Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 07, 2020

Securities Finance November 2020

- November revenues decline by 1% YoY

- IPOs & SPACs drive US specials balances

- European equity revenue rebound intact

- ETF revenues increase 72% YoY

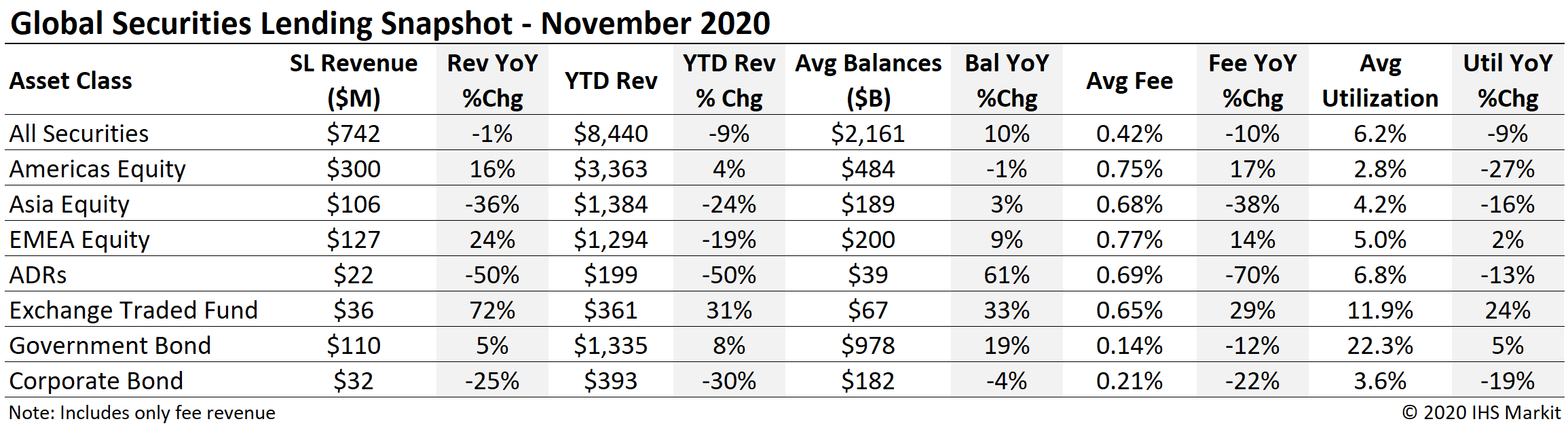

- QTD revenues -11% YoY

Global securities lending revenues declined by 1% YoY in November, however revenues did increase 3.6% MoM. That marks the third consecutive month of increasing returns following a challenging environment during the summer. While the November YoY change is small at the top level, it is the result of substantial changes in returns for the different asset classes. European and US equity revenues trended higher in November. APAC equity revenues continue to be subdued, however an increase in activity QTD for some markets may augur well heading into 2021. In this note we will review revenue drivers from November within the context QTD and YTD results.

Americas Equity

Americas equity revenues came in at $300m for November, a 16% YoY increase, and the largest monthly return since July ($436m). The broad market advance in November boosted lendable inventories by more than loan values, leading to the lowest utilization on record. Americas QTD equity revenues of 581m reflect a decline of 9.3% YoY; The uptrend during November revenues sets up an opportunity for December to improve the YoY Q4 comparison.

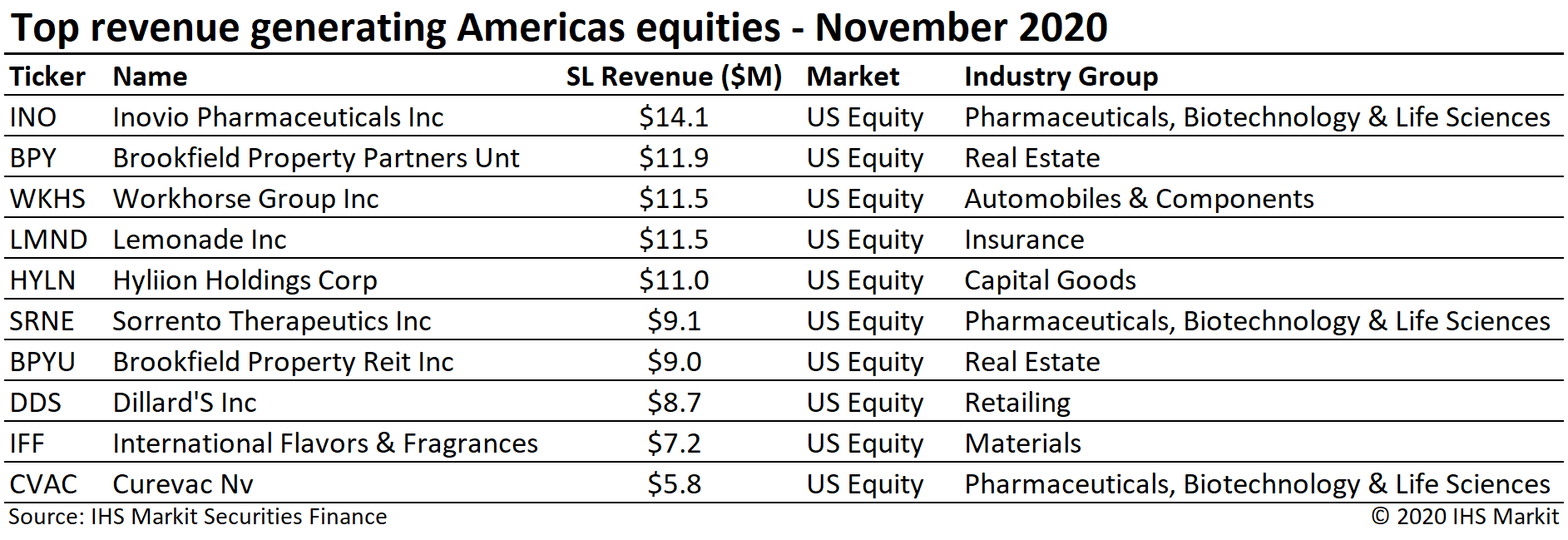

US equity revenues came in at $274m, a 30% YoY increase and 6% MoM increase. The YoY comparison for November presented a lower hurdle than October, largely the result of the revenue boost from Beyond Meat lockup expiry in October 2019. The most revenue generating US equity in November 2020 was Inovio Pharmaceuticals, whose borrow cost soared after reporting earnings on November 9th. In that case traded volume gave an indication that spot rates were likely to increase, with 39% of the float trading between November 9th and 10th, while the share price declined by 19% and then increased by 35%, respectively, leading to the spike in spot borrow fees on November 12th.

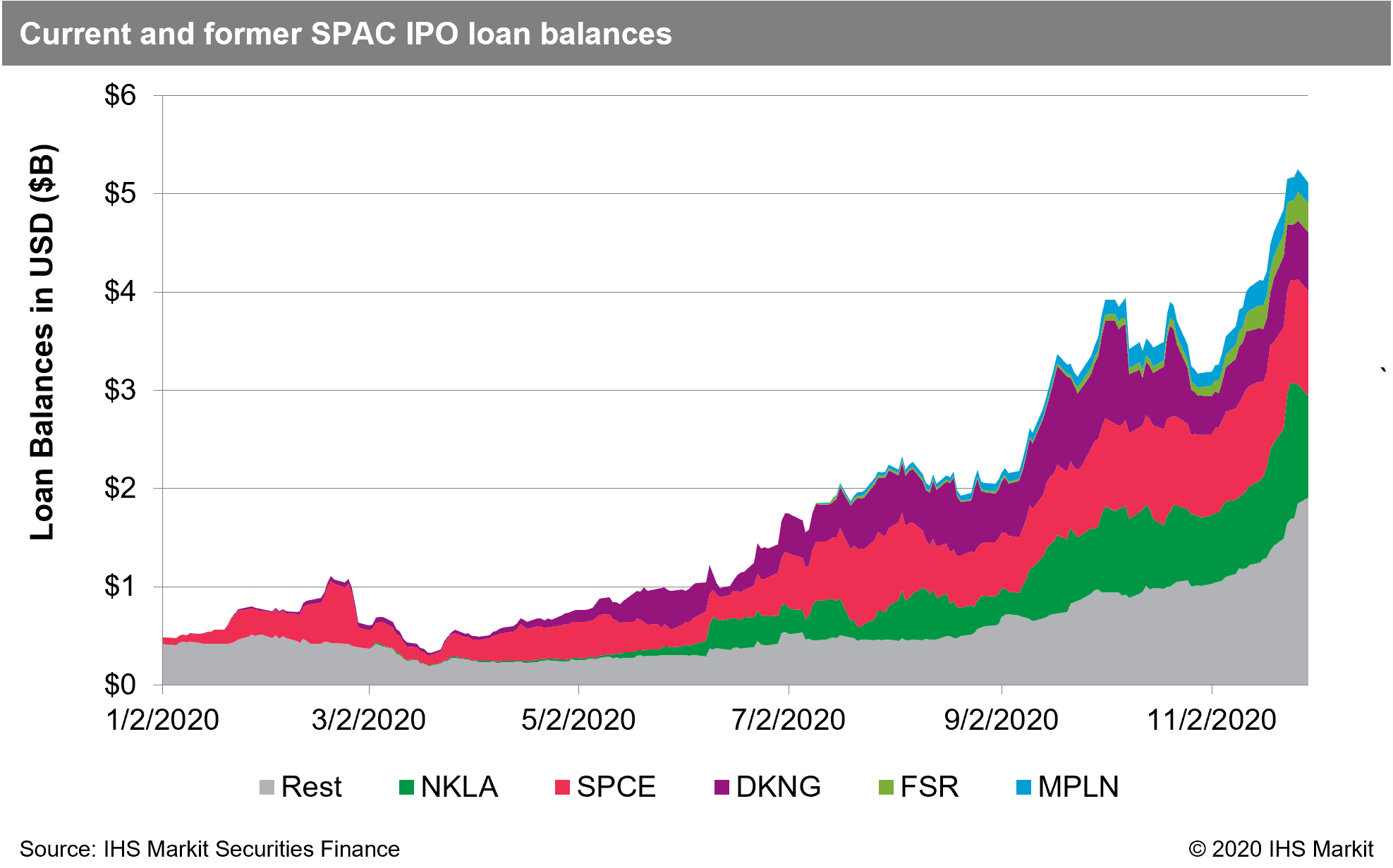

Former SPAC IPOs in the electric vehicle space delivered increased revenue in November; Workhorse Group and Hyliion Holdings were exemplary, with the surge in EV valuations and trading volumes driving increased lending revenue. Both pale in comparison with the $202m in YTD revenue generated by Nikola Motors, primarily relating to warrant arbitrage and lockup expiries. Utilizing the IHS Markit Situational Analytics dataset we aggregated all current and former SPAC IPOs to review the impact on overall US equity lending revenue. Excluding the impact of NKLA the YTD returns total $75M, 2.6% of US Equity revenue; The significance is increasing, with ex-NKLA SPAC IPOs contributing 10% of US equity revenues for the month of November.

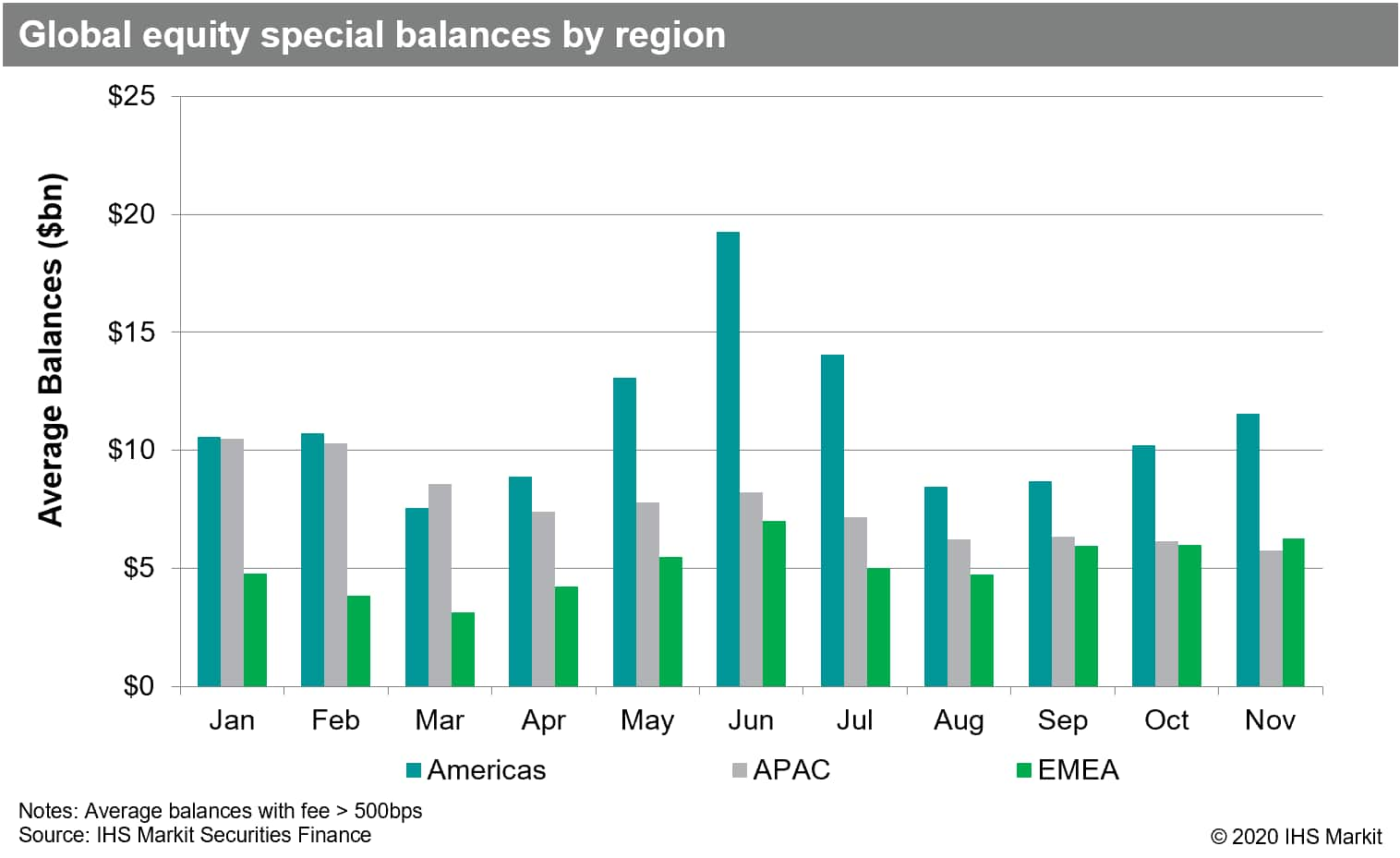

With further conventional and SPAC IPOs on deck, notably including the long-awaited Airbnb listing, it's likely that US equity returns maintain the current uptrend through December. US equity "special" balances, defined here as loans with a fee greater than 500bps, increased 13% MoM from an average of $9.8bn in October to $11.1bn in November (remaining well below the $18bn YTD peak observed in June).

Canadian equity lending returns increased 12.5% MoM but remain well below the YoY comparable, which has been the case since March. Cannabis related returns have declined steadily as increased issuance has translated to additional lendable shares and lower fees, while the recent share price rally in the sector drew in less of an increase in short positions than has been the case in previous Cannabis rallies. Canadian equity average specials balances increased by 15% MoM, but at $460m remain less than half the average observed over H1 2020.

European Equity

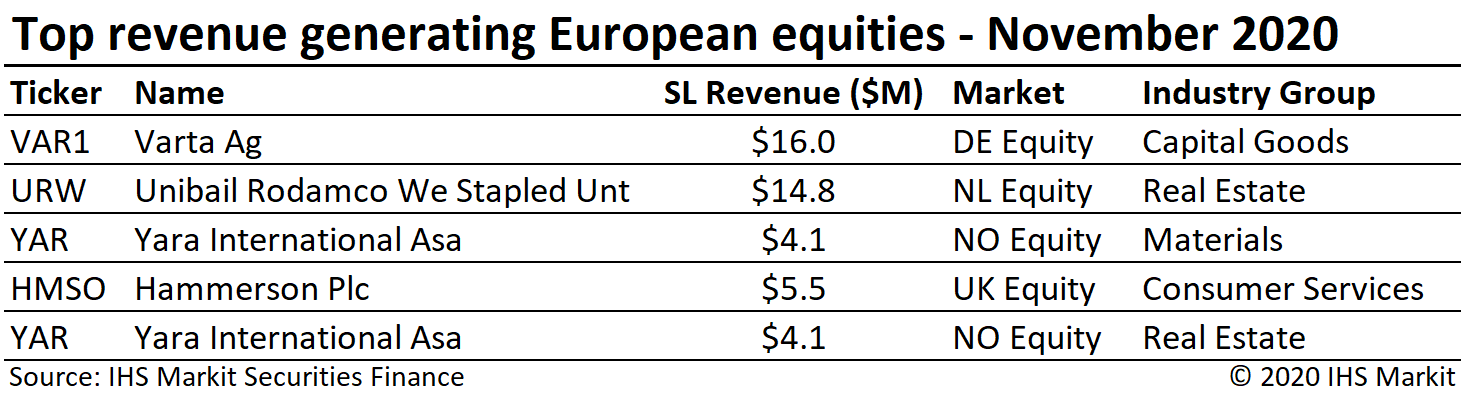

European equity revenue increased 25% YoY for November, following October where revenues increased by 17% YoY. The European upswing continues to be concentrated in relatively few equities though the revenue contribution did broaden slightly in November. The Hammerson Plc scrip dividend briefly made HMSO shares the most expensive to borrow in UK again (HMSO shares briefly held that title in September around the firm's rights issue). German equity lending revenues continue to be bolstered by Varta Ag, which delivered $16m in November revenue, the 4th consecutive month that the German battery maker was the top revenue generating security globally. German equity lending revenues totaled $29.4m for November, a 73% YoY increase and a 7% MoM decrease MoM; The decline relative to October was the result of declining borrow demand for Deutsche Lufthansa Ag and Grenke Ag.

French, Italian and Spanish equity revenues continue to lag YoY, with November revenues declining 36%, 35% and 17%, respectively. YTD European equity lending revenues total $1.3bn, a decline of 18.5%, however it's worth noting that each month starting with July has seen revenue increase YoY.

Asia Equity

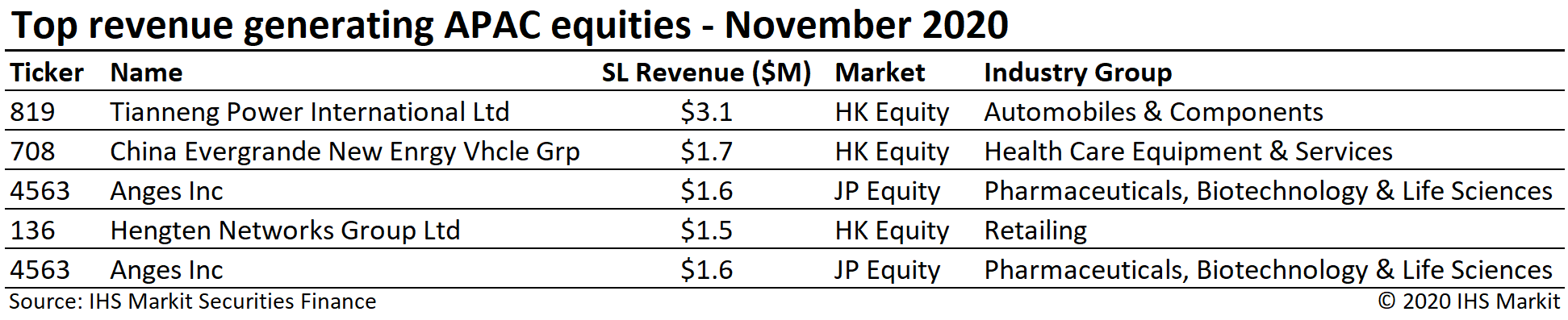

Asia equity lending revenues continue to fall short of 2019, with November revenues of $105m reflecting a 36% YoY decline, and the lowest monthly return YTD. The largest market, Japan equities, delivered $42.5m in November revenues, a decline of 32% YoY. Hong Kong equity lending revenues continued to trend higher in November with $26m in revenue reflecting a 3.5% YoY increase, extending the recovery from the YTD low point observed in September. The short sale ban in South Korea continues to limit lending revenue, with $8.8m in November revenue being the lowest for any month of 2020. Asia equity special balances began November at the lowest level since June 2014, $5.3bn, though they did increase 18% during the month. Asia equity revenues are down 24% YTD through November, with the gap widening in Q4 which is on pace for a 34% YoY decline.

Exchange Traded Products

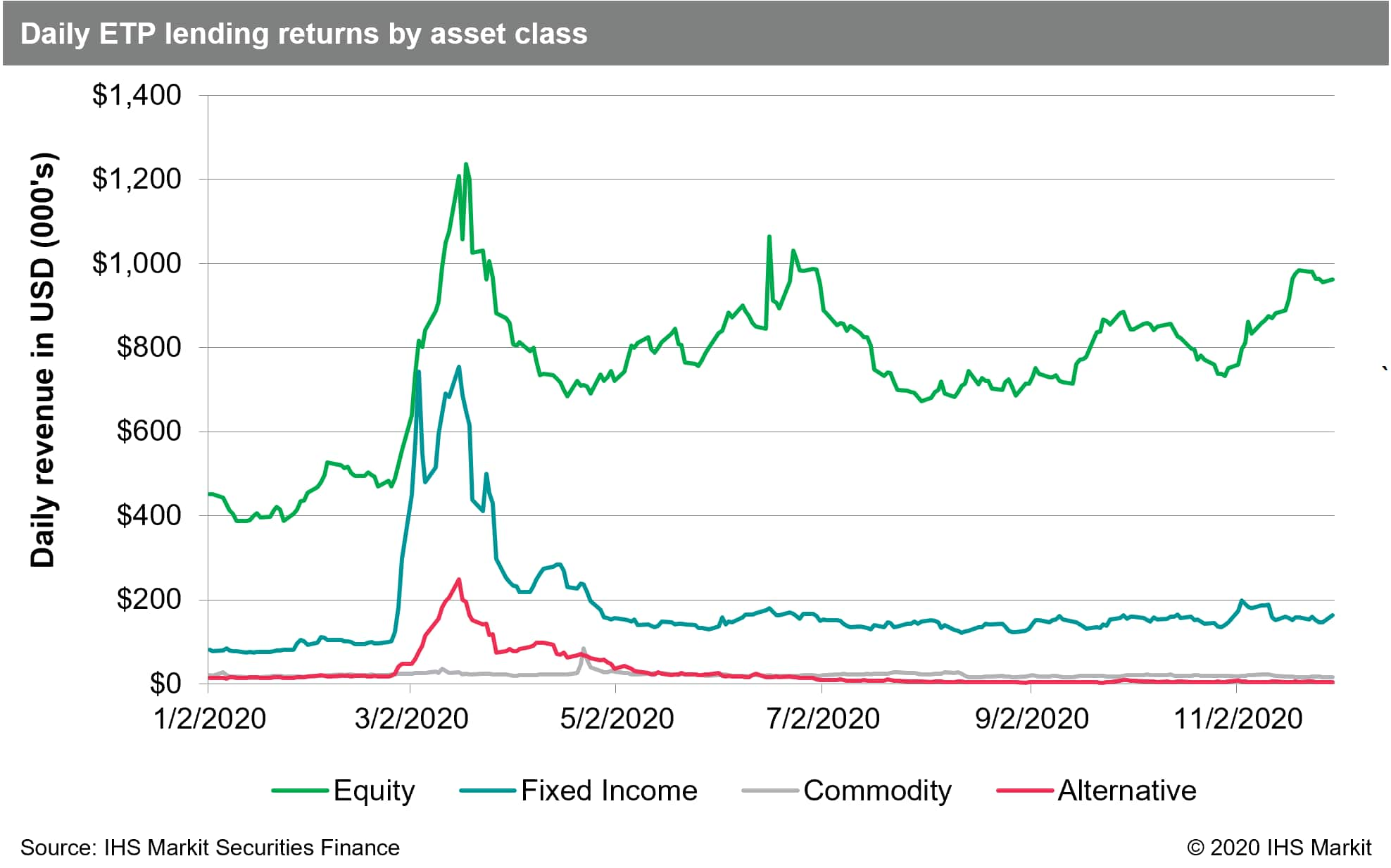

Global ETP revenues were $36m for November, a 72% YoY increase, however MoM increase only 9% compared with October. The $36m in November return was the most for any month since March, narrowly exceeding June. On-loan balances averaged $67bn, a 4% MoM increase though still well below the peak monthly average balance of $73bn observed in March. The recent upswing in ETP revenue has been primarily driven by equities, which generated 82% of November revenue, raising the YTD contribution to 76%, with high-yield and loans products having generated substantial returns in Q1.

Corporate Bonds

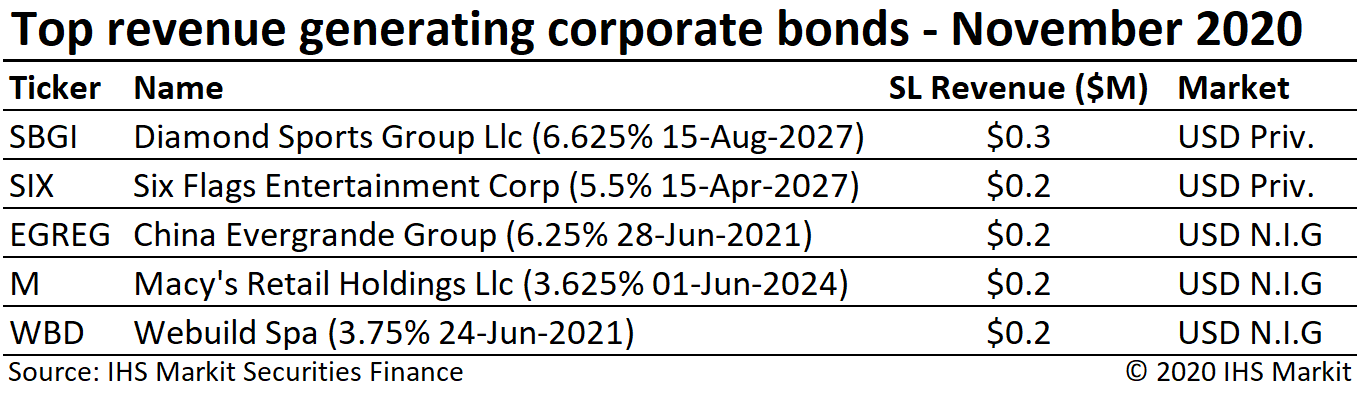

Corporate bond lending returns came in at $32m for August, a 25% decline YoY and a 2.7% MoM decline. Corporate bond lending revenues have been on a steady decline since the post-GFC peak in 2018. Central bank support for global credit has dampened borrow demand while lendable value has increased steadily since April, however October did see a 2% increase in average on-loan balances, $182bn, bringing balances at positive spreads to the highest level since February's $198bn. The IG and HY CDX indices widened during the last half of October, which combined with the uptrend in loan balances suggested an increase in market hedges; Loan balances continued to increase in November while the CDX indices narrowed to the tightest since late February, meaning the cost of credit protection is approaching the level observed prior to the COVID related market disruptions.

Government Bonds

Government bond lending activity has substantially returned to pre-COVID levels in terms of spread and reinvestment revenue. Global government debt lending revenues totalled $110m in November, a 4.7% YoY increase, however failed to build on the MoM growth in October and declined 2.5% MoM. Fee-based revenue for lending US government securities came in at $62m for November, a 13% YoY increase. Returns from lending European sovereigns were $37.2m for October, a 2% YoY decline and the first YoY relative underperformance since June.

Conclusion

Following a lackluster Q3, when global quarterly revenues posted the first double-digit YoY decline since Q2 2019, -13%, Q4 appears on pace to notch the second, with revenues down 11% QTD through November; However the uptrend in daily revenues throughout November suggests a better result is likely heading into December. In the October note we pointed out that returns equity finance derived long-short factors had bounced back per IHS Markit Research Signals. The relative underperformance of crowded shorts augurs well for many long-short equity strategies, so this development was most welcome as an indicator of future borrow demand for specials. While specials balances did increase in November that was partly the result of short squeezes, with the implied loan rate factor suffering substantially in Europe and US, reflecting pain on the part of directional short sellers in the more crowded positions. It is also worth noting that the most expensive to borrow APAC equity shorts markedly underperformed in November, which had the direct result of lowering specials balances but may in turn boost borrow demand for hard-to-borrow shares in the region.

Through the first eleven months of 2020 global securities lending returns of $8.4bn reflect a decline of 9.1% compared with the first eleven months of 2019, a result almost entirely driven by lower fee spreads; YTD average global loan balances increased by 3%. Revenues have been increasingly dependent on corporate actions and will likely remain so, with the pipeline of SPAC and traditional IPOs providing a baseline, which one-off deals and other marginal sources of demand may build on.

Stay tuned for monthly revenue snapshots from IHS Markit Securities Finance!

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-2020.html&text=Securities+Finance+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-2020.html","enabled":true},{"name":"email","url":"?subject=Securities Finance November 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+November+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}