Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jul 03, 2024

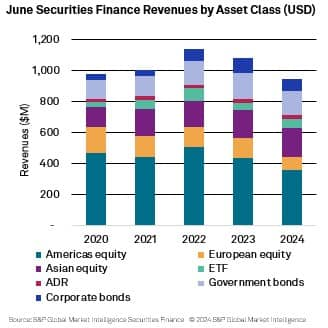

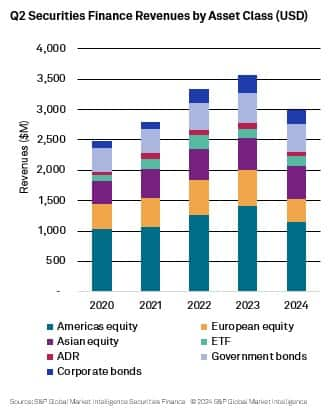

By Matt Chessum

In the securities lending markets, monthly revenues of $962M were generated. Average fees across all securities declined 16% YoY to 43bps with the largest declines seen across corporate bonds (-31%). EMEA equities continued to struggle as average YoY fees fell by 33%. As asset valuations continued to grow during the month lendable increased by 5% YoY pushing utilization lower by 7% YoY. During Q2, the securities lending market generated $3,068M in revenues and during H1 $5,816M of returns were produced.

In the equity markets, there were two bright spots during the month, Asian equities, and Exchange Traded Products (ETP's). Asian equity revenues grew by 5% YoY to $188M as Taiwan, Hong Kong, and Japan all experienced YoY increases in revenues with average fees across all three markets also observing rises. Average fees across all Asian equities grew by 5% YoY during the month to 111bps. EMEA equities offered a mixed performance during the month with revenues across certain markets such as South Africa (+45%), Belgium (+52%) and Spain (+58%) performing very strongly YoY but other markets that traditionally generate the strongest revenues such as France (-46%), Germany (-40%) and Sweden (-30%) all significantly undershooting their June 2023 performances.

ETPs had a strong month as both American and Asian ETPs increased YoY revenues by 30% and 32% respectively. Average fees also pushed higher across both asset classes increasing the average fee across all ETPs by 10% YoY (67bps). Average utilization increased to 10% (+3% YoY) as American assets saw double digit growth in balances.

Across the fixed income markets, a deterioration in YoY revenues continued, as the decline in average fees across both government (-13%) and corporate bonds (-31%) persisted. The trend of increasing balances and declining fees played out across the month which impacted revenues. Returns across Americas government bonds increased by 5% YoY to $104M (65% of total revenues) whilst YoY revenues declined across EMEA government bonds ($47M, -11%), Asian government bonds ($9M -2%) and Emerging Market government bonds ($6M, -33%). Average fees across corporate bonds remained steady during the month at 30bps. Despite average fees remaining elevated when compared to 2023, during the first half of the year, fees declined 25% YoY. Balances continued to increase across the asset class reaching a 2024 high during June, of $302.8B.

Activity within the securities lending markets remained robust during the month even though the revenue numbers may, at first glance, suggest a rather lackluster performance. Strong pockets of activity continued to appear throughout the market but the number of high value single special stocks that boosted market revenues during 2023 continued to fade. The market environment was not particularly conducive to strong securities lending activity during the first half of the year with unidirectional markets and low volatility, but heading into the second half of 2024, this appears to be changing. As interest policy starts to diverge across the globe and as increasing geopolitical risk starts to be consumed by equity investors, volatility is returning. It appears that equity markets maybe starting to wake up to the impact that upcoming political change may have on future economic growth and fiscal policy. As this realization increases heading into the second half of the year, it is possible that securities lending may be a strong beneficiary of this new dynamic.

SAVE THE DATE

Q2 Securities Finance Market Review

Our regular Q2 Webinar will be taking place on July 25th3PM UK / 10AM EST. During the webinar we will be sharing the most recent Q2 data, and we will have a guest speaker, Gesa Johannsen, Managing Director, Head of Clearance & Collateral Management International Business, BNY, who will be running us through the most recent trends, opportunities, and challenges in collateral management.

To register, please click HERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.