Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 04, 2019

The next catalyst

Research Signals - March 2019

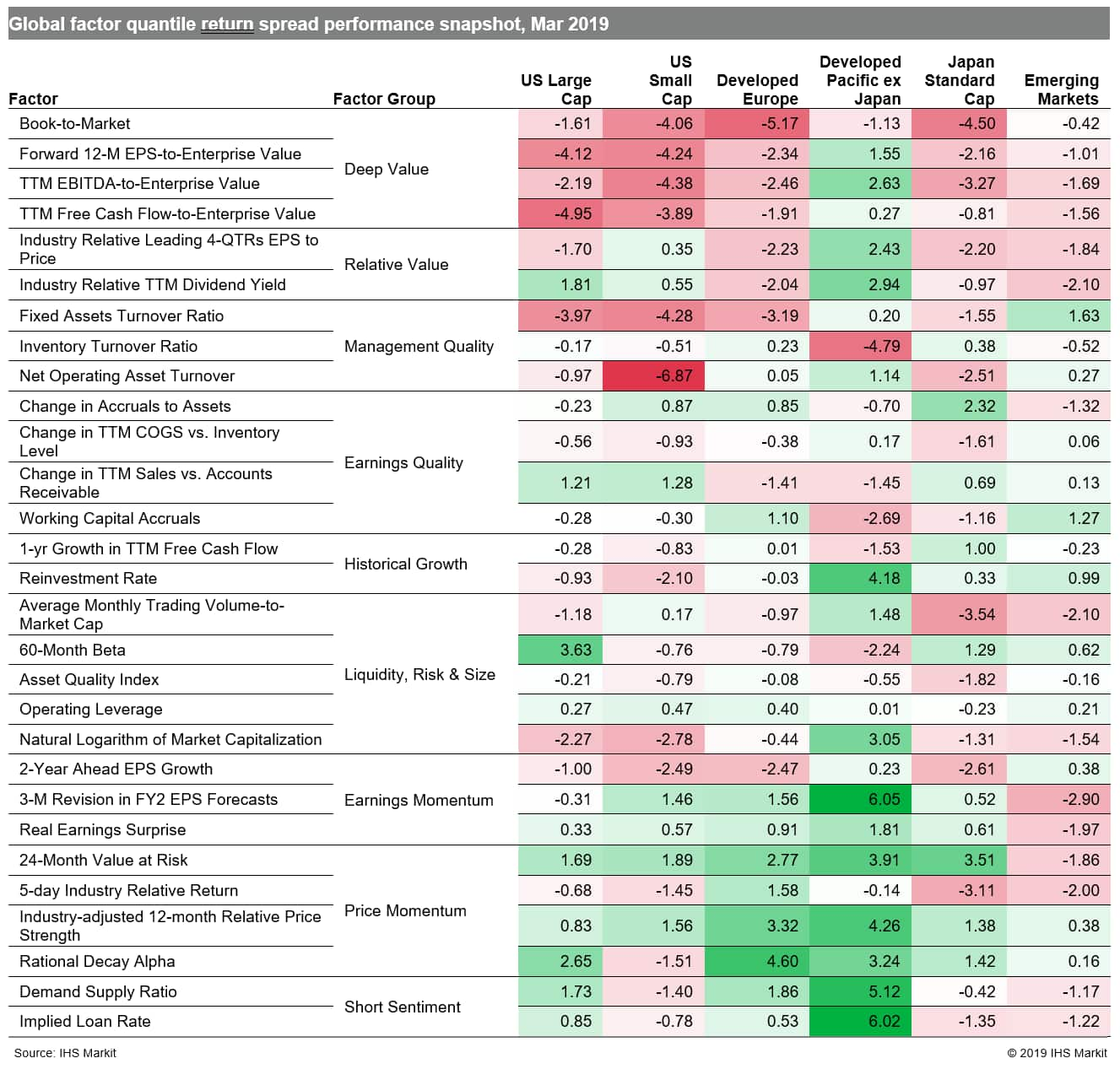

Stocks strengthened worldwide as global equities posted their strongest quarter in several years, supporting high momentum strategies at the expense of valuation (Table 1). Investors put their hopes on China and the US reigniting the lackluster global manufacturing economy, despite the global manufacturing sector's unchanged J.P.Morgan Global Manufacturing PMI reading from February's 32-month low. However, if progress on the long-running trade dispute between the US and China has already been priced into the market, what will the next catalyst be to sustain momentum in equity markets?

- US: Top performing factors among large caps captured a blend of low risk and high momentum, as represented by 60-Month Beta and Rational Decay Alpha, respectively

- Developed Europe: Investors favored stocks with strong momentum and avoided firms with weak revisions, as captured by Industry-adjusted 12-month Relative Price Strength and 3-M Revision in FY2 EPS Forecasts, respectively

- Developed Pacific: In markets outside Japan, Implied Loan Rate, a Short Sentiment measure of the cost of borrowing a stock, extended an upward trend in performance, with positive spreads in all but two months over the past year

- Emerging markets: Valuation was a negative signal, as indicated by factors such as Industry Relative Leading 4-QTRs EPS to Price and TTM EBITDA-to-Enterprise Value

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnext-catalyst.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnext-catalyst.html&text=The+next+catalyst+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnext-catalyst.html","enabled":true},{"name":"email","url":"?subject=The next catalyst | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnext-catalyst.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+next+catalyst+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnext-catalyst.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}