Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 04, 2019

IHS Markit European GDP Nowcast

Update 4th September 2019:Underperforming PMIs raise UK recession risk

In July 2019 we introduced two nowcasting models for the eurozone and the UK. The models utilise a range of data widely used to track economic developments and provide timely estimations of quarterly GDP growth.

As the datasets include information provided from business surveys, official statistics offices and the financial markets, there is a steady flow of new data available to us during a quarterly nowcasting cycle. With our model frameworks comfortably able to incorporate this new information in a statistically efficient manner, this calls for regular, real-time, nowcast updates which we present in this new report.

Alongside the nowcasts for the eurozone and the UK, we have also been able to extend our coverage to include updates for France, Germany and Italy.

Summary: 4th September 2019

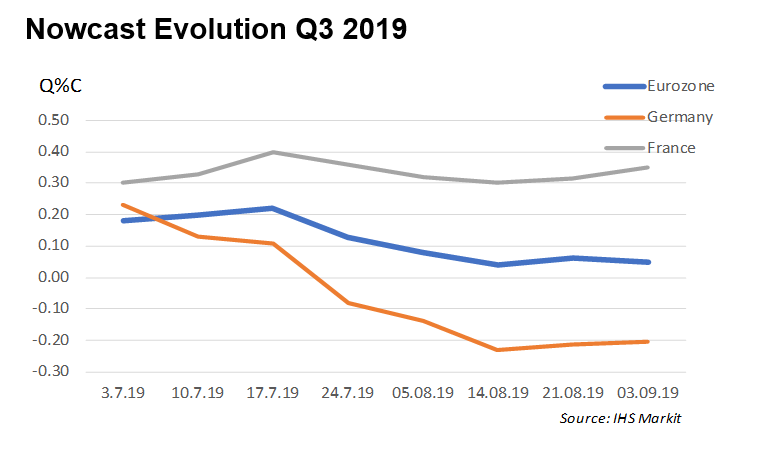

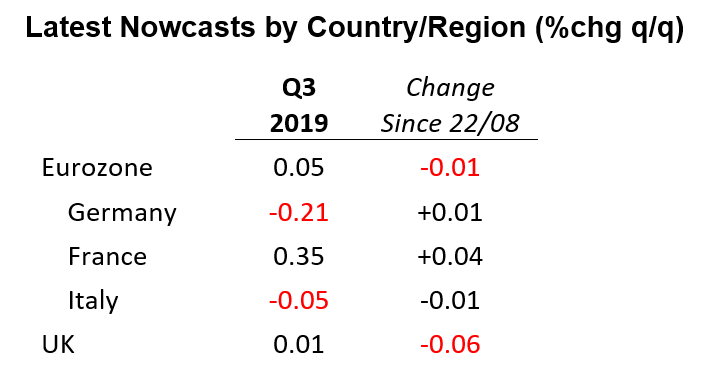

According to our latest nowcasts, which include the release of August PMI data, there remains notable growth divergences in the euro area, whilst the risk of recession in the UK is rising ahead of the upcoming Brexit deadline of 31st October.

Reflecting weaker-than-expected PMI readings across manufacturing, services and construction indicators, as well as soft business and consumer confidence data, the early September nowcasts suggests a stagnant UK economy in the third quarter of the year. Whilst uncertainty is elevated given the fluidity of the Brexit process, the sharp downward revision to the nowcast since our last update (+0.07%, to +0.01%) points to an economy clearly losing steam midway through the third quarter.

Meanwhile, the picture across the channel remains little changed, with the euro area expected to show some marginal growth in the third quarter (+0.05%) but with vastly different trajectories for its two biggest member states.

Supported by a strongly performing domestic economy and improving labour market, France is forecast to expand at a rate of 0.35% in the third quarter. That contrasts sharply to Germany, where the economy is contracting at a rate of -0.21%, based on latest data.

Output in Germany is being driven lower by a sharp industrial downturn, with signs of infection spreading to the domestic economy. This week's July data for industrial production and factory orders will go some way to providing greater clarity on the likely scale of any third quarter contraction, with any positive surprises in the data especially welcome given the persistently gloomy newsflow seen throughout much of the current nowcasting cycle to date (see chart below).

Joe Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

Paul Smith, Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-european-gdp-nowcast-040919.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-european-gdp-nowcast-040919.html&text=S%26P+Global+European+GDP+Nowcast+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-european-gdp-nowcast-040919.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcast | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-european-gdp-nowcast-040919.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcast+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-european-gdp-nowcast-040919.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}