Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Aug 11, 2020

Shale dividends - reduced shelf life

Increased bankruptcies foreclose meaningful shareholder return

Ever since the Shale region became an important contributor to US oil production and employer in 2010, it has only had a couple of years of uninterrupted success, that is until the last major oil price collapse in late 2014. Shale players have since then lurched from one crisis to another, all the while adding more and more debt hoping to recapture the success of 2010-2014 but to no avail. The emerging picture is one of companies, big and small, with too much debt and too few opportunities to balance the books, making the pandemic merely the last straw rather than a catalyst that led to the recent wave of bankruptcies.

These companies, like their peers in the world, have experienced an overall decline in output, demand and oil price caused by the disruption of global market conditions, in many instances having to revise or even suspend their annual guidance.

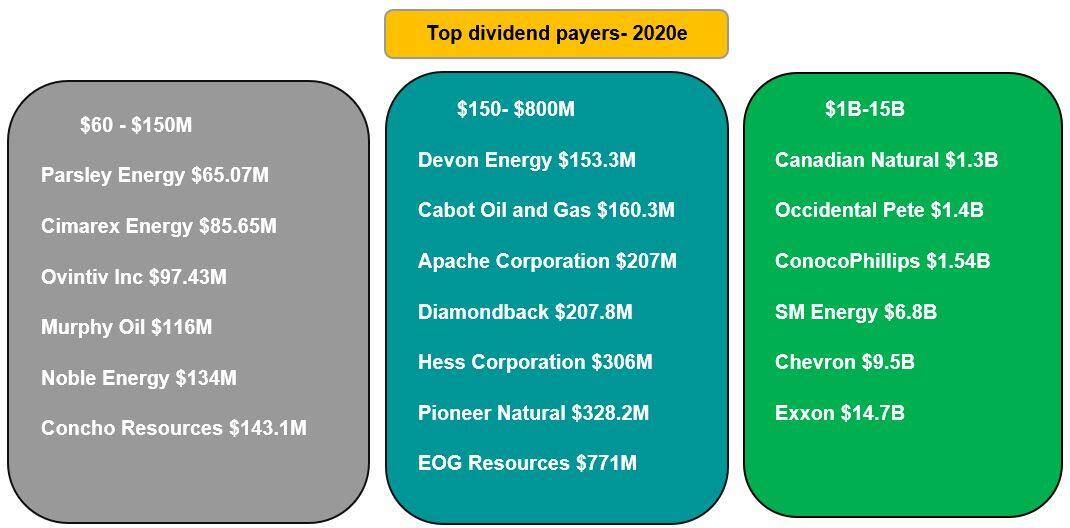

<span/>We examine the main dividend players in the Shale region and how their dividend sustainability is affected by potential annual payout, debt, reserve-based lending and change in productivity amidst the current unprecedented times. The table below demonstrates the lowest to highest expected dividend payers for the Shale region for FY'20. It is important to note that names such as Canadian Natural Resources (CNQ) and ConocoPhillips (COP), although among companies with the highest expected payout for the year, are still at risk for a cut in their upcoming quarter.

Borrow to Drill

Since the last financial crisis, the Fed's longstanding quantitative easing program made debt much cheaper and more accessible to a lot of companies in the Shale region. Most of these companies opted to issue debt in the case of blue chips, signed up for revolvers or reserved-based lending for mid- and small-cap names. Ordinarily this practice is well and good when demand and supply of oil are balanced, the price of oil is higher than their breakeven prices and they can service their debt with no issues but that is not the case and arguably hasn't been so since 2015.

More than 230 North American oil and gas producers owing at least $152 billion in debt have filed for bankruptcy since 2015. In the second quarter of 2020, the companies that went bankrupt totaled a whopping $29 billion in debt outstanding.

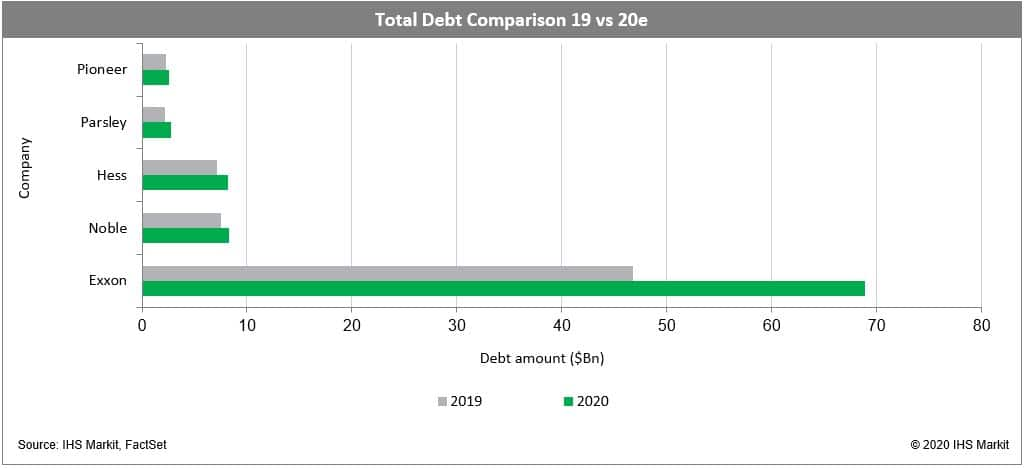

Even for blue chip companies such as Exxon Mobil (XOM) the debt feels like a noose around its neck, potentially threatening the company's survival. XOM represents the highest debt increase year-over-year of the companies we analyzed, with the company being expected to increase its total debt by $22.19 billion, or approximately 48%. Exxon has previously mentioned that about 70% of its shareholders look to the company's dividend as an important source of income, but the company's actions in the debt markets could potentially jeopardize the vaunted position of the dividend. Credit ratings in both Moody's and S&P show a negative outlook and has had its rating downgraded already in 2020.

Year-over- year debt increases of $1.07 billion, or 15%, for Hess Corporation (HES) with total debt as a % of Equity increasing from 79.2% in 2019 to 115% in 2020. Hess has a stable liquidity position, with only one near term debt maturity that comes from a three-year loan agreement with JPMorgan for $1 billion. Although its debt position does not cause a problem for the company, earnings and free cash flow are projected to be negative for the upcoming two years, potentially impacting funds available for dividends.

Regarding Parsley Energy (PE), total debt increases by 27% year-over-year, and as a response to the Covid-19 pandemic, the company entered into an amendment to its revolving credit facility which reaffirmed its borrowing base at $2.7 billion, increasing the committed amount to $1.075 billion and extending the maturity date to October 28, 2023. With a stable liquidity position and long-term debt due solely in 2025, PE finds itself in a strong position to maintain the dividend, with the possibility of increasing it by 2021, along with the diminished risk of debt default due to an extended period of raised capital.

Geopolitical Risk

Going back to the oil downturn of 2014, many oil companies had cut costs in response to the event, when OPEC opened wide oil taps to try to protect members' market shares in reaction to the US Shale revolution. Nowadays, with the oil price benchmark showing decreases since the start of the pandemic, many companies revised their plans of return promises to investors, either by slowing down share buy backs or reintroducing non-cash dividends.

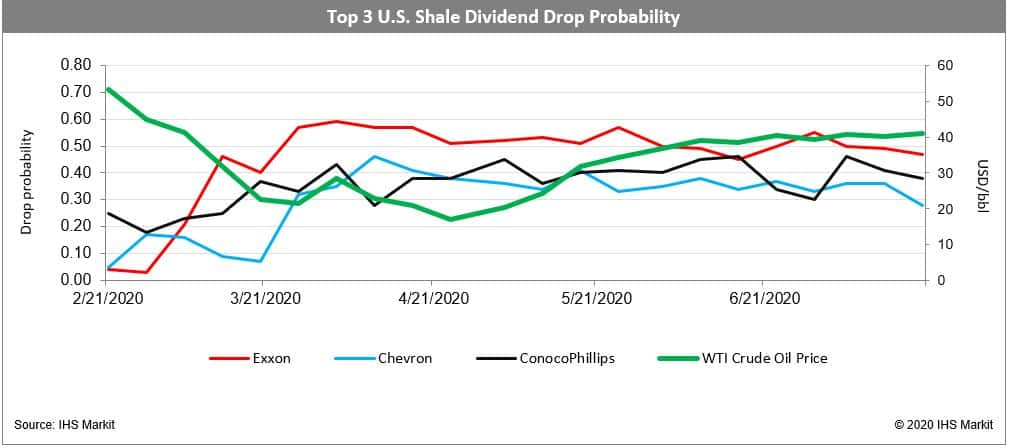

The Russia-Saudi Arabia oil price war that initiated in March 2020 also complicated the global oil stability. Due to Russia's refusal to reduce oil production in order to keep prices for oil at moderate levels, a steep drop of oil price happened over the spring of 2020.The graph below shows the oil price dropping to the mid-teens in April while at the same time, our internal drop probability scores went up. For example, XOM's probability of a dividend cut went from less than 10% in February to almost 60% in March-April period when the toll of the price war and the steep decline in demand were hitting oil and gas companies.

Going forward, in response to the fall in oil price, multiple Shale oil producers that require oil prices above a $40 per barrel to sustain operations were forced to cut production, especially given the fact that most of them expected a barrel price of $55-65 in 2020. As a result of the oil price crash, several companies with Shale presence declared bankruptcy, such as Whiting Petroleum and Chesapeake, for example. What investors can expect is that if oil prices are not stabilized and OPEC members continue engaging in price wars and dictating the global price of oil with production curtailments or increases, it won't be long until we see a lot of the oil companies' financial position being affected and consequently, their ability to pay dividends.

Contacts:

Amira Abdulkadir, Product Analysis & Design Director

Kelvin Menezes, Research Analyst

Email: dividendsupport@ihsmarkit.com

To access the report, please contact dividendsamer@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshale-dividends-reduced-shelf-life.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshale-dividends-reduced-shelf-life.html&text=Shale+dividends+-+reduced+shelf+life+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshale-dividends-reduced-shelf-life.html","enabled":true},{"name":"email","url":"?subject=Shale dividends - reduced shelf life | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshale-dividends-reduced-shelf-life.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shale+dividends+-+reduced+shelf+life+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshale-dividends-reduced-shelf-life.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}