Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 20, 2023

The prospect of draft limitations being extended well into next year on the largest ships able to transit the Panama Canal has ocean carriers privately questioning the long-term viability of a waterway that still handles the majority of containerized cargo from China and other North Asia countries into the North American East Coast.

Carrier executives and others tell the Journal of Commerce that draft limitations imposed due to a shortage of rainfall needed to flood the lock chambers that carry deep-draft ships over the Isthmus of Panama are creating a more difficult economic rationale for the so-called all-water route to the East Coast.

As much as 10 to 15% of a vessel's capacity is unavailable to be filled due to the reduction implemented in May in the permissible draft of neo-Panamax ships from 50 feet to 45.5 feet, which was later further revised downward to 44 feet. Carriers are thus denied the ability to fully fill or profile their ships at a time when freight rates have plummeted off their pre-pandemic highs while many elements of cost remain stubbornly high.

"Measures taken will be maintained for the remainder of this year and throughout 2024, unless weather conditions change significantly from current forecasts," the Panama Canal Authority said on Sept. 5

Despite many previous impositions of draft restrictions, the duration of this episode is giving carriers pause.

"With severe drought causing such restrictions — now set to be in place for at least another 10 months — the critical question must be asked of whether carriers operating neo-Panamax containerships through the canal have the patience or commercial fortitude to accept suboptimal load factors indefinitely," James Caradonna, vice president at MCL-Multi Container Line, wrote in the company's most recent client alert.

The draft restrictions are being kept in place despite rising water levels in Panama's Gatun Lake, which feeds the locks, and the canal authority's own forecast that the upward trend will continue for the remainder of the year. To ocean carriers, that indicates that the canal's concerns about water levels will remain front and center as the country enters its traditional dry season that will begin late in the year and last through mid- 2024.

Since the draft restrictions were first imposed earlier this year, container ships have seen minimal delays due to their cargo being valuable enough to enable carriers to afford reservation slots to transit the canal. Carriers tell the Journal of Commerce that delays have been three days at most, while bulk carriers have had to wait for 15 days or more. Thus, there have been minimal delays to containerized supply chains due the issues at the canal.

With overcapacity now the norm in the trans-Pacific, carriers have not hesitated to slow their ships en route to the canal so as not to wait at anchor for a transit slot.

Draft restrictions at the canal aren't new. Since completion of the second set of neo-Panamax locks in 2016, the canal has issued draft restrictions at some point during four of its seven years operating the new locks, Caradonna said.

"In fact, seasonal periods of low water in the canal are nothing new, but now that this has become an almost annual challenge, it becomes more difficult to imagine any sustained normalization of draft at or even close to the third locks' designed depth of [60 feet]," he said.

The Panama Canal forecasts water levels in the Gatun Lake will rise from 79.8 feet as of Tuesday to more than 81.5 feet by late November. The historical average is 83.94 feet. But with the traditional dry period starting late in the year and continuing through the spring, the canal authority is clearly thinking ahead to what could be a difficult start to 2024.

Longer-term, Caradonna said, draft challenges at the Panama Canal "could mean more services diverted or restructured to route through the Suez Canal."

But with China still accounting for 60% of total US containerized imports from Asia and the Panama Canal the preferred route for those volumes into the East Coast, diverting sizable volumes through the Suez will inevitably be a challenge.

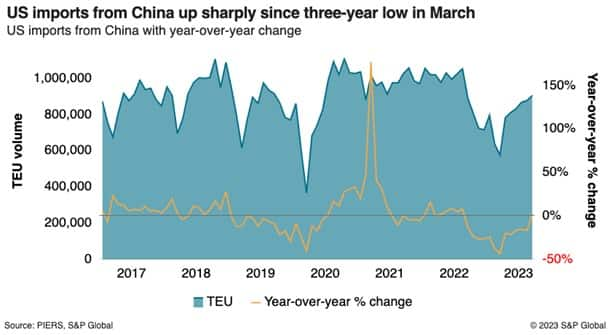

US imports from China have risen sharply since falling to a three-year low in March. Imports of 895,296 TEUs in August were up 55% since March, although still down 15% year over year, according to PIERS, a sister product of the Journal of Commerce within S&P Global.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?