Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 04, 2023

Our 2023 annual projections for Central Europe and the Balkans (CEB) show GDP growth decelerating across the region, amid tighter monetary policy and weaker external demand. Against these headwinds, EU funding inflows, including under the RRF, are expected to support fixed investments in several countries.

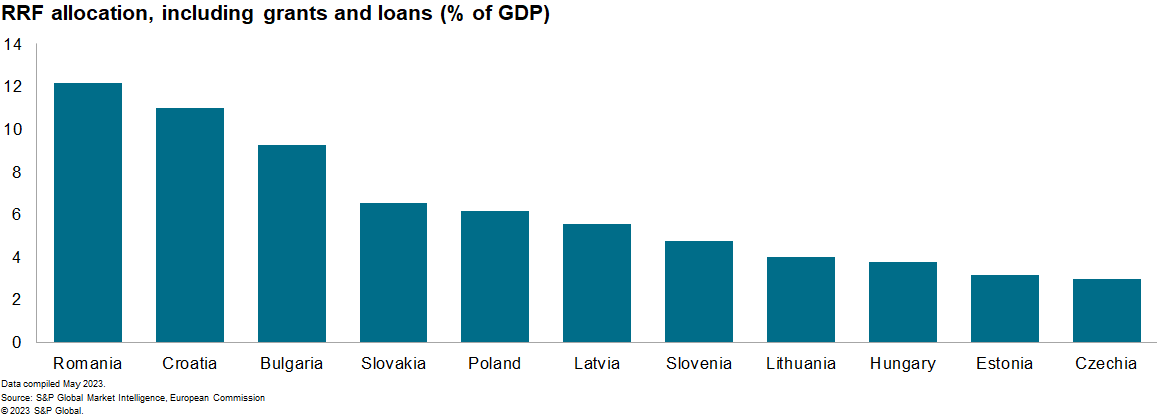

This support is quite substantial for Romania. The country's national RRF plan was endorsed by the European Commission in September 2021, amounting to EUR29.2 billion, or 12.2% of GDP, of which EUR14.9 billion are in loans and EUR14.2 billion in grants. The plan's estimated expenditure is mainly concentrated in green transition and digital transformation.

To compare with regional peers, Czechia's RRF plan was also endorsed by the Commission in late 2021 but amounts to a much smaller EUR7 billion in grants, or 3.0% of GDP. Given concerns around the rule of law, the Polish and Hungarian plans were endorsed only in 2022; disbursements under the facility remain suspended until these concerns are addressed.

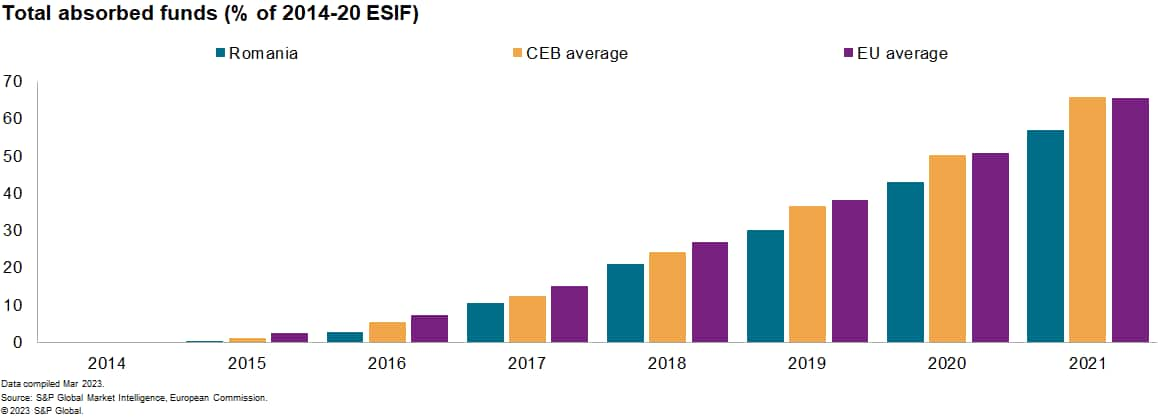

With vast funding available and absent a standoff on rule of law, Romania's poor track record of absorbing EU structural support represents its main challenge. In the 2014-20 budget period, the country's absorption rate for the European Structural and Investment Funds (ESIF) was consistently lagging the average for the EU and the CEB. As of the beginning of 2023, Romania still has around 27% of 2014-20 ESIF unclaimed.

The year 2022 experienced promising improvement on this front. Romania has so far absorbed nearly 22% of available RRF grants and loans, for the first time ahead of the CEB average of 16% and the EU average of 17%. Relative to the last budget period, a harsher macroeconomic environment is likely to have been a catalyst for accelerating the absorption of much-needed cheap funding.

Frequent and substantial data revision notwithstanding, 2022 saw the beginning of a shift away from consumption-led growth in Romania and towards an investment-led one. This transition is expected to continue in 2023 amid a contractionary fiscal policy and constrained household budgets, making forthcoming EU funding even more pertinent for this year's growth performance. However, unlocking further payments will be challenging.

Around EUR6 billion are earmarked to be claimed this year, which would take the absorption rate up to 42%. Of this, EUR3 billion represent the second payment request submitted at the end of 2022. To unlock the payment, Romania has until mid-June to fully transpose into national law the EU Whistleblower Directive, legalize the closure of coal mines, and remove scope in the decarbonization law to keep coal units open on grounds of "an energy crisis." With time running out, it is becoming increasing likely that a partial disbursement will be received for the milestones met.

The disbursement of the third payment request, representing the remaining EUR3 billion, is even more uncertain as it is linked to legislative changes to the country's pension system, an issue that lacks consensus in the ruling coalition. To meet the milestone, Romania needs to reform the special pensions provision which effectively reduces retirement age. However, the submission of this legislation in parliament is likely to overlap with the upcoming prime ministerial transition (planned for May/June), complicating matters further. A watered-down reform, unlocking some of the payment with delays, is likely but Romania's political challenges could derail progress further.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.