Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 28, 2022

Regulatory Spotlight: Corporate Sustainable Due Diligence Directive

The CSDD will significantly change the way many Corporates and Financial Institutions look at their entire supply chain. In particular, it will impact how they deal with due diligence on their suppliers, specifically from a Human Rights and Sustainability perspective.

We've highlighted some of the key questions and answers needed in the context of third party supplier management:

What is it?

The CSDD aims to foster sustainable and responsible corporate behavior and anchor human rights and environmental considerations in companies' operations and corporate governance. The initial request for this directive came from calls from a broad range of stakeholders looking for mandatory due diligence rules. 70% of the respondents to public consultation sent a clear message: action on corporate sustainability due diligence is needed.

Specifically, CSDD introduces mandatory due diligence obligations on human rights and environmental impacts with the main objective to foster sustainable and responsible corporate behavior in companies' operations. Also, Member States will designate an authority to supervise and impose effective, proportionate, and dissuasive sanctions and compliance orders. Furthermore, they will ensure that victims get compensation for damages resulting from any failure to comply

The most important part of the proposed directive remains in the due diligence section. Ultimately, firms will now have a corporate due diligence duty to identify, mitigate and account for any negative human rights and environmental impacts in their own operations, or those of their subsidiaries and value chains.

Who is in scope?

Approximately 13.000 companies inside the EU and approximately an additional 4,000 companies incorporated outside the EU are in scope.

Companies incorporated in the EU

Companiesincorporated outside of the EU

Why is CSDD Important for TPRM?

Firms will have to perform Due Diligence on their entire chain of suppliers. Developing such a due diligence approach is complex and executing it is operationally time-consuming.

In short, and from a TPRM perspective, firms' high-level due diligence requirements will be impacted in the following ways:

Interaction with other frameworks?

The directive aligns or ties into a diverse range of other (local) frameworks. As a first important example, it aligns with Human Rights Due Diligence (HRDD) process described in UN Guiding Principles, pillar II (UNGP) and OECD guidelines (2011) and guidance (2018). Also, Some European territories already have similar frameworks in place such as France, the Netherlands, Germany, and Norway.

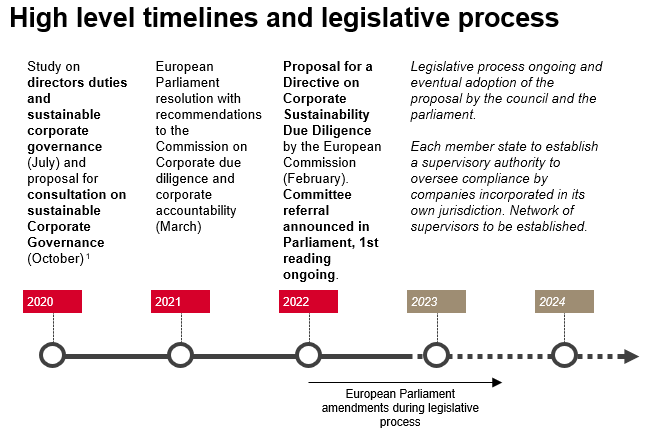

What's the status of the regulation?

The Directive is currently in the proposal phase. See below indicative timelines (based on S&P's interpretation of the legislative process in the EU).

Disclaimer: based on understanding as of October 5, 2022. For indicative purposes only.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.