Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 25, 2024

By Chris Rogers and Eric Oak

Learn more about our data and insights

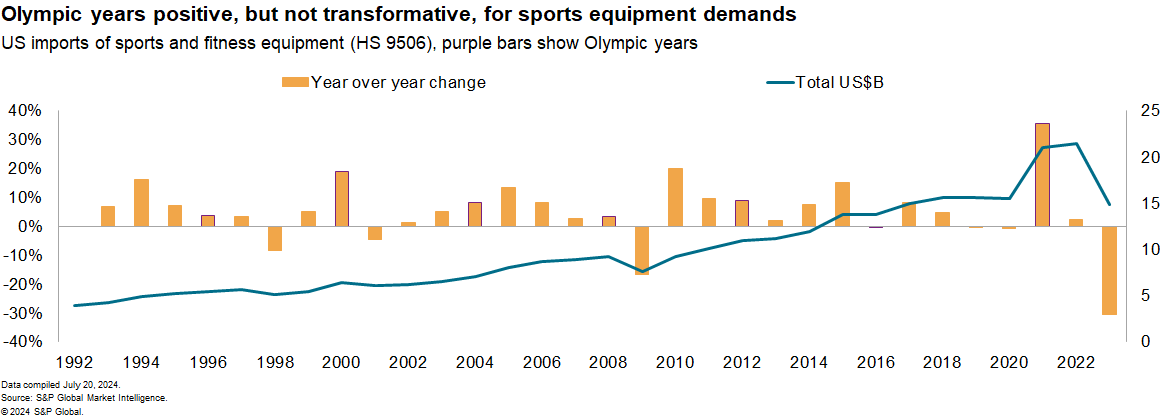

The Olympic and Paralympic Games Paris 2024 from July 26 onward represent the peak of a four-yearly cycle of sports promotion, with the Olympic organization's charter including the promotion of sports for all. A general downturn in global trade in sports goods suggests a new round of inspiration for sports and fitness activities is needed. From a peak of $20.97 billion in 2021, US imports of sports products fell to $14.85 billion in 2023.

Shipments historically increased in Olympic summer games years, rising an average 11% year over year between 1992 (Barcelona) and 2021 (Tokyo) while non-Olympic years rose by just 3% on average. However, the spread in performance is much closer when excluding Tokyo and the period since due to the distorting effect of pandemic-era consumer spending.

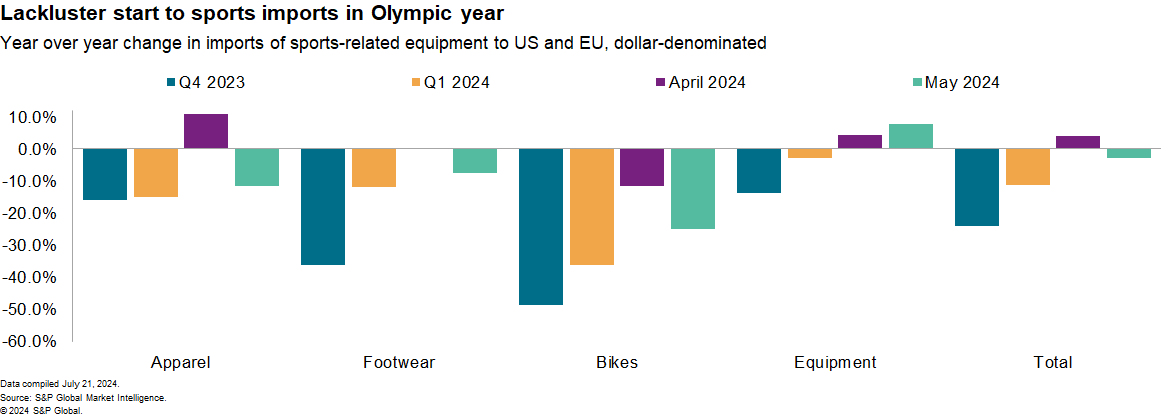

So far in 2024, US and EU imports have been lackluster, with shipments having fallen by 11.3% year over year in the first quarter, with a small increase of 3.1% in April being followed by a 2.9% dip in May. EU imports of sports apparel jumped 22.8% year over year in April, which may reflect a mixture of merchandise for the Olympic Games as well as an influx of replica shirts for the Euro 2024 soccer championships.

Triathlon equipment

The widest range of equipment, and toughest athletes, can be found in the triathlon events with swimming gear including wetsuits, dedicated tri-suits, bicycles and accessories and high-end running shoes.

Many of the high-end wetsuits used by both elite and amateur athletes are produced locally on a small basis relative to the global apparel sector. For swimwear more broadly there are signs of a decline, with total US and EU imports of all gender-styles of swimwear down by 9.4% year over year in the first five months of 2024. Swimwear shipments are also highly seasonal, peaking in March to supply spring and summer season retail lines. There's also some evidence of a slightly later peak than normal, potentially reflecting delayed deliveries from key production centers in Asia.

Shipments of bicycles continued to decline, falling by a double-digit amount for both the EU and US combined due to weaker demand linked to the post-pandemic boom and elevated interest rates for what can be expensive products. The cycling sector has also been through a pandemic-era boom thanks to smart-trainers, an evolution of traditional indoor roller systems to include magnetically controlled resistance trainers with app connectivity.

The final stage of the Olympic triathlon, the 10-kilometer run, benefits from many of the technological advancements experienced by the running sector more broadly, including the emergence of new brands. Most of the major running sports-focused brand producers have significant sourcing from Vietnam, with signs of a recovery in the second quarter of 2024.

Vietnam has come to dominate the production of sport shoe production, accounting for 62.4% of imports in the first five months of 2024, up from 54.9% in the same period of 2022. Those gains have been at the expense of shipments from mainland China and Indonesia.

Regional shifts and reshoring opportunities

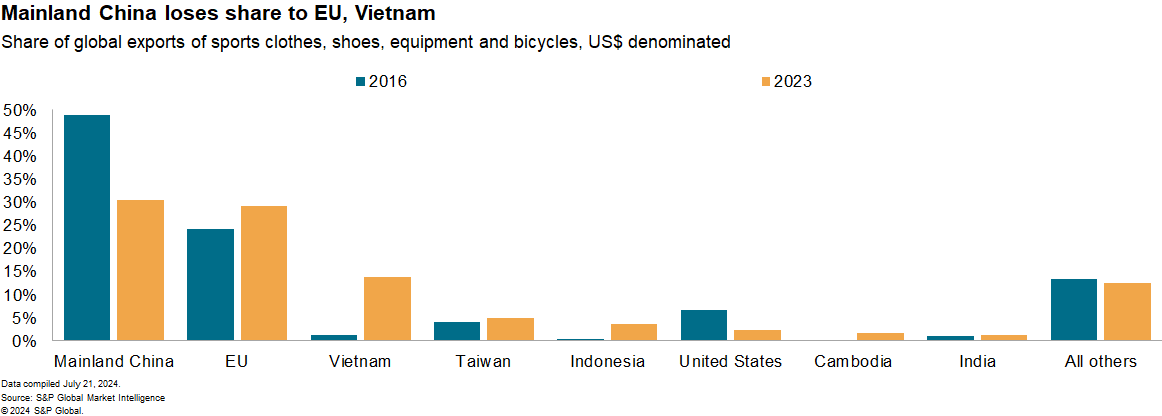

In common with many other industries, the sporting goods sector has been through a marked supply chain restructuring over the past 10 years. Mainland China's share of global exports of sports apparel, footwear, bikes and sports equipment fell to 30.4% in 2023 from 48.9% in 2016.

As with many other assembled goods, Vietnam has been the biggest winner from reshoring with its share rising to 13.8% from 1.2%, with gains across sports footwear and apparel. Indonesia also experienced a gain to 3.7% from 0.4%, largely focused on footwear.

The EU has also gained, with a share rising to 29.1% from 24.2%, with gains across apparel, footwear and equipment potentially reflecting reshoring to eastern Europe and a growing importance of high-end brands where labor cost is less of a defining factor.

Sports clothing supply chains are more fragmented. Looking specifically at dedicated sports clothes (as opposed to dual-use fashion products such as t-shirts and shorts) there are two tiers of supplier countries.

Global centers that account for similar shares of EU and US imports include those in mainland China (29.6% of the two regions' imports combined), Vietnam, India, Bangladesh and Cambodia. Manufacturer scale, cost and operational stability are likely driving factors for supply chain decision-makers.

The second tier is more regionally focused. For example, Mexico accounts for 11.4% of US imports but just 0.05% of EU imports, while Tunisia accounts for 8.9% of EU imports and 0.2% of the US. That likely indicates the importance of geographically short supply chains, particularly for more seasonal or fast-evolving product lines where timing matters.

Such sourcing decisions need to be dynamic. In the case of Bangladesh, recent student strikes come on top of earlier protest risks, which may make the country less desirable for future sourcing decisions. Reshoring away from Bangladesh may also provide new opportunities for regional centers to diversify their exports, for example, Morocco to North America or Mexico to Europe. Yet, labor costs and tariff risks will also need to be borne in mind when picking a team for the next Olympic clothing lines.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.