Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 23, 2019

Nickel Ore Trade: Indonesia will again ban exports of nickel ore, encouraging investors to build smelters at home to produce value-added products

Indonesia will again ban exports of nickel ore, encouraging investors to build smelters at home to produce value-added products. Nickel prices surged following the news and freight premium for nickel ore fitted ships, mostly Supramax, will increase in the short-term.

According to IHS Markit Global Trade Atlas:

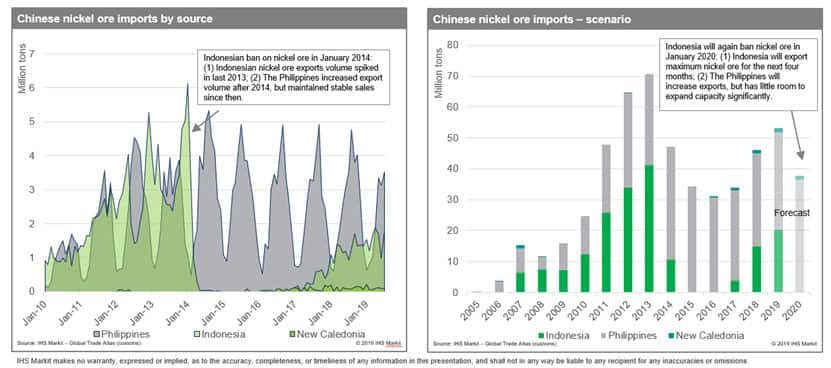

- When Indonesia banned Nickel ore in January 2014, Indonesian nickel ore export volumes spiked in the last quarter of 2013. The Philippines increased export volumes after 2014 but have maintained stable sales since

- In 2018, the Philippines accounted for 59% of global nickel ore supply, while Indonesia contributes to 29% of global supply

- There are not enough alternative suppliers, New Caledonia and others have 7% and 5% market share respectively in 2018

- China is the world's largest producer of stainless steel and naturally the biggest importer of nickel and nickel ore. Indonesia contributed to 32% of China's nickel ore imports in 2018

According to IHS Markit Commodities at Sea tracking tool:

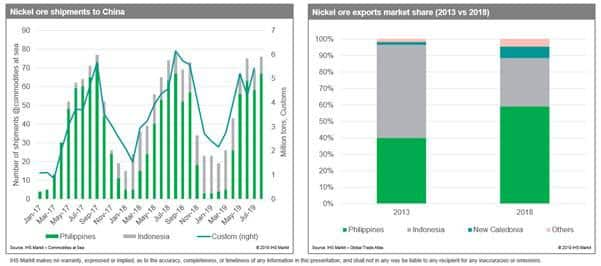

- Indonesian nickel ore shipments to China were already up pretty significantly so far this year before the announcement of the ban and will export maximum nickel ore for the rest of the year. This will boost near-term nickel ore supply although there are still some limitations given export quotas

- The Philippines has also increased their exports by 5% YTD and is expected to increase exports in 2020 but has little room to expand capacity significantly. In the short-term, the Philippines nickel ore exports will face seasonal decline in the coming months

IHS Markit Freight Rate Forecast for Supramax is currently taking the following base case for nickel ore trade:

- IHS Markit had assumed the ban would not come into force until 2022, therefore, IHS Markit 2019 nickel price forecast has been revised substantially higher

- The nickel ore trade impact in freight will be limited as the current Indonesian nickel ore export market share is much less than the 2013 level (57%). However, the premium for nickel ore fitted Supramax will increase in the short-term, given there are limited vessesls which can load nickel ore owing to liquefaction risk

- Overall, Supramax freight rates are expected to stable in the short-term with strong ECSA grain chartering activities and speculative coal demand in China. However, there remains a downside risk in the medium-term, with weak US grain demand and potential Chinese coal import control in the fourth quarter

Source: IHS Markit Global Trade Atlas, IHS Markit Freight Rate Forecast, IHS Markit Pricing and Purchasing

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnickel-ore-indonesia-will-again-ban-exports-of-nickel-ore.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnickel-ore-indonesia-will-again-ban-exports-of-nickel-ore.html&text=Nickel+Ore+Trade%3a+Indonesia+will+again+ban+exports+of+nickel+ore%2c+encouraging+investors+to+build+smelters+at+home+to+produce+value-added+products+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnickel-ore-indonesia-will-again-ban-exports-of-nickel-ore.html","enabled":true},{"name":"email","url":"?subject=Nickel Ore Trade: Indonesia will again ban exports of nickel ore, encouraging investors to build smelters at home to produce value-added products | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnickel-ore-indonesia-will-again-ban-exports-of-nickel-ore.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nickel+Ore+Trade%3a+Indonesia+will+again+ban+exports+of+nickel+ore%2c+encouraging+investors+to+build+smelters+at+home+to+produce+value-added+products+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnickel-ore-indonesia-will-again-ban-exports-of-nickel-ore.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}