Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Dec 20, 2021

Research Signals - December 2021

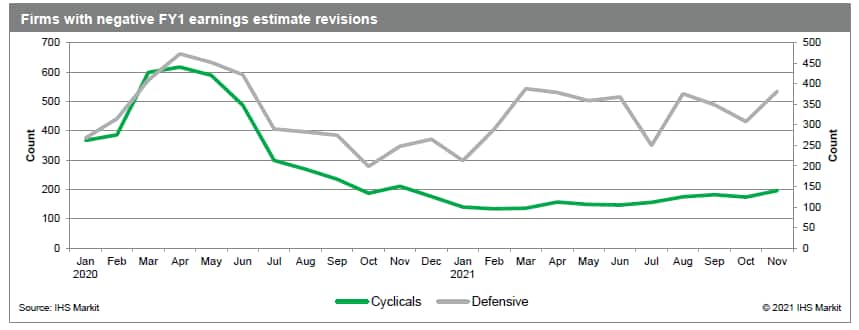

At the conclusion of the two-day policy meeting ending 15 December, the Federal Open Market Committee (FOMC), as widely expected, stated that it will accelerate the taper of its bond purchases and anticipates raising the federals funds rate target around mid-2022. Throughout 2021, the value/growth cycle has reacted to the trend in yields as equity and bond markets priced in developing inflation and economic growth expectations. As value stocks stage a comeback in this anticipated increasing rate environment, we take a closer look at the traditional value sectors and find nuances between cyclical and defensive value stocks.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.