Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 08, 2020

Russian crude oil exports down while Libya could start recovering

OPEC+ countries announced their intention to extend their current production cuts of 9.7 million b/d for at least another month. Some producers have made deeper cuts than those agreed, while the compliance from Iraq, Angola, Nigeria and Kazakhstan has been rather poor. All did not reach their full commitment in May and June, and will have to compensate between July and September. Russia now predicts a shortage in the oil market in July, with the country's Energy Minister Alexander Novak expecting this shortfall to be between three and five million b/d. Overall, compliance reached 89% in May, with Iraq standing only at 42% of compliance.

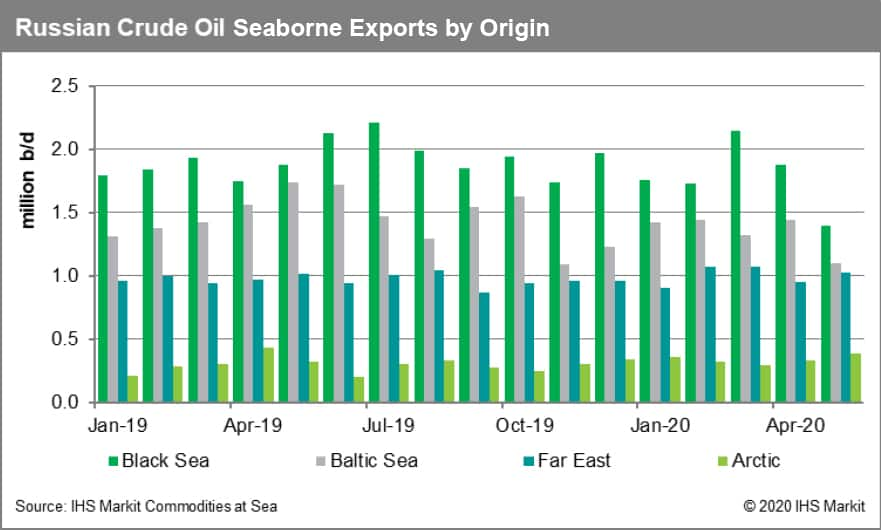

Russian seaborne exports of crude oil marginally fell below four million b/d in May, with volumes coming down 15% month-on-month and 21% year-on-year. Shipments from both the Black Sea and the Baltic declined by around a quarter versus April. Seaborne flows from the Russian far east haven't been affected.

Source: IHS Markit Commodities at Sea

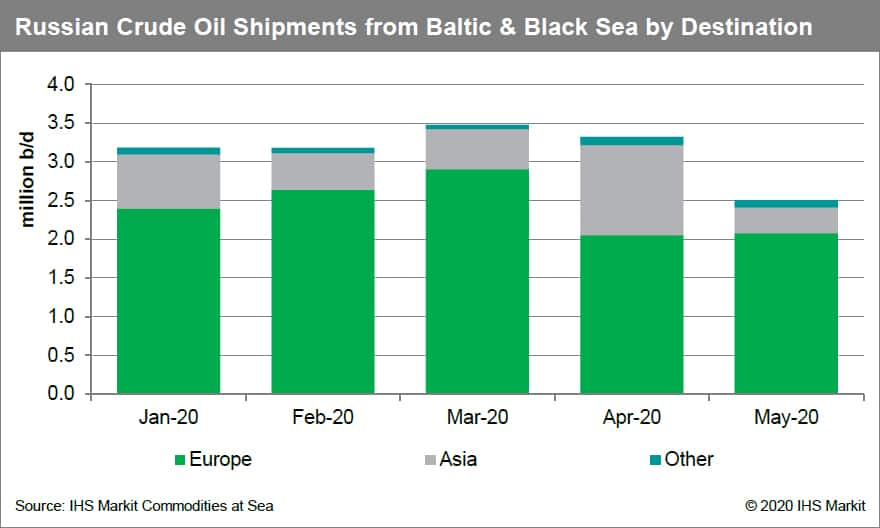

Crude oil flows from Russia Black Sea and Baltic Sea have been primarily targeting European destinations, but the volumes have remained close to two million b/d during the last couple of months, with demand having been sharply affected by COVID-19 and the general lockdown in most of the continent. Meanwhile, flows to China and the rest of Asia increased quickly in April, a trend which didn't last for long, with May flows not surpassing volumes shipped in first quarter of 2020.

Source: IHS Markit Commodities at Sea

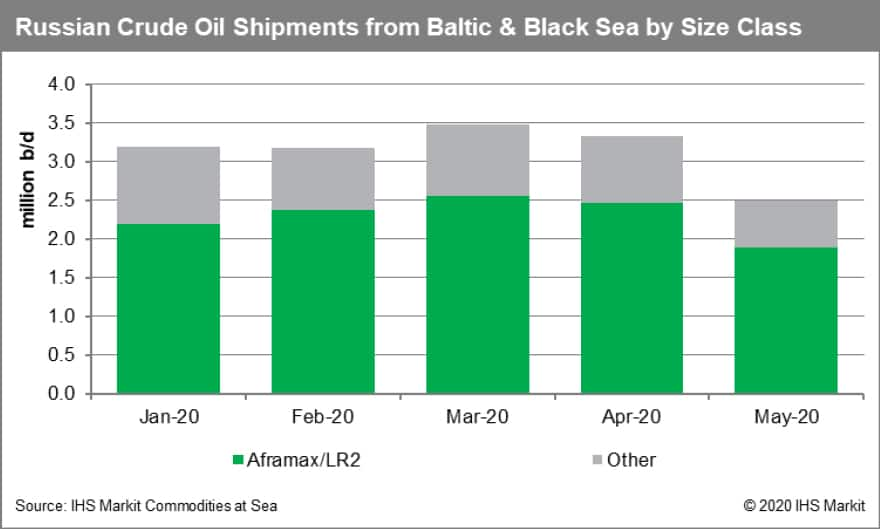

Focusing on shipping, Aframaxes have been hit by the decline in Russian crude oil production cuts, with shipments on the size class (including dirty LR2) down by 23.5% month-on-month in May.

Source: IHS Markit Commodities at Sea

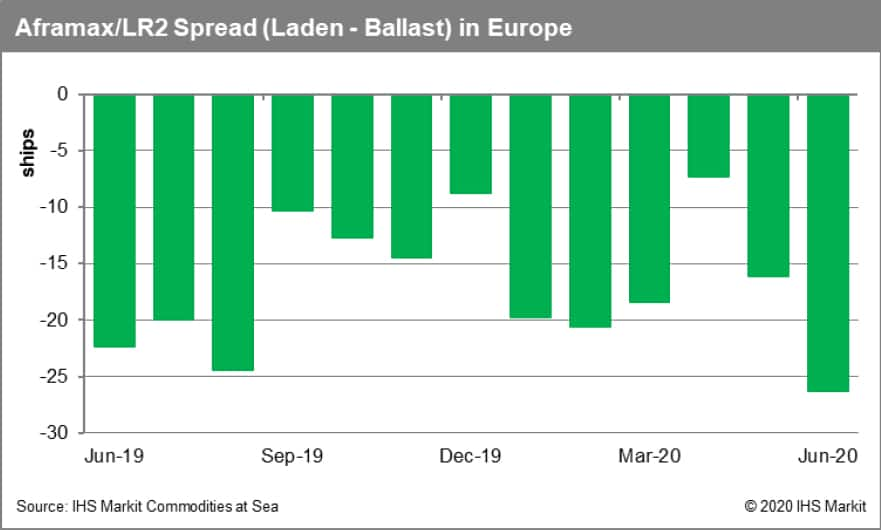

This has strongly affected employment for Aframax/LR2 in the continent, with the spread between laden and ballast units dropping to the lowest observed in last year, primarily due to the much lower cargoes to pick up from Russia.

Source: IHS Markit Commodities at Sea

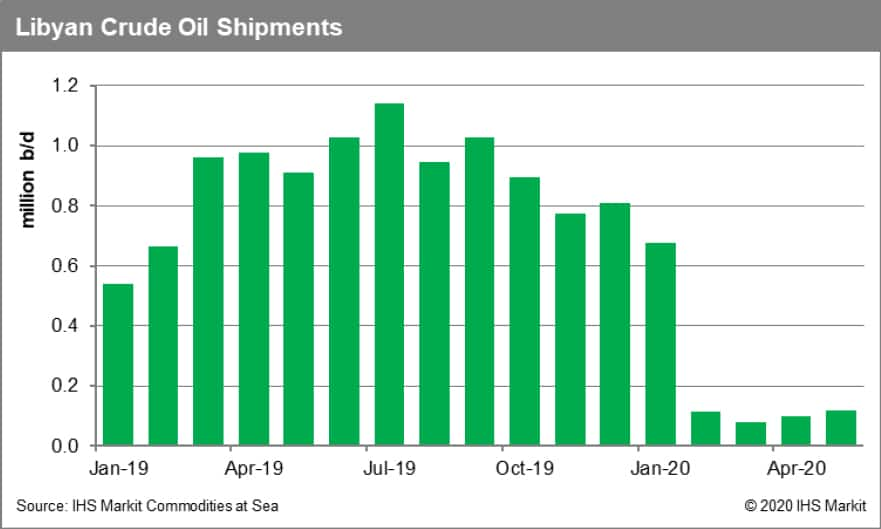

Russian flows to European destinations have been supported by Libya's absence as the country's production and exports of crude oil have collapsed since February. The civil conflict and the ongoing battle to determine which side will ultimately control the country's oil hasn't allowed Libya to recover and start exporting. However, its largest oilfield resumes production. El-Sharara oilfield can produce more than 300,000 barrels of crude oil per day.

Source: IHS Markit Commodities at Sea

The oilfield resumed production on Sunday, according to the National Oil Corporation (NOC), after long negotiations. Az-Zuwaytinah port was closed earlier this year by Khalifa Haftar's militia. Production will start at El Sharara with a capacity of 30,000 per day which could approach full capacity (above 300,000 b/d) within 90 days. This is roughly one third of the country's production. A complete restart at El Sharara and other oilfields could add nearly 400,000 b/d of production, while OPEC+ targets to keep production and exports as low as possible.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-crude-exports-down-while-libya-could-start-recovering.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-crude-exports-down-while-libya-could-start-recovering.html&text=Russian+crude+oil+exports+down+while+Libya+could+start+recovering+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-crude-exports-down-while-libya-could-start-recovering.html","enabled":true},{"name":"email","url":"?subject=Russian crude oil exports down while Libya could start recovering | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-crude-exports-down-while-libya-could-start-recovering.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russian+crude+oil+exports+down+while+Libya+could+start+recovering+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-crude-exports-down-while-libya-could-start-recovering.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}