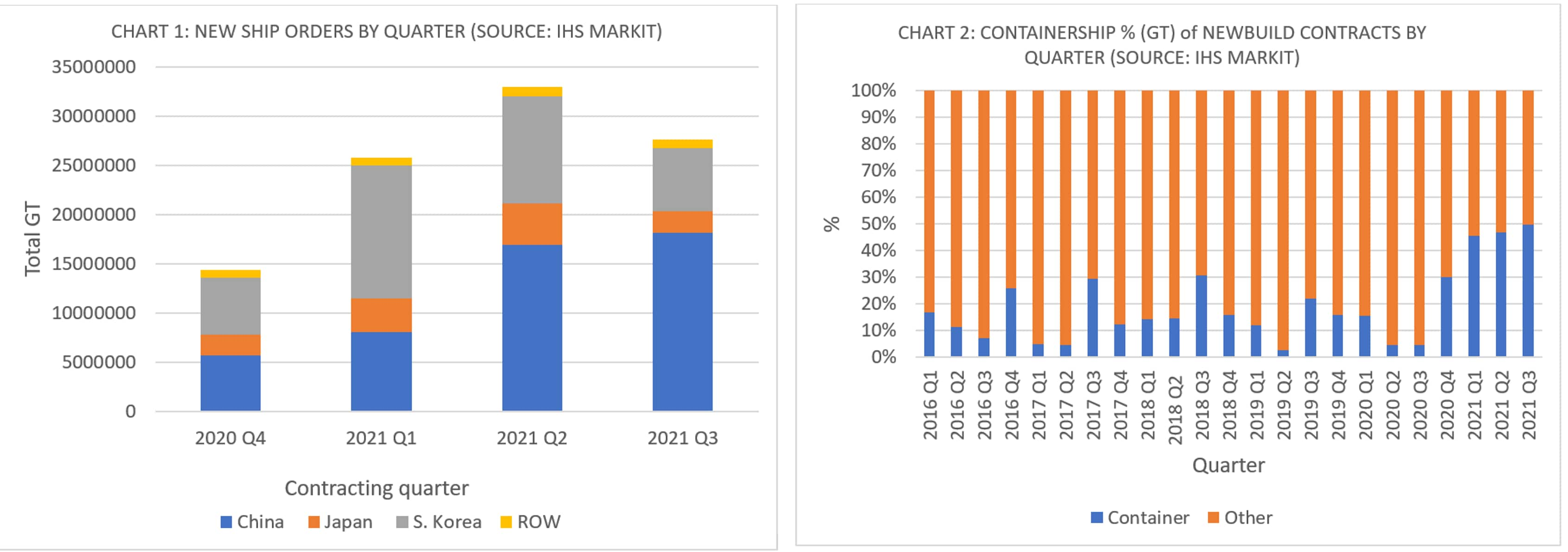

According to the latest IHS Markit Maritime & Trade newbuilding data, Chinese shipbuilders picked up the lion's share of shipbuilding contracts during the third quarter of 2021 with some 68% in terms of gross tonnage (GT), of all new orders in Q3 2021 being placed in China (see chart 1). Fuelled by rising demand for new containerships, over 60% of orders in GT terms contracted at Chinese shipyards in Q3 were of this vessel type. This compares to 50% if analysed on a global basis and is significantly up from the negligible levels seen prior to Q4 2020 (see chart 2).

Major boxship orders placed by liner operators in Q3 included Hong Kong-based OOCL which recently penned 10 x 16,000teu units at Cosco KHI Shipbuilding (a joint venture of Cosco Corp and Japan's Kawasaki HI). In addition, non-operating owner Seaspan contracted 15 x 7,000teu vessels at Jiangsu Yangzi Xinfu and Shanghai Waigaoqiao for long-term charter to Israel's Zim Lines (comprising five dual-fuel units) and Ocean Network Express of Japan (10 x scrubber-fitted ships) respectively.

Other significant containership contracts placed in China recently comprised Taipei-based Evergreen Marine Corp's order for no less than 24 ships as part of its intra-Asia fleet replacement and expansion programme. This comprised 2 x 1,800teu, 11 x 2,300teu and 11 x 3,000teu ships which were all ordered at the Guangzhou Wenchong Shipyard. Evergreen, which requires vessels of very high specification in terms of equipment and crew accommodation, previously had long-term relationships with Japanese shipbuilders for most of its fleet requirements. However, in the past decade Evergreen utilised South Korea's Samsung HI for several series of newbuildings. With the exception of an overspill order for 4 x 23,000teu 'A-type' ships at Jiangnan Group (the lead yard being Samsung HI) this is the first Evergreen contract placed in China for a significant series of new ships.

Elsewhere in the containership sector, French liner operator CMA CGM recently ordered 6 x 7,300teu dual-fuelled ships at South Korea's Samsung HI.

Driven by an exceptional container shipping market which is driving record margins for liner operators, and a requirement for more efficient and less polluting vessels, China and South Korea have been the main beneficiaries for this liner shipping order boom. Chinese shipbuilders are also understood to be offering particularly attractive payment terms and financial packages supported by state-owned banks. In Japan, Nihon Shipbuilding (a joint venture of Imabari Shipbuilding & JMU) picked up orders for a handful of 12,000teu and 14,000teu vessels for operation with Ocean Network Express during Q1. However since then no new boxship orders have been recorded in Japan. Having run down a significant amount of shipbuilding capacity in the past decade due to Government policy, Japan's ability to attract major orders is probably now limited. The only other significant builder of containerships is currently CSBC Corp of Chinese Taipei which has 4 x 3,000teu ships on order, building for its own account presumably for resale.

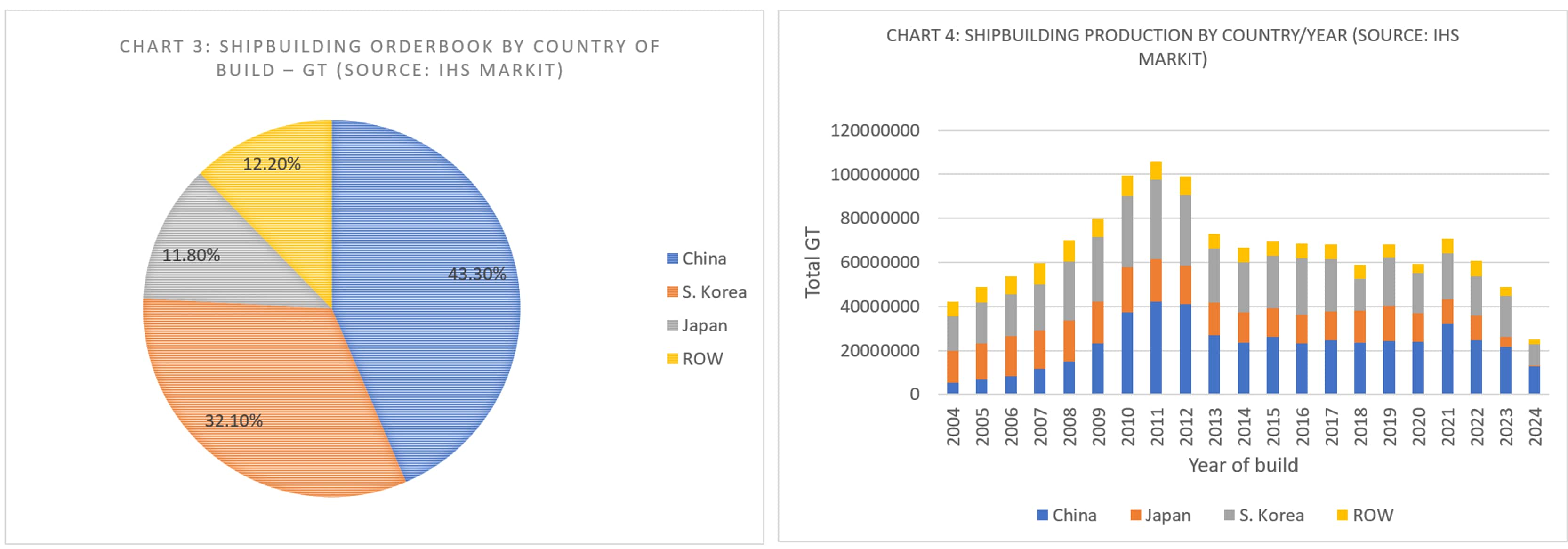

With these latest orders, China's position as the leading shipbuilding nation in terms of production output is cemented. China currently has a 43.3% share of the global orderbook (see chart 3) having held the number one spot continuously since 2017. In 2020, China produced 41% of the World's ships by GT with this figure expected to rise to 45% for 2021 (see Chart 4).

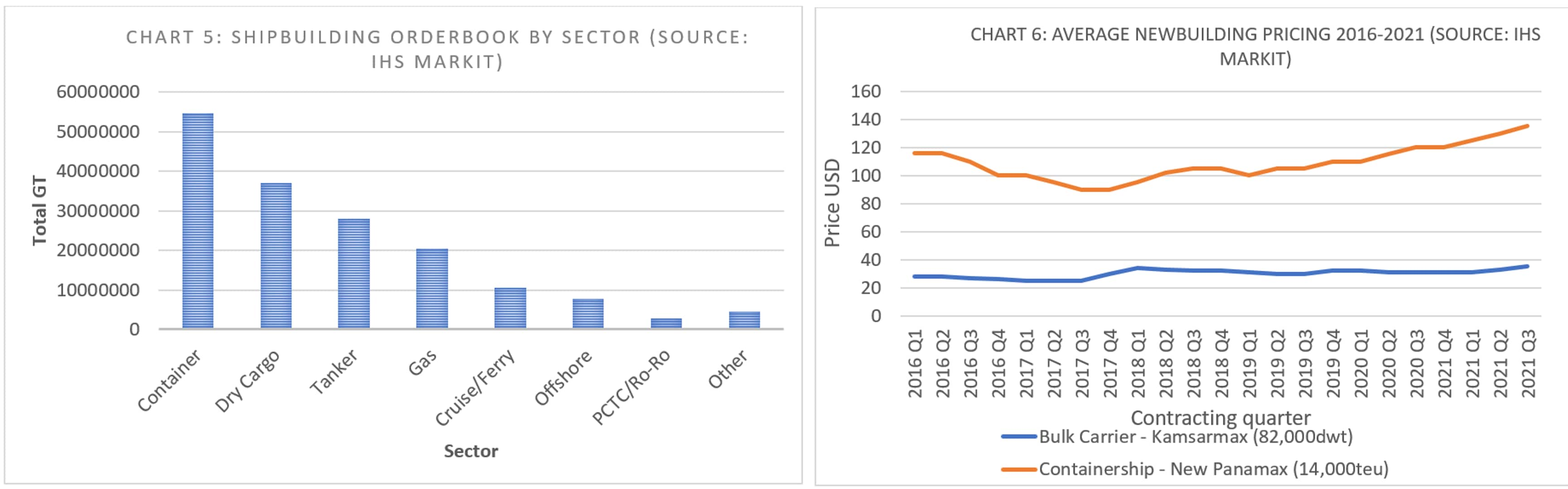

With this surge in ordering activity, containerships now make up some 33% of the current orderbook (see chart 5). This is followed by the dry cargo (bulk carrier and general cargo) sector making up 22% with tankers providing 16.8% of the orderbook followed by the gas sector (LNG and LPG) at 12.3%. Whilst the cruise and ferry sector presently makes up 6.3% of the orderbook this is likely to reduce as cancellations of cruise vessels work their way through the system. Meanwhile, the offshore sector comprises 4.6%, ro-ro cargo and PCTC 1.7%, with all other sectors making up 2.7% of the orderbook.

Increasing demand for containerships are allowing shipyards to increase their contract prices (see chart 6) and at least provide an improvement in margins which have been historically low since the fallout from the global financial crisis. Nevertheless, contract prices are still only slightly above those seen during the previous bull market of 2006-2008. In addition, recent increases in steel plate prices, equipment and skilled shipbuilding labour shortages are likely to put further pressure on the global shipbuilding industry.

For more insight subscribe to our complimentary commodity analytics newsletter

Posted 08 October 2021 by Robert Willmington, Operations Manager, Maritime, IHS Markit

How can our products help you?