Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 04, 2020

Securities Finance: February 2020

- IPOs special around lockup expiry delivery

- ETF borrow demand and lending revenues on the rise

- Increased borrow demand for corporate bonds

Securities lending revenues were relatively flat YoY in February. Average daily revenues increased by 0.4% compared with February 2019, however daily returns were 0.7% lower than January. COVID-19 emerged as a negative catalyst for global equity and credit markets, erasing the YTD equity market gains over the last two weeks of February. Borrow demand for some assets increased in the last week of the month as the sell-off deepened, most notably exchange traded funds.

The two most recent comparisons for lending around a broad equity market decline are Q1 2016 and Q4 2018, which paint different pictures in terms of expectations for returns. The first quarter of 2016, as well as Q4 2015, were very positive for overall securities lending revenues, mainly attributable to energy related credit and equity and to an increase in ETF demand. The fourth quarter of 2018 did not see an overall revenue uptick, however demand for ETFs, particularly credit focused funds, did see a meaningful increase. Both periods of market stress precipitated an increase in demand for ETFs, and to a lesser extent credit; the difference was in demand for individual equities, which increased in nominal terms despite the sell-off in late-2015/early-2016 but declined with the broader market in Q4 2018. The challenge is that declining market valuations naturally put pressure on lending returns, by virtue of lower balances, absent an offsetting increase in borrowing or fees.

The COVID-19 related sell-off has resembled 2018 thus far, with an increase in borrow demand for ETFs, along with single name equity loan balances being relatively flat. Global ETF loan balances increased by 30% in February, ending the month at the 2nd highest level on record, $68.8bn (the April 2011 record was the result of a single day loan in a gold fund). The increased borrow demand for exchange traded funds may, in part, reflect the unwinding of "create to lend" trades, where the securities underlying an ETF are borrowed and delivered to the ETF sponsor with the aim of creating shares of the ETF for borrow. The two largest high-yield funds, HYG and JNK, have seen a combined $8.8bn in YTD outflows through the end of February, while loan balances for shares of the ETFs have increased by $3.9bn. The increased borrow demand for the HY ETF shares drove lending fees higher, most notably for HYG. Fixed income ETFs contributed 40% of February's $16bn increase in loan balances, equities contributed 53% and the remainder came from commodity funds and alternatives.

There are a few equities where recent changes in share price and borrow demand were clearly driven by outbreak concerns. Facemask manufacturers such Alpha Pro Tech (APT) in the US and Kawamoto Corp in Japan have seen increased borrowing and fees following surging share prices. With the continued surge in share price, number of borrowed shares and lending fee, APT was one of the top 50 US equity earners over the last week of February. Lakeland Industries (LAKE), maker of protective clothing, has also seen an increase in share borrowing and fees. Biotech firms working on a treatment have also seen surging share prices and borrow demand, including Novavax (NVAX) and Vir Biotechnology (VIR); the borrow demand for NVAX declined in February, while it became progressively more difficult to borrow shares of VIR.

February saw a marginal uptick in Asia equity balances, notable given the decline in valuations, however it was not consistent across the region in a way that would suggest a significant change in broad hedging of equity exposure. Overall Asia equity loan balances increased by 2.8% in February as compared with January; however, the $182bn in average loan balances is essentially flat YoY compared with February 2019 (a decline of 0.1%). Average equity loan balances increased in Japan and Hong Kong; balances declined in South Korea and Taiwan. Asia equities delivered $134m in February revenues, a 0.7% reduction in average daily revenue compared with January.

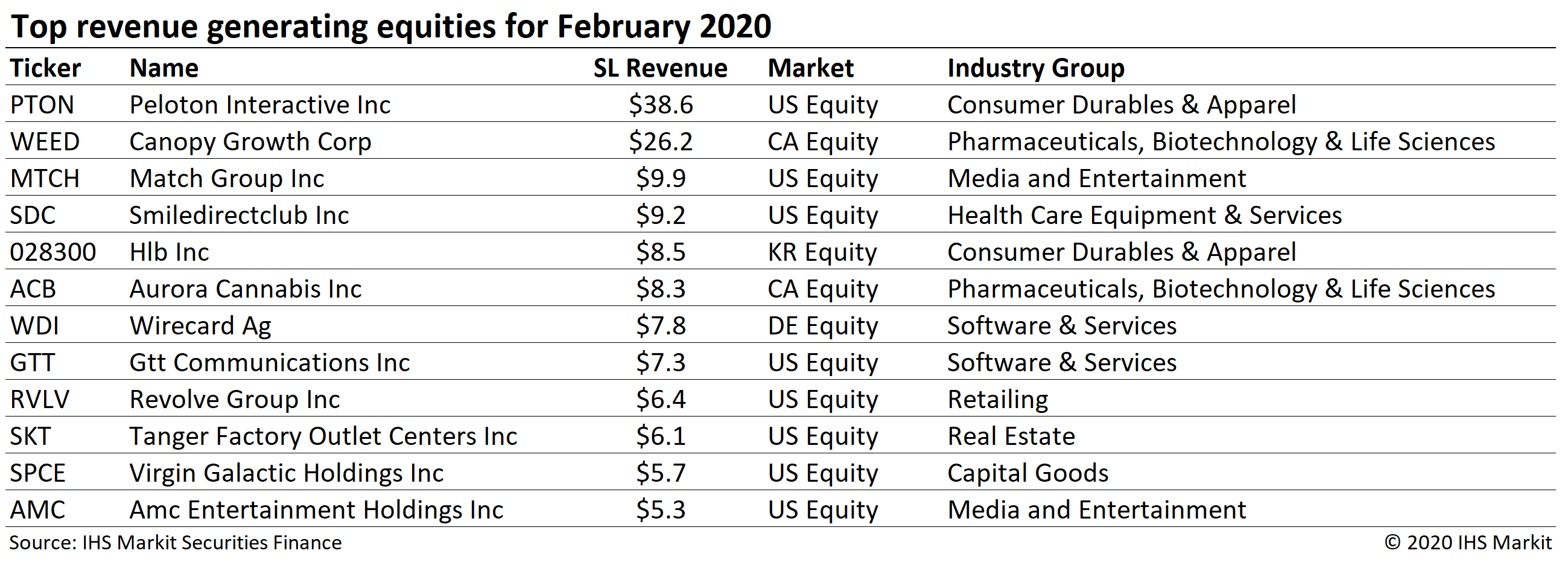

As noted in the January revenue note, some formerly significant revenue generating securities have seen declines as result of lower demand or increased supply. At the time, we pointed out the sharply lower revenues for NIO and Casino Guichard, in addition to the IPO class of 2019, most of which have already passed their lockup expiries. Peloton (PTON) can be added to the list after its lockup expiry on February 25th, which resulted in a sharp reduction in share borrowing and fees. Shares of Peloton were the most revenue generating globally in February, with revenues greater than $38m. Similarly, demand for shares of Virgin Galactic Holdings, and lending fees, collapsed in the last week of February. The firm's equity shares, and warrants, had been on an absolute tear prior to the firm reporting earnings on February 25th, which sent the share price down more than 35% by Feb 27th, when the firm filed a form with the SEC stating it may issue up to 27.4m shares relating to the exercise of outstanding warrants.

Next up for 2019 IPOs with substantial loan balances and fees is SmileDirectClub.com, which has seen increased share borrowing and fees even though the 51% decline in share price over the last two weeks of February negatively impacted revenues by virtue of lower nominal balances. Shares of SDC are likely to see elevated fees through its lockup expiry, however the question from a lending revenue perspective is the lack of large IPOs with lockups expiring over subsequent months. Given the substantial portion of revenues generated from lending recent IPOs over the last twelve months, monthly revenues will see much tougher YoY comps in the months ahead. The 2019 vintage was ideal for generating lending revenues, with reasonably large nominal floats, which were also relatively small compared with the outstanding shares which were subject to lockup agreements. An optimistic take at the outset of 2020 was that the short demand for some of the 2019 IPOs would grow into the new larger floats and again put pressure on borrowers with a commensurate increase in borrow cost; that theory has yet to bear fruit, with increases in shares on loan for Beyond Meat, Lyft and Slack Technologies proving insufficient to drive an increase in borrow cost. While "special" balances related to recent IPOs have declined, the Cannabis sector continues to be a key driver for North American equity lending revenues. US equity loan balances declined by 5.9% over the course of February, a smaller decline than broad market indices, reflecting the 4.7% increase in share borrowing.

Corporate bond loan balances continued to increase in February, with total loan balances reaching $200bn for the first time since March 2019, increasing from $183bn at the start of 2020. The Diamond Sports Group Llc 6.625% note maturing in 2027 was the most revenue generating credit in February, as it was in January. The 2nd most revenue generating credit was the Wirecard 0.5% note maturing in 2024, following the increase in fee in January which made it one of the most expensive to borrow fixed income instruments. Reflecting the crossover borrow demand, Wirecard equity was most revenue generating EU equity in February. Credits related to pharmaceutical firms with opioid liability continue to be in demand, with Mallinckrodt and Teva issues both among the most revenue generating in February, as they have been for much of the past year. Corporate bond lending revenues came in at $40m for February, with average daily revenues increasing 1.2% compared with January.

Government bond lending revenues remain stable, though well below the Q1 2018 peak. Borrow demand for French sovereign debt continued to increase in early February, reaching €75bn on February 7th, however, balances declined slightly thereafter. Borrow demand, at positive spreads, for the largest contributor to bond lending revenues, US debt, continues to be subdued, with average daily revenue nearly 7% lower in February than January.

Conclusion:

Times of market stress highlight a key benefit of securities lending, which is that revenues often increase at the times when they are most helpful. In that sense, securities lending can provide a similar benefit to beneficial owners as short selling does for long-short hedge funds, namely providing income when assets decline in value. For single name equities, the sell-off in Q4 2018 was notable given that there wasn't an uptick in borrow demand or revenues, however, credit and ETF borrow demand did see a pickup. Other prior selloffs have coincided with increased equity lending returns including late-2015/early-2016, and the financial crisis 2008, despite the decline in returns after the US equity short sale ban. It remains to be seen whether the COVID-19 outbreak will cause a lasting slowdown in the global economy, and, if so, what impact that will have on securities markets. Thus far the upshot for securities finance has been a significant increase in borrow demand for ETFs, with equity loan balances relatively flat globally amid the market stress.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-revenue-february-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-revenue-february-2020.html&text=Securities+Finance%3a+February+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-revenue-february-2020.html","enabled":true},{"name":"email","url":"?subject=Securities Finance: February 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-revenue-february-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance%3a+February+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-revenue-february-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}