Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 12, 2024

By David Owen and Jingyi Pan

The impact from the Red Sea crisis on manufacturing supply conditions remained especially pronounced in Europe according to the latest February PMI data, whereby Comment Trackers showed increasing degrees of disruptions in several countries.

While the overall ramifications on global supply chains appear contained in February, detailed sector data revealed divergences by sector and regions. Sectors such as chemicals and beverage & food products notably continued to see a worsening of delivery times.

Here we examine the implications of the latest Red Sea crisis on supply conditions across various sectors and go further into looking at demand conditions to assess the near-term output and price trends.

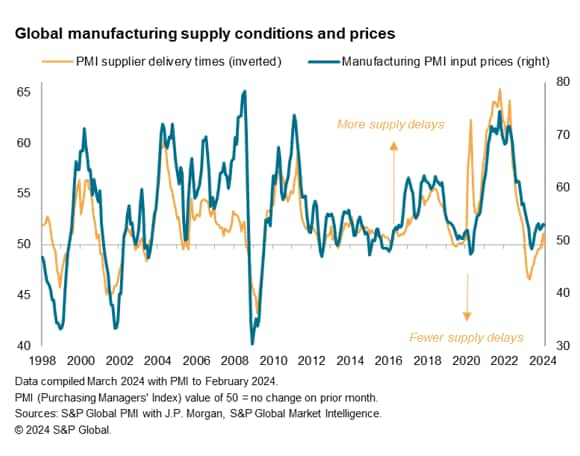

February PMI data revealed that average global supplier delivery times shortened marginally after having lengthened for the first time in a year in January. The January lengthening had been to a large degree driven by shipping delays, in turn linked to the rerouting of vessels around Africa to avoid Yemen-based Houthi militant group attacks in the Red Sea, en route to the Suez Canal. The February data therefore point to no worsening of supply delays after the disruptions seen in January. However, digging into the February data reveals that attacks on ships in the Red Sea continued to have a substantial impact on certain supply chains, and to a greater degree across several countries when compared to January.

This more detailed analysis can be shown by PMI Comment Tracker data, which tracks keywords in companies' qualitative survey responses to measure a number of global thematic trends. Here, we saw increased mentions of the Red Sea crisis among firms reporting a lengthening of delivery times, especially in Europe where the impact had also been the most severe during January.

At the country level, the UK was once again the worst impacted by the Red Sea crisis, with 14% of companies seeing lead times lengthen as a direct result of Red Sea related factors, up from 12% in January. Delays also reportedly worsened in countries such as Greece, Italy, and Spain, whereas Germany was the only European country indicating that supply disruptions had eased.

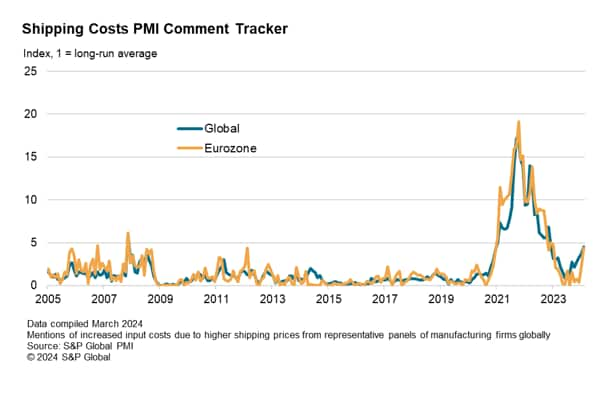

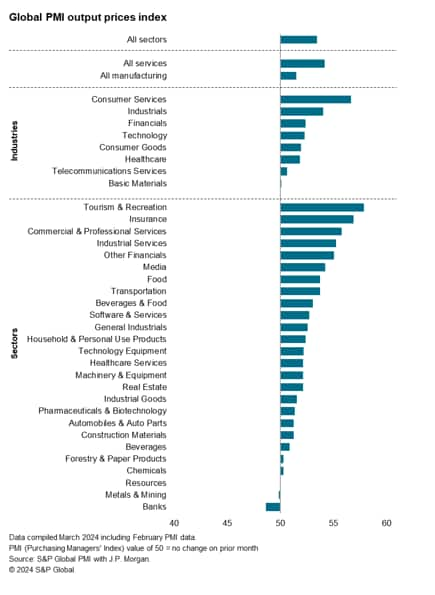

As well as facing delivery times delays, manufacturers also indicated an increase in shipping costs in February as freight rates adjusted higher due to the longer routes taken, notably via increased fuel costs. The PMI Comment Trackers revealed that global shipping price pressures were at their highest since December 2022, accelerating particularly rapidly in the eurozone. The data therefore suggest that manufacturers are seeing renewed shipping rates feed through into their input costs, which could start to reaggravate the inflationary environment.

Concurrently, manufacturers' input costs rose at a rate little changed from January, reflecting that costs have yet to rise more quickly on a global scale against initial fears of protracted impact from the Red Sea crisis. That said, Comment Tracker data again come in useful here to show that easing wage inflation likely helped to offset higher shipping cost inflation in February. As such, any further increase in shipping prices still needs to be monitored for passthrough to overall input costs, especially during a period when we are seeing nascent improvements in global goods demand, as shown by the first rise in Global Manufacturing PMI New Orders Index since mid-2022.

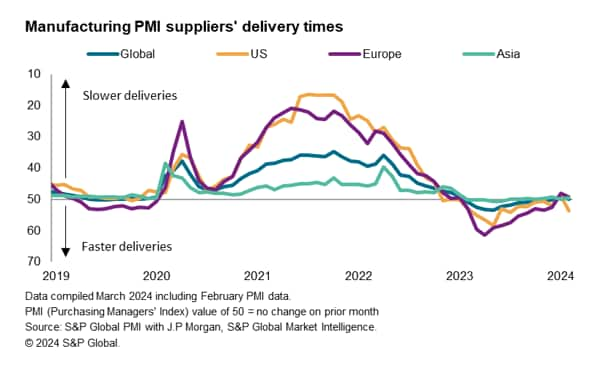

As with January, the focus is on Europe as far as the Red Sea crisis is concerned. Regional PMI data again showed that Europe was the region that experienced the most extensive delays when compared with the US and Asia. European lead times for goods producers lengthened for a second successive month, marking only the second time that delivery delays have been observed in the past 13 months. This is while manufacturing new orders in Europe remained in contraction territory, thereby emphasising the impact of the Red Sea disruptions on the supply chain.

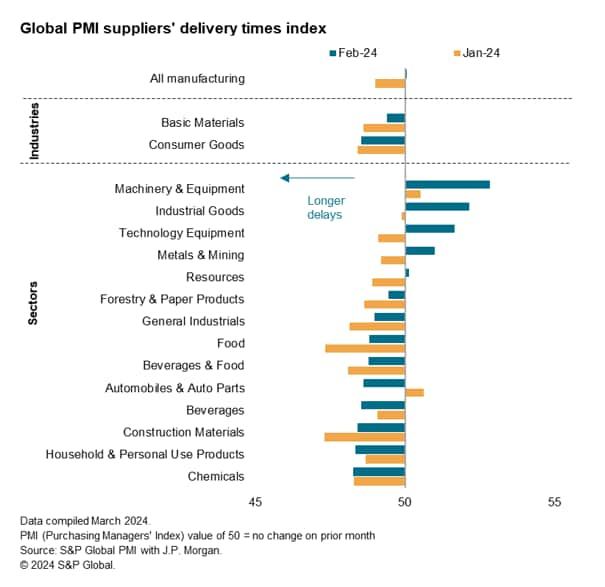

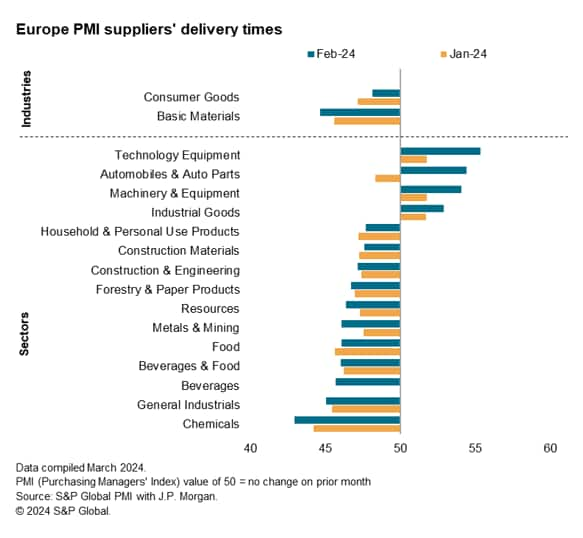

In addition to country PMI data, sector PMI data, developed for 34 sectors across three tiers of detail, provide a unique window into studying various economic trends. In the pursuit of examining delivery delays in February, we can sieve out the manufacturing sectors to look at the change in lead times in February.

The latest sector PMI data showed that the chemicals sector replaced construction materials as the sector facing the most pronounced deterioration in vendor performance. The food sector notably also experienced further delays in February, though the good news was that the rate at which lead times lengthened eased from January.

The same may not be said about the beverage sector, which saw lead times lengthen at a more pronounced pace in February. Automobiles & auto parts was another sector that experienced a worsening of conditions, with lead times lengthening in February after improving marginally at the start of the year.

Tuning to detailed sector PMI data by regions, which we have for three regions - namely the US, Europe and Asia, we can look further at the impact from Red Sea disruptions on European businesses.

In line with the global picture, the chemicals sector was the most badly affected in Europe. It is also worth mentioning that, despite new orders falling at the slowest pace in nearly two years at European chemicals companies, output declined at a quicker rate in February, validating prior warnings from chemicals producers regarding near-term production challenges stemming from Red Sea disruptions.

Besides the chemicals sector, various other sectors such as general industries, beverage & food and metals & mining all saw lead times worsening at more aggravated rates in February across Europe, and will therefore need to be monitored for the impact on output and prices in the coming months.

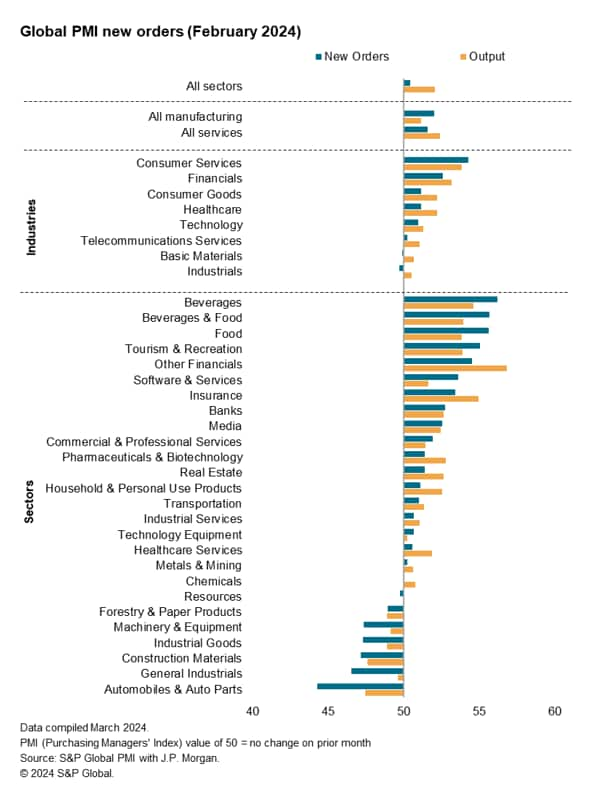

While the PMI Suppliers' Delivery Times Index may be helpful in gauging the extent of the impact of the Red Sea crisis, another important PMI sub-index often watched in conjunction with other indicators will be the New Orders Index. Here, the seasonally adjusted New Orders Index can be examined for the changes in demand conditions to thereby gauge the extent to which supply conditions may be further tested in the near-term, in addition to the potential impact on prices.

Diverging new order trends between the beverage & food sector and the chemicals sector make for a good case study in February.

Focusing on the beverage & food sector, they have been among the sectors to experience the most pronounced lengthening of lead times globally, while simultaneously seeing costs on the rise. Given that this took place against a backdrop of rising demand, with beverage & food seeing the fastest rise in new orders among manufacturing sectors, firms were able and also keen to pass on rising costs to their clients, leading to an elevated increase in output prices in February. This rising inflation trend was already highlighted last month observing PMI sub-indices data and remains one to be monitored given the potential impact for headline consumer inflation.

In contrast, the chemicals sector - while being one to see input costs rise at the fastest pace in 16 months, stemming from Red Sea disruptions - had only registered a marginal increase in output prices. A near-stagnation of incoming new orders in February led to chemicals firms being conservative with raising selling prices. One watching the price trends here should not be surprised if output prices eventually rise should chemical manufacturers become unable or unwilling to absorb further cost increases. However, for anyone concerned with chemicals sector output, the risk is that any further increase in costs in the short-term may further erode demand and thereby affect output.

Overall, the New Orders Index also has leading-indicator properties compared to the headline PMI and can help to identify where output is expected to rise in the near-term barring supply disruptions, supporting analysis of sector trends.

Access the Global Sector PMI press releases here.

David Owen, Economist, S&P Global Market Intelligence

david.owen@spglobal.com

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.